Termination of mutual fund units means the transfer of ownership.

In this article, we will learn the process of transmitting mutual fund units upon the death of the unit holder in India. This process is essential to ensure that the investments are transferred to the beneficiary(s)/nominee(s) or the legal heir(s) smoothly and legally.

Table of Contents

Who is the Beneficiary / Nominee?

In the context of mutual funds, the beneficiary/nominee refers to the individual chosen by the unit holder to inherit the mutual fund units in the event of the unit holder’s death. The nomination ensures a smooth transmission of mutual fund units.

Who is a Legal Heir?

In India, the term “legal heir” refers to individuals who are entitled to inherit the property and assets of a deceased person as per the laws of succession or inheritance.

The specific rules governing legal heirs in India are primarily defined by personal laws based on an individual’s religion.

Hindu Succession Act, 1956

For Hindus, Buddhists, Sikhs, and Jains, the Hindu Succession Act governs property inheritance. Legal heirs include:

Class I heirs: Include the deceased’s spouse, children, and mother.

Class II heirs: If there are no Class I heirs, then Class II heirs, such as father, siblings, and their descendants, become legal heirs.

💡Learn more about the Hindu Succession Act, 1956

Muslims Personal Law

Muslims are governed by their personal laws.

Muslim law recognizes two types of heirs: Sharers and Residuaries.

Sharers are the ones who are entitled to a certain share in the deceased’s property, and Residuaries would take up the share in the property that is left over after the sharers have taken their part.

💡Learn about Inheritance under Muslim law, Christian Succession Act, 1925, and the Indian Succession Act, 1925

Documents Required for the Transmission of Mutual Fund Units In Case of Death

- Transmission request form.

- Original Death Certificate of the unitholder OR copy of the death certificate duly attested by Gazetted Officer or a Notary Public.

- If the Nominee is a minor, then the birth certificate copy.

- PAN Card copy of the nominee (s) / Guardian (in case the nominee is a minor).

- KYC Acknowledgment, and if KYC of the nominee is not in place, then KYC Form for a new KYC. One can also complete their new KYC online and submit a KYC Acknowledgment.

- Personalized canceled cheque of the Nominee OR nominee’s recent Bank Statement/Passbook (which is not older than 3 months).

- Additional document based on transmission amount:

- (a) Transmission amount up to Rs. 5 lakhs: For Major nominee: Nominee’s signature attested by the Bank Manager as per Annexure-I(a). For Minor nominee: The guardian’s signature (as per the minor’s bank account or the Minor or the joint account of the minor with the guardian) must be attested.

- (b) Transmission amount above Rs. 5 lakhs: The nominee’s signature must be authenticated by either a Notary Public or a Judicial Magistrate First Class (JMFC). This authentication should include a seal and date, and it should be placed in the designated space below the claimant’s signature on the TRF form itself.

Process For Transmission of Mutual Fund Units: Step-by-step guidance

1. Notification and Documentation:

- 🔹Notify the mutual fund house: It is suggested to notify the fund house immediately in the event of death of the unit holder of a mutual fund scheme.

- 🔹Arrange documents: Arrange the above-listed documents

2. Find out who is the beneficiary/nominee

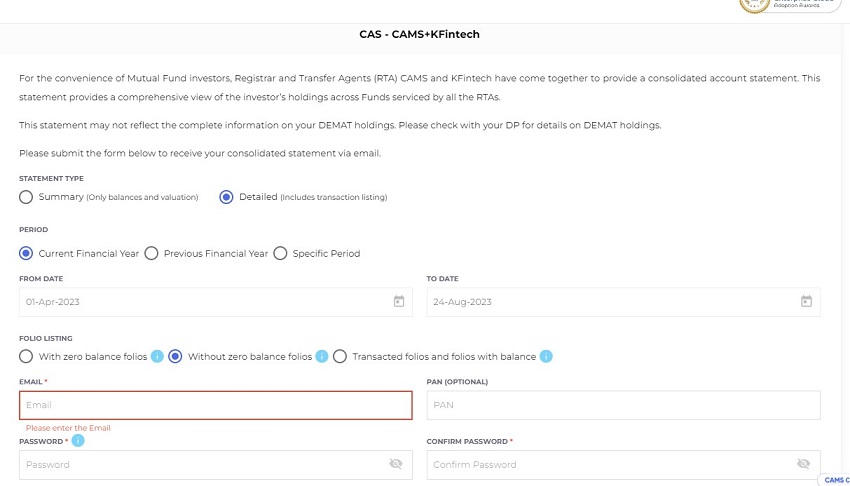

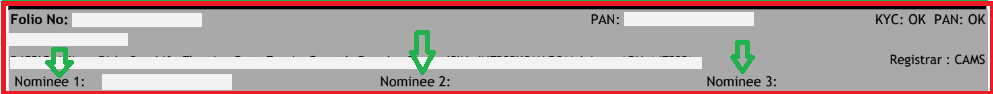

- You can determine the beneficiary by running a CAMS mail-back Report (detailed report). If the nomination is blank, one must arrange a legal heir certificate.

In the CAMS report, the nominee’s name will be mentioned under each folio.

3. Legal Heir Certificate:

Obtain a legal heir certificate from the relevant authority. This certificate establishes the legal heirs who are entitled to claim the mutual fund units. The procedure for obtaining a legal heir certificate can vary from state to state in India, but it often involves submitting an application along with supporting documents such as the death certificate, identity proof of the legal heirs, and an affidavit.

4. KYC Compliance:

Ensure that the nominee is KYC (Know Your Customer) compliant. If the nominee is a minor, then the KYC of the guardian is required.

5. Transmission Application:

Download the transmission of units application form-T3. This form requests the transfer of mutual fund units from the deceased unit holder to the nominee/legal heirs.

6. Documentation Required for Transmission:

- 🔹Transmission Application Form: Fill out the transmission application form with accurate details. The legal heirs must provide their information, including their names, addresses, PAN (Permanent Account Number) details, and KYC information.

- 🔹Death Certificate: Attach the death certificate of the deceased unitholder – original or photocopy duly attested by a Gazetted Officer or attested by a Notary Public.

- 🔹Legal Heir Certificate: Include a copy of the legal heir certificate obtained in the deceased unitholder’s name (in case of no nomination).

- 🔹KYC Documents: Attach the KYC acknowledgment of the nominee or of guardian if the nominee is minor.

- 🔹Mutual Fund Account Statement: Provide a copy of the mutual fund account statement to prove ownership of the units.

7. Submission of Documents:

- Submit the completed transmission application form and all the required documents to the mutual fund company or registrar’s office (CAMS/Karvy) where the mutual fund units are held.

8. Verification and Processing:

- The mutual fund company will verify the submitted documents to ensure their authenticity and compliance with regulatory requirements.

- Once the verification process is complete, the mutual fund company will process the transmission of units request.

9. Issuance of New Units:

- After successful verification and processing, the mutual fund company will issue new units in the name of the legal heirs. These new units represent the transferred ownership.

10. Updated Account Statement:

- The mutual fund company will provide an updated account statement reflecting the transfer of units to the legal heirs.

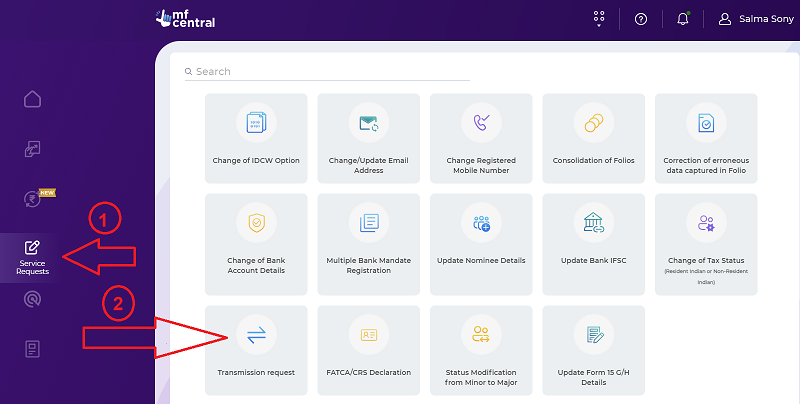

Process Of Transmission of Mutual Fund Units Online: MF Central

With MF Central, the transmission of mutual fund units has become seamless.

Here are the steps:

- Sign-up for MF Central

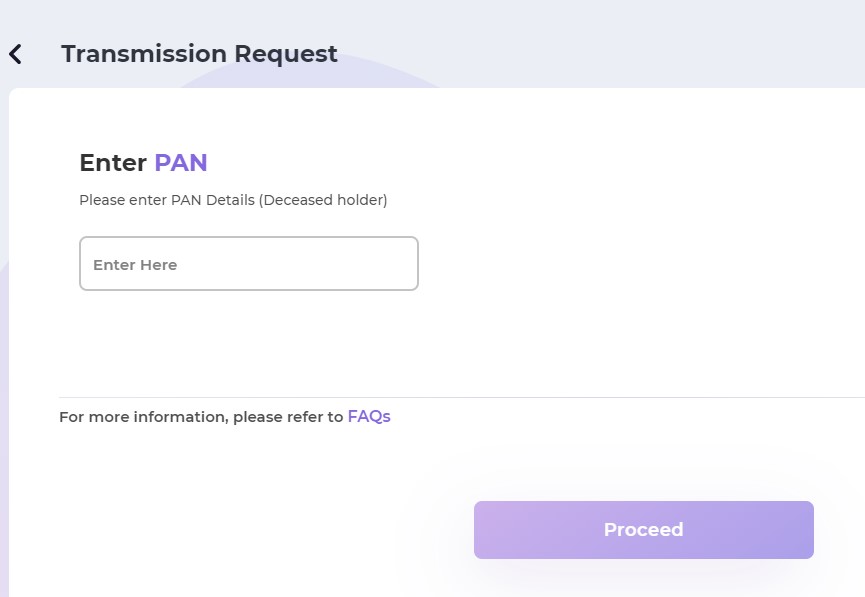

- Click on service request followed by transmission request as shown in the below screen-shot.

3. Enter the as shown in the screenshot and proceed (if you are eligible for online transmission, then the folio should reflect to proceed).

Note: I tried the process to capture the steps, but it said, “No eligible folio(s) found“. I observe that the online transmission process is still not smooth, and one must go offline for unit transmission if the online transmission isn’t working.

Tax Implications

Tax implications will arise only when units are sold; hence, there won’t be any tax implications upon transfer.

Once the units are sold after transmission, the date of purchase will be considered the original purchase date and not the date of transmission for capital gain calculation.

Important Points For Unit Holder

Often, I have seen individuals not taking the nomination process seriously. It is important to correctly mention the nominee’s name as per PAN while nominating. If you cannot figure it out, then cover it in the financial planning process or get your financial advisor’s help.

Example: If the spouse’s name is Sunita Sharma as per PAN but at the time of nomination, it’s mentioned S Sharma or Sunita S or just Sunita. This is one of the biggest problems a nominee faces at the time of claim. Hence, it’s the individual responsibility to nominate all their investment correctly (name as per PAN).

Frequently Asked Question

How do we transmit mutual fund units if there are two holders?

If the primary holder passes away and there are two surviving joint holders, the surviving second holder will be treated as a new primary or first holder. In this case, you need to choose Transmission of units Form T-2.

In case of deletion of the name of the deceased 2nd or 3rd Joint holder, use Transmission of units Form T-1.