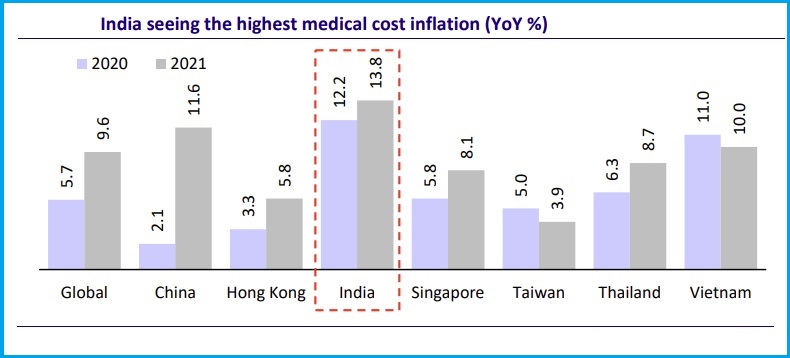

With the increased medical costs in India, having the right health insurance coverage for oneself and one’s family to cover unexpected medical expenses becomes essential. Regarding medical inflation, India reported 13.8% (the highest among Asian countries) in 2021, forecasted to increase to 11% in 2024 from 9.8% last year. This data seems worrying due to the increase in healthcare costs and instantly brings a thought: “How Much Health Insurance Do I Need?” In this article, I will discuss the same.

Table of Contents

2 Major Reasons to Buy Medical Insurance

- Medical Inflation: One of the primary reasons you must have health cover is because medical inflation is increasing almost double that of economic inflation, and health insurance coverage offers a financial safety cushion. This action can help you experience high-quality healthcare without worrying about the expenses.

Source: MOFSL

- 2. Coverage Wide Range of Services: You must consider a comprehensive medical policy with a wide range of services, including hospitalization, outpatient care, surgery, and maternity benefits. Once you have sufficient medical coverage, consider buying stand-alone critical illness coverage that covers critical illnesses like cancer and is usually not part of regular medical insurance.

Added advantage: By buying the medical cover, you can also claim tax benefit u/s 80D of the IT Act. Tax planning should not be the reason to buy medical insurance, but your family’s medical protection.

When Should You Buy Health Insurance?

The earlier you buy, the better for you and your family. In this era, there is no age for disease. Because of the change in lifestyle and polluted environment, we are all highly exposed to illness. It’s better to protect early and be at mental peace that you have a safety net in case of medical need.

Type of Health Insurance Coverage

Multiple types of health insurance may confuse you about which one to opt for. Hence listing the important ones.

- Individual Health Insurance Policy: This policy covers individuals. If you are unmarried, you must opt for an individual health insurance policy.

- Family Floater Health Insurance Policy: This policy covers all family members under one policy. If you are married, you must opt for a family floater health insurance policy.

- If you have an individual policy and your marital status changes from single to married, you must convert your individual policy to the family floater and add your spouse; this will help you continue your last policy benefits, like a no-claim bonus and a waiting period, which starts fresh for new members.

- A family floater’s premium is cheaper than that of an individual policy, and each family member shares the sum assured.

- Critical Illness Insurance Policy: Critical illness policy covers critical illnesses like cancer, stroke, heart attacks, kidney failure, etc., which are usually not covered in regular health coverage (individual and family floater policy). The insurer may not provide a policy to someone with a medical history.

- In the critical illness cover, the claim payment is a one-time lump sum and does not depend upon the cost of treatment. Example: You have Rs. 25 lakhs of critical illness coverage. In case of Critical Illness diagnosis and after the waiting period, the insurance company pays the cover amount of Rs. 25 lakhs..

- Senior Citizen Health Insurance Policy: Senior Citizen Health Insurance covers seniors above 65. Usually, the individual and family floater policy maximum entry age is up to 65. Senior Citizen Health Insurance cover is expensive compared to the regular policy. You can consider opting for it for your parents if your company does not cover them and you have not created a corpus for their medical contingency.

- Super Top-up Health Insurance Policy: This is a budget-friendly health plan that can help you cover your medical needs at an affordable cost. However, suppose you are thinking of having just a Super top-up health insurance policy. In that case, you might have a problem as this policy comes with a deductible that covers the medical cost above the basic limit.

- Example: You have a Super top-up policy with a higher sum insured, let’s say Rs. 50 lakhs, with a deductible of Rs 5 lakhs; your Super top-up policy will cover the bill amount over and above Rs. 5 lakhs (basic limit). Hence, in this case, having a basic cover of Rs 5 lakhs is a must, or else you will have to pay it from your pocket.

- Note: Initial Rs. 5 lakhs can be paid from your company group health insurance, personal medical policy, or pocket.

- Personal Accident Insurance Policy: A personal accident insurance policy takes care of medical expenses arising from the treatment due to an accident. You must consider this if you travel often due to job responsibility, travel, office, or other reasons.

- Maternity Health Insurance Plan: If you plan to start a family, add a maternity feature to your base policy. Usually, insurance companies have a one-year waiting period. Hence, plan in advance to cover expenses incurred during the prenatal, delivery, and postnatal stages.

How Much Health Insurance Do I Need?- Rs 5 Lakhs, Rs 10 Lakhs or More

If you start exploring to cover yourself and your family based on the thumb rule, you will get confused as some say your medical coverage should be at least 50% of your annual income, equal to annual income, 2-3 times your annual income, etc.

However, if you think logically, you will realize that disease doesn’t come by looking at a person’s income; I suggest covering each family member with a minimum of Rs 10 lakhs.

So, if you are a family of 2, a minimum of Rs 20 lakhs cover, combine the base policy with the super top-up policy to make it budget-friendly. Combining them allows you to take more coverage with a low health insurance premium.

Conclusion

Having medical insurance to protect yourself and your family is a must. The primary purpose of any insurance is to protect; hence, don’t expect anything in return. Exactly, the way you don’t expect in motor insurance.

After all, your health is more important than your motor (bike/car). When you don’t think while protecting your motor, then why should you while protecting your health and life?

Play safe, buy health and life cover, work on your financial planning, and live a peaceful life.

Frequently Asked Questions

What is health insurance?

Health insurance falls under general insurance and pays for medical and surgical treatment expenses incurred by the insured. It provides financial protection against healthcare costs.

Why do I need health insurance?

Health insurance offers financial protection by covering medical expenses, which can be substantial. It ensures you can access necessary healthcare services without worrying about the financial burden.

What does a health insurance policy typically cover?

Health insurance policies vary, but they generally cover hospitalization expenses.

What is a premium?

A premium is the amount you pay the insurance company for health insurance coverage. It is usually paid annually. You also have an option to pay for 2 and 3 years.

What is a deductible?

A deductible is the amount you must pay from your company coverage or out-of-pocket for the covered sum assured before the insurance company pays. For example, if you have a health insurance cover of Rs 5 lakhs with a deductible of Rs. 5 lakhs, and the bill amount is Rs. 7 lakhs, then you must pay Rs. 5 lakhs before your insurer covers the balance of Rs. 2 lakhs (Rs. 7 lakhs – 5 lakhs).

What is a co-payment?

A co-payment is a fixed amount you agreed to pay for a covered policy.