SEBI Registered Investment Advisor | RIA No.-INA000017222

Need Financial Clarity?

Use the search bar to explore trusted financial insights

SEBI Registered Investment Advisor | RIA No.-INA000017222

Use the search bar to explore trusted financial insights

Expert Financial Advice That Focuses On You, Not On Selling Financial Products.

When it comes to financial planning, the experts' guide can change your financial future.

Without Financial Plan

With Financial Plan

Our family is the most important for us, and they are our world. That’s why it’s our responsibility to make them feel secure. A family is considered strong, stable and secure when it is financially comfortable today and tomorrow. For a happy family, financial wellness is a must.

Every family’s financial goals, aspirations and dreams are unique and precious.

“I believe money is a tool, and Financial Planning helps enjoy life today while still planning responsibly for tomorrow.”

Financial Planning can build financial wellness for families. It needs a personalized approach, meticulous Planning, and Financial Advisory Service will help you on that.

An investment based on a financial plan makes you more likely to attain your financial goals.

A Financial Partner Who Works Only for You

I have Fiduciary responsibility. Hence, I put clients’ interests ahead of everything else. Trust, Ethics and Integrity are the foundations of client engagement.

My goal is to simplify your financial life. I follow the simplistic approach of awakening a financial planner inside you by guiding you on how to control your behavior and manage the risk.

I am not affiliated (directly and indirectly) with any Mutual Fund Companies, Insurance Companies or sell you any products. I practice the fee-only financial planning module, where my approach revolves around you.

Working With a Certified Financial PlannerCM Makes a Difference

As a SEBI Registered Investment Advisor and Certified Financial PlannerCM, I specialize in helping individuals gain clarity, structure, and confidence with their money, without selling financial products.

Whether you’re just starting or planning for the future, my approach focuses entirely on what’s best for you.

Helping Individuals and Leaders Build Lasting Financial Security For Themselves And Their Employees

A Financial Advisory Service based on Financial Planning is a holistic approach to personal finance management. It provides a 360-degree view of your financial needs.

Financial Planning Services include:

Financial Advisory Service based on Financial Planning can help you in your financial future beyond imagination.

Financial wellness results from making informed short- and long-term financial decisions that result in optimal health, productivity, and a solid foundation for every stage in life.

But why exactly is financial wellness important for an organization? Here are few reasons:

Client's Love

EXCELLENT

Because no one taught us money in school, here’s how to catch up fast.

Bite-sized lessons that simplify financial planning, investing, and money habits to help you save more, invest smartly, and plan your future, delivered in your language.

Quick, insightful posts that break down personal finance, wealth-building strategies, and real-life money decisions, designed to inform, inspire, and elevate your financial mindset shared on LinkedIn.

Every article here is written for smart investors to help you make wise money decisions, based on real expertise, not opinion.

Explore the answers to common questions about the expert financial planning services.

Financial Advisory Service will help you create a road map of your life financial goals and help you achieve them on or before time by implementing, grabbing market opportunities, and tracking right.

Financial Advisory Service will help you plan your finances in the right manner. If you are looking to enjoy life today and secure your financial future then the right time is NOW. Explore Fee only Financial Planning Services.

Fee Only Financial Planning Services is an annual service.

A fee only financial advisor / fee only expert financial planner are SEBI Registered Investment Advisor who operates on a transparent and straightforward model. Unlike financial planners in India who earn commissions or fees based on product sales, fee only financial advisors charge a flat fee only for their financial services, ensuring unbiased financial advice that aligns with client’s financial goals. This structure eliminates conflicts of interest, putting the client’s best interests ahead of everything else.

In this internet era, getting your finances sorted virtually with financial planning services is convenient and saves you time.

Salma Sony is a SEBI-Registered Investment Advisor (RIA) and Certified Financial Planner (CFP), featured as “One of the Best Fee-Only Financial Planners in India.”

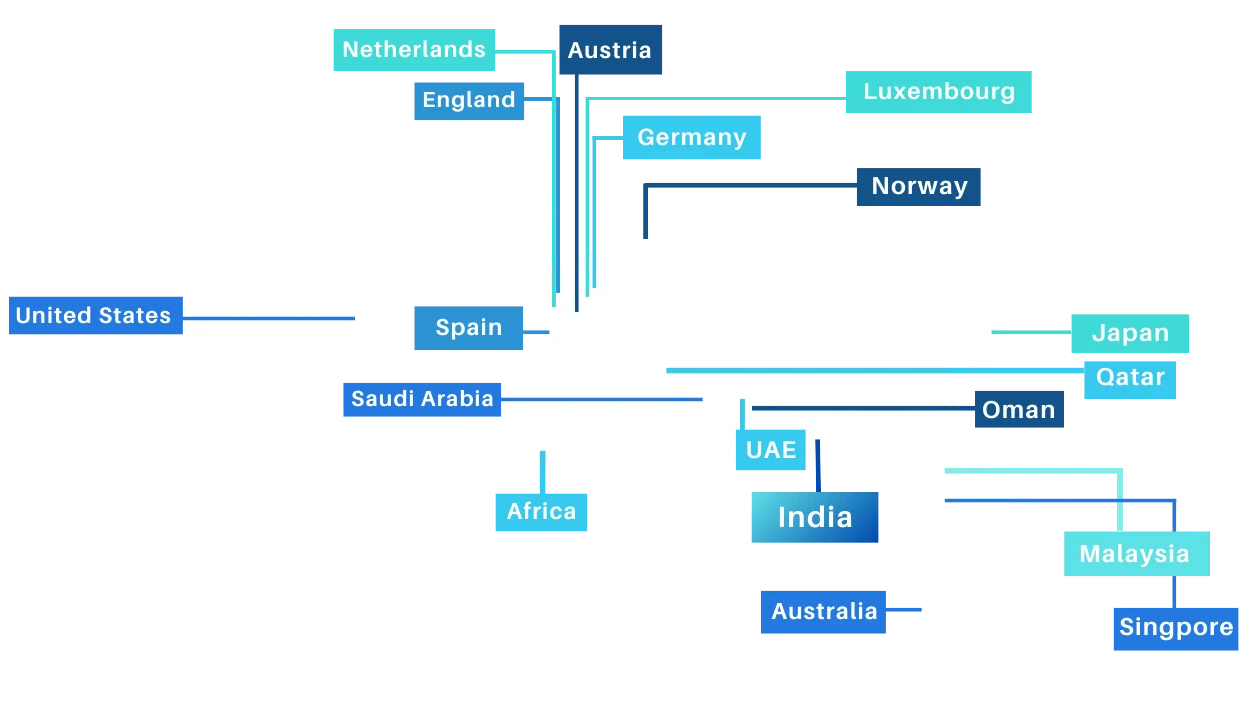

She has advised 500+ working professionals across 15+ countries to help them gain clarity, control, and confidence in their finances through practical, goal-based financial planning.

She aims to help you shift from surviving paycheck to paycheck to thriving with a clear, structured, and confident financial roadmap.

If you are earning well but wondering, “Where does all my money go?” – I’m here to help you find the answer and change the outcome.

You can contact Salma Sony, Fee Only Financial Advisor, directly on WhatsApp (+91-8180923895) or email at salmasony.cfp@gmail.com. Also, can DM her on LinkedIn or Facebook.

I can personally guide you. Click below to start the conversation.

Get insights and updates on financial planning, wherever you scroll.

Follow Me

Watch & Learn

Read Threads

Join Group

Read Posts