India has been experiencing significant growth in the digital space over the past few years. Concerning the financial sector, there is substantial growth in the mutual fund, direct share, and insurance industries. Almost everything is possible online in the mutual fund industry, from new e-KYC to updating existing KYC, investing, redemption, etc.

As most of us are so busy, investing online has become hassle-free; likewise, even the insurance industry is working on making the insured experience hassle-free with e-insurance.

In insurance, now you can opt for e-insurance account, where you can hold all your insurance policies in one place. In this article, we will learn about what e-insurance is, its benefits, what you should opt for it, and everything you should know about e-insurance.

Table of Contents

What is an Insurance Repository and its Objective?

As we learn about e-insurance, it is essential to know about Insurance Repositories as they play a significant role.

An Insurance Repository refers to an entity established and incorporated under the Companies Act, 1956 and authorized by the Insurance Regulatory and Development Authority (IRDA) to maintain electronic records of insurance policies on behalf of insurance companies. These repositories facilitate the secure storage of insurance policies in digital format, ensuring convenient access and management for policyholders.

The primary aim behind establishing an insurance repository is to allow policyholders to store their insurance policies digitally, enabling them to swiftly and accurately make changes, updates, and amendments to their policies. Moreover, the repository serves as a centralized hub for various policy-related services. This system of insurance repositories further enhances the efficiency and transparency of the entire process of issuing and managing insurance policies.

Here is the list of four Insurance Repositories in India:

- CAMS Repository Services Limited

- Central Insurance Repository Limited

- Karvy Insurance Repository Limited

- NSDL Database Management Limited

Every e-Insurance Account will possess an exclusive Account number, and each account holder will receive a distinct Login ID and Password to access their electronic policies via the online platform.

Benefits of e-Insurance Accounts (eIA)

- Convenience and Accessibility

With an eIA, you can access and manage all your insurance policies in one place, eliminating the need to manage physical documents.

E-insurance makes tracking policy details, renewal dates, and premium payments easier. Premium payment for all your policies can be made by logging in to your e-Insurance account and proceeding by selecting the insurance policy for which you want to pay the premium.

- One-Time KYC Submission

Know Your Customer (KYC) involves a verification process to confirm the identity and authenticity of policyholders. Since your Electronic Insurance Account is established following thorough authentication, you are not required to submit your KYC documents when purchasing new policies repeatedly. Simply referencing your Electronic Insurance Account number suffices. However, in the non-electronic form, you must submit your KYC documents whenever you buy a new policy.

Also, the below details can be updated with a single click across multiple policies:

- 🔹Change of Address

- 🔹Contact details

- 🔹NEFT Update

- 🔹Aadhaar linking

- Enhanced Security and Safety

An e-insurance Account provides a trustworthy and authenticated platform for securely storing all your insurance policies, as IRDA has granted a certificate of registration to the depository for maintaining data of insurance policies in electronic form on behalf of Insurers.

Insurance repositories must adhere to rigorous safety and security measures for the transmission and encryption of policy-related data, and they are also accountable for compensating policyholders for any negligence-related loss or damage.

You can access your documents anytime and from anywhere with a single click. This service holds immense value, especially during urgent situations like a vehicle accident or a health emergency, where quick access to policy details is more important than anything else.

- Paperless Documentation and Environmental Impact

Last but not least, by opting for an eIA, you avoid unnecessary paperwork, manage your insurance policy hassle-free, and contribute to a green environment by reducing paper consumption. A win-win situation.

Which Insurance policies can be held in e Insurance Account?

Below insurance types can be held in an e-insurance account if your policy is registered with IRDA and you have opted for e-insurance.

- 🔹Life insurance

- 🔹Non-life insurance

- Health insurance

- General insurance

- Annuity policies

Note: LIC is not associated with e-insurance. Hence, you will have to use their Premier service to update/ change address, nominee, etc, by login into the LIC account. However, LIC policy surrender cannot be done online.

How to Open an e-Insurance Account?

Step-1: Choosing an Authorized Insurance Repository

In India, there are four Insurance Repositories. Choose any one among CAMS, CIRL, Karvy, and NSDL.

Step-2: Arrange KYC and other documents/details to submit along with the application:

-

- ✔️Identity proof

- ✔️Address proof

- ✔️Cheque copy

- ✔️Passport-size photo

- ✔️Contact detail

Step-3: Download and complete the application form for opening an e-insurance account or apply online using the below links:

CAMS Repository Services Limited

Central Insurance Repository Limited

Karvy Insurance Repository Limited

NSDL Database Management Limited

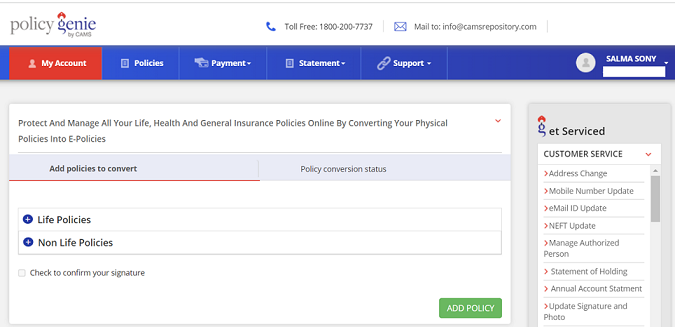

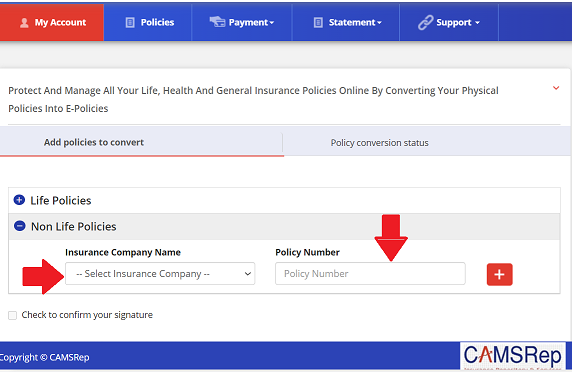

Here is what the CAMS E-Insurance portal looks like:

How to Convert the Existing Physical Policy to e-Insurance?

Step-1: Apply for e-insurance and login

Step-2: Select your policy type- Life Policy / Non-Life Policy followed by the insurance company and type the policy number, then add.

What is the cost associated with e-insurance?

e-Insurance is completely FREE.

e-Insurance Account: Real-World Story

Holding e-insurance can be handy at the time of need. One of my clients recently had a heart attack, and he could not access the policy because he was unconscious. First, his spouse called me, and I could share the policy document (luckily, they had shared the policy with me).

Now the question comes to me what if I was not reachable? Sharing all the financial details with your spouse is essential, and having e-insurance in place will be helpful for quick and easy access, as here comes the concept of an Authorized Representative.

Who is an Authorized Representative?

An authorized Representative is a person appointed by the e-Insurance account holder who steps in to manage the account in case of unfortunate passing or incapacity of the account holder. This representative will notify the Insurance Repository, providing valid evidence of the account holder’s death or incapacity.

The Authorized Representative’s role is to access the e-Insurance account after the account holder’s demise. The Authorized Representative primarily serves as a mediator and doesn’t possess rights to receive policy benefits unless explicitly designated as a nominee.

💡Pro Tip: It’s good to hold all your investments and insurance in one place.

Making your spouse an authorized representative for your insurance and their involvement in the financial planning process is can be an added advantage.

Conclusion

Opting for e-insurance for your existing insurance may look like additional work. Still open an e-insurance account as it’s a one-time essential exercise to make your insurance management smooth and handy, easy to access at the time of need.

Frequently Asked Questions

✓ How many days may it take to open an e-Insurance account?

An account will be opened within 7 days of submitting a duly completed application. Once the account is successfully opened, a welcome kit containing instructions on its operation will be dispatched to the e-Insurance account holder.

✓ Can I convert my existing paper policies into electronic policies?

Yes. Please read the article “How to convert the existing physical policy to e-Insurance.”

✓ I have an e-Insurance account. How can I buy a new policy in electronic form?

Simply provide your unique e-Insurance account number on your new insurance proposal form and request the insurance policy electronically.

✓ Can I change the authorized representative later, if needed?

Yes, you can change the authorized representative by requesting an insurance repository.

✓ Is it possible to opt out of the Insurance repository system?

Certainly, the policyholder is required to submit a request to their insurance provider. Once all necessary procedures related to this request are fulfilled, the physical copy of the policy document will be provided.