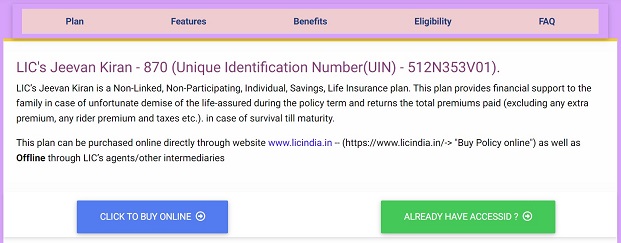

LIC recently launched a new term plan named LIC Jeevan Kiran (LIC table no. – 870) under UIN 512N353V01.

LIC Jeevan Kiran is a Non-Linked, Non-Participating (benefits payable on death or maturity are guaranteed and fixed irrespective of actual experience), Individual, Savings Life Insurance plan offering protection and savings.

LIC Jeevan Kiran (term assurance plan) has an inbuilt feature of return of premium in case of survival of policy holder till maturity.

You can buy this policy either online or offline through a broker.

Table of Contents

LIC Jeevan Kiran – Eligibility Conditions

- Minimum entry age: 18 years

- Maximum entry age: 65 years

- Minimum age at maturity: 28 years

- Maximum age at maturity: 80 years

- Policy term: Between 10 years – 40 years

- Premium Payment Term (PPT): Single or Yearly / Half-Yearly (Regular)

- Minimum Premium: Rs. 3,000/- for Regular premium policies and Rs. 30,000/- for Single premium policies.

- Minimum basic sum assured: Rs. 15 lakhs

- Maximum basic sum assured: No limits.

- Loan facility: Not available

- Eligible-Life

- 🔹The individual life proposed must have its own earned income.

- 🔹The life-proposed should be residing in India, Resident Indian.

- 🔹NRI (Non-Resident Indian) can also apply during their stay in India, subject to the condition.

LIC Jeevan Kiran – Benefits

Death Benefit

Upon the policyholder’s death during the policy term, the death benefit is payable to the beneficiary called a “Sum Assured on Death.”

The Sum Assured on Death is higher of below for the regular premium:

-

- 🔹105% of total premiums paid – upto the date of death; or

- 🔹7 times of annualized premium

The Sum Assured on Death is higher of below for the single premium:

-

- 🔹Basic Sum Assured; or

- 🔹125% of Single Premium

Note: Here, the total or single premium paid does not include the taxes, premium paid towards the rider, loadings for modal premiums, and underwriting extra premiums, if any.

Maturity Benefit

Sum assured on maturity will be payable upon the policyholder surviving till maturity. Where “Sum Assured on Maturity” is as follows:

- 🔹Under the Regular Premium Payment policy, it equals “Total Premiums Paid.”

- 🔹Under the Single Premium Payment Policy, it is “Single Premium Paid.”

Note: Here, the total or single premium paid does not include the taxes, premium paid towards the rider, loadings for modal premiums, and underwriting extra premiums, if any.

LIC Jeevan Kiran – Rider & Settlement Options

LIC Jeevan Kiran has an accidental rider option available that you can avail of at the time of policy purchase.

Rider Options

- For single premium: LIC’s Accidental Death and Disability Benefit Rider is available.

- For Regular premium: Two options are available

- 🔹LIC’s Accidental Death and Disability Benefit Rider

- 🔹LIC’s Accident Benefit Rider

Settlement Options

For Maturity Benefit

The settlement option is to receive maturity benefits in installments over 5 years instead of a lump sum amount.

The installment payment mode is monthly, quarterly, half-yearly, and yearly. However, to opt for payment of the net claim/settlement amount in installments, the policyholder must exercise it at least 3 months before the due date of the maturity claim.

For Death Benefit

The settlement option is to receive death benefits in installments over 5 years instead of a lump sum amount.

The installment payment mode is monthly, quarterly, half-yearly, and yearly. However, to opt for payment of the net claim/settlement amount in installments, the policyholder must opt during their lifetime.

How to purchase LIC Jeevan Kiran Plan online?

Here are two ways to buy LIC Jeevan Kiran online:

- Buy LIC Jeevan Kiran Plan (870) online -> Term Assurance -> LIC Jeevan Kiran (Table No.- 870)

- 2. You can also buy directly through LIC’s official website -> “Buy Policy online.

LIC Jeevan Kiran – Should You Consider Buying For Your Life Cover?

Knowing whether you need life cover before deciding to buy LIC Jeevan Kiran is essential.

A saving component linked to a life insurance policy is a red signal. Although LIC Jeevan Kiran is a term assurance plan and focuses on life cover, its inbuild feature, “return of premium” makes it like any other investment-based insurance product. Remember, there is no free lunch; if you have the option to get your premium back on your survival, then it does come at a cost, and that cost is a higher premium.

It is better to buy pure-term insurance with no additional benefits or rider. Pure-term insurance is the cheapest form of insurance policy. When it comes to life cover, it’s wise to go with pure-term insurance. It’s good to keep your investment and insurance separate. If you are unsure, do not hesitate to take expert help on financial planning.

Important Articles Related to Personal Finance

- Mutual Fund KYC Online Registration Using CAMS

- How to Surrender LIC Policy Before Maturity: Complete guide

- How To Invest When Sensex And Nifty All-Time High?

- Maximize Your Tax Savings With Tax Harvesting Mutual Funds

- 18 Common Tax Filing Mistakes You Must Avoid FY 2022-23 (AY 2023-24

- ITR For Salaried Person: Which ITR Should I File For FY 2022-23 (AY 2023-24)?

- Tax Planning For Salaried Employees

- Unclaimed Mutual Funds In India: An Overview And Steps For Recovery

- 9 Strategies: How To Close Home Loan Early

- 5 Safe & Best Short-Term Investment Plan 2023

- Debt Mutual Funds Taxation New Rule from 1st April 2023

- All About Sukanya Samriddhi Yojana Benefits