Investing in direct mutual funds in India using MF Utility (MFUOnline) is a simple process offering several advantages, including lower expense ratios and potentially higher returns than regular mutual funds. In this step-by-step guide, I will walk you through the steps involved in investing in direct mutual funds through MFU.

Table of Contents

How to Invest in Direct Mutual Funds Online

Understanding Direct Mutual Funds

Mutual funds pool money from multiple investors to invest in a portfolio of stocks, bonds, or other securities.

The mutual fund allows investing in a diversified portfolio of securities managed by professionals with expertise in picking and managing investments.

Now, let’s understand the two modes of investing in mutual funds, i.e., regular and direct plans, to understand direct mutual funds better.

Differences Between Regular and Direct Mutual Funds

Regular mutual funds are sold through intermediaries like agents or distributors, while direct mutual funds are purchased directly from the fund house/asset management company (AMC). The key difference lies in the expense ratio, as direct plans have lower expenses and potentially higher returns.

Benefits of Direct Mutual Funds

- 🔸Lower Expense Ratios

- 🔸Potentially Higher Returns

- 🔸No sign-up or subscription fees

- 🔸Auto-link all the existing investments (except those in the demat account).

What is MF Utility (MFU) / MFUOnline?

MF Utility / MFUOnline is a free online platform launched by AMFI (Association of Mutual Funds in India) that allows investors to transact in direct mutual funds from multiple fund houses through a single account. It simplifies the investment process and reduces paperwork.

Features of MF Utility

- 🔹Single-window access to multiple mutual funds

- 🔹Consolidated view of your portfolio

- 🔹Online investment, switch, STP, SWP, and redemption options

- 🔹Common Account Number (CAN) for easy tracking

- 🔹Goal mapping facility

Advantages of Using MF Utility

- 🔸Invest in multiple funds from different AMCs using a single account

- 🔸One-time registration process, no need for numerous KYC verifications

- 🔸Reduced paperwork and hassle-free transactions

- 🔸There are no Advertisements, unlike private player apps like Groww, ET Money, etc

Preparation Before Investing in Direct Mutual Funds

Before proceeding, ensure you have the following documents ready:

✅KYC (Know Your Customer) Requirements: To invest in mutual funds, you must have your KYC in place. If you are a first-time investor, complete Mutual Fund KYC Online.

✅PAN Card: Permanent Account Number (PAN) is mandatory for all mutual fund investments. Keep a self-attested PAN card copy ready.

✅Aadhar Card: Aadhar card is required for e-KYC and online verification. Keep ready Aadhar number and mobile seeded to Aadhar for OTPs.

✅Bank Account: You will need an active bank account for transactions. Keep ready the canceled cheque with your signature.

✅Mobile Number and Email ID: These are essential for communication and alerts.

Invest in Direct Mutual Funds Online: 6 Steps of Creating an MFU Account

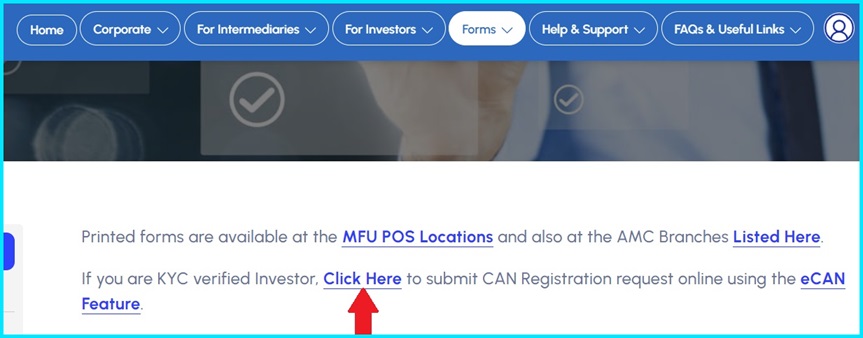

Visit the MFU Website CAN registration page and tap “click here” to proceed with the CAN registration.

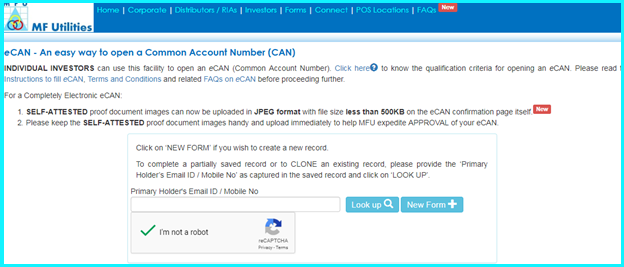

Step-1: Upon clicking the above link, the below window will open à Click on “I’m not a robot” followed by the new form

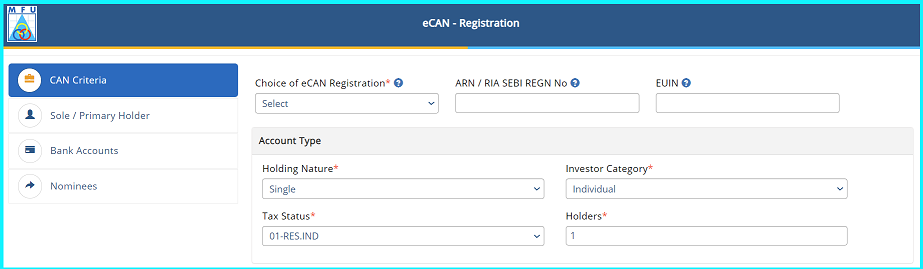

Step-2: Choose CAN Criteria as mentioned below:

✔️Choice of eCAN Registration: Completely Electronic

✔️ARN/ RIA SEBI REGN No: Leave Blank

✔️EUIN: Leave Blank

✔️Holding Nature: Single, Joint, Anyone or Survivor (as applicable)

✔️Investor Category: Single, Minor, Sole Proprietor (as applicable)

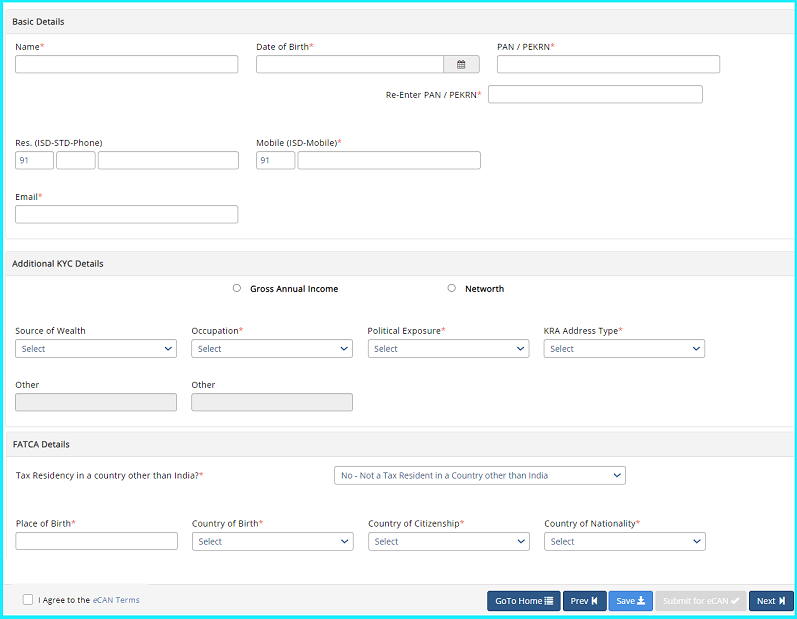

Step3:

- 🔹Fill in Basic, Additional & FATCA details

- 🔹Keep the self-attested PAN copy and address Proof ready in JPEG format with a file size of less than 500KB to upload to complete the eCAN registration.

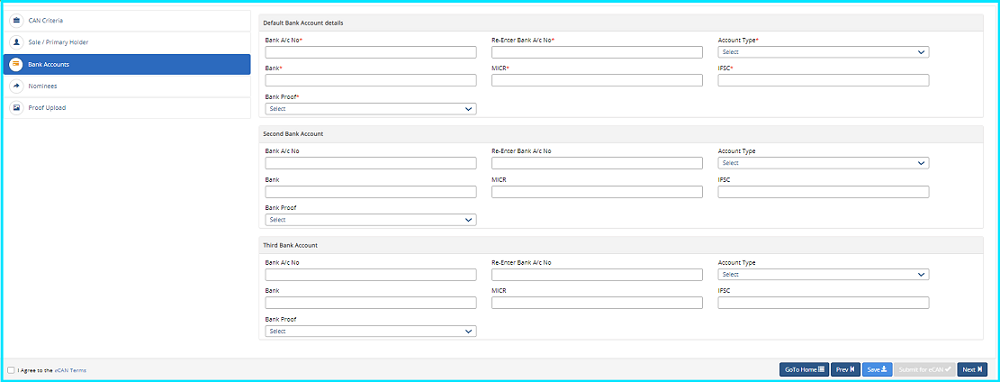

Step4:

- 🔹Fill in the bank details with which you would like to make investments (lump sum & SIP) online.

- 🔹You may register three banks in one go or add a single bank account and later add another bank (if required).

- 🔹Prepare the cheque copy in JPEG format with a file size of less than 500KB to upload to complete the eCAN registration.

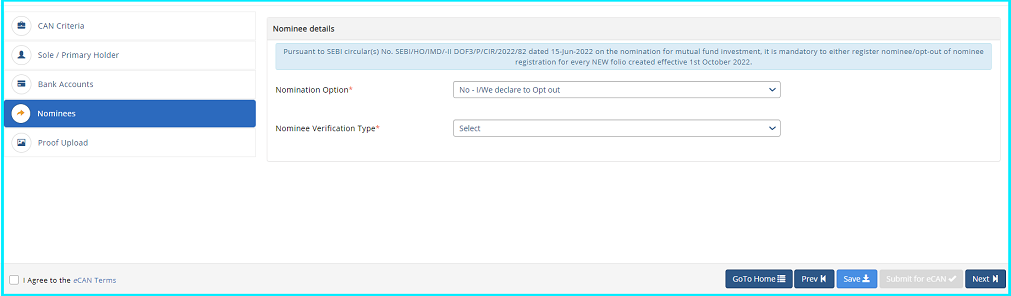

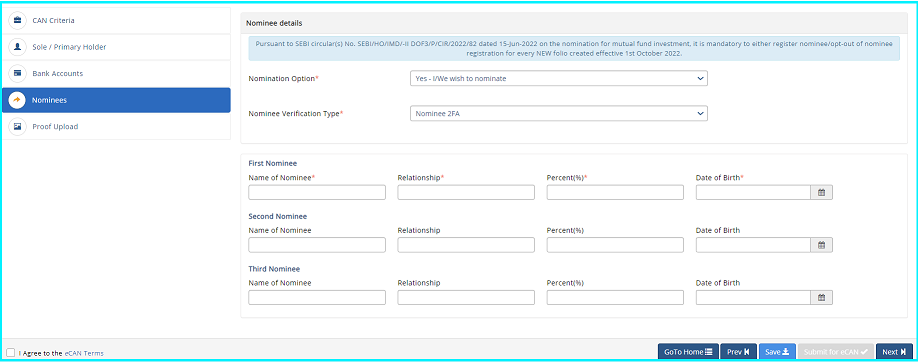

Step5:

- 🔹Nominate your Mutual Fund investments.

- 🔹You may choose to nominate a one or max three-person

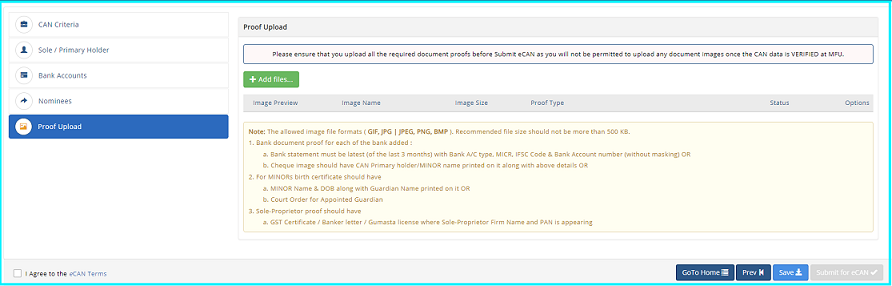

Step-6: Upload Proof listed below copy

- 🔹Copy of PAN – Self-attested

- 🔹Proof of Bank Account – Latest bank statement (not older than last three months) OR Cheque copy with CAN Primary holder name printed on it along with Bank A/C type, MICR, IFSC Code & Bank Account number (without masking)

Click on Add Files to attach relevant Proof. Accordingly, select the proof type and click on upload.

Then click on “Submit for eCAN.”

Upon submitting, you will be immediately allotted with the e-CAN. It may take 1-2 working days to get confirmation of CAN no. approval.

Invest in Direct Mutual Funds Online: Activation & online user ID creation

Once your eCAN is successfully approved, complete the below 2 Steps.

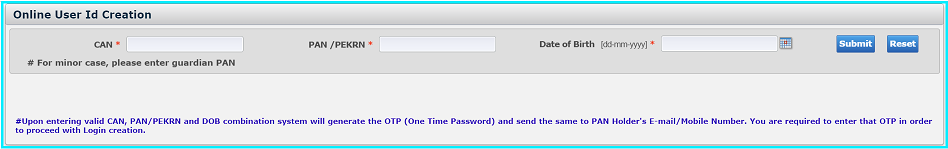

Step-1: MFU Login ID creation

For the Login ID creation, provide the details below to proceed.

CAN No., PAN No, and DOB

Upon creation of login credential, you may use the below link to log in:

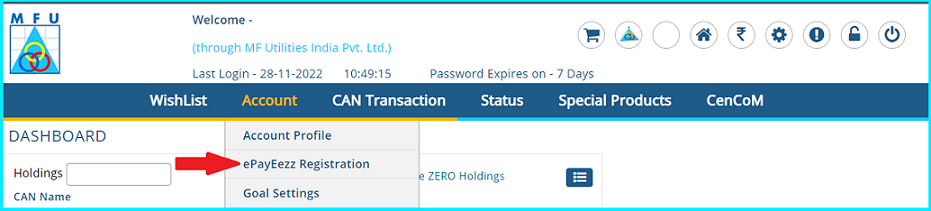

Step-2: PayEezz registration in 5 Steps.

PayEezz registration is a one-time mandate that needs to be completed for SIP registration for auto-debit of the funds.

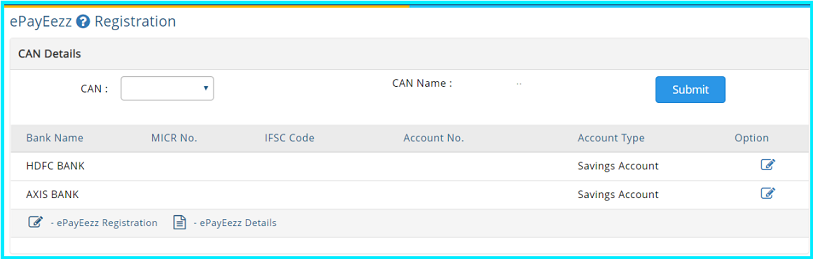

Step-1: Upon login, you will find the below screen. Please click on account –> ePayEezz Registration.

Step-2: Select the Bank for which you want to register PayEezz by clicking on the option. (If you registered only one Bank with MFU, then select that and proceed.)

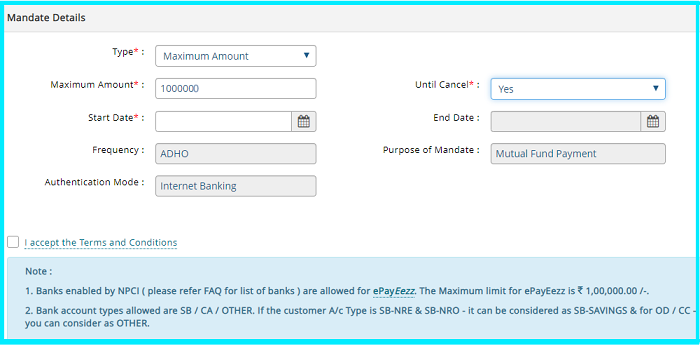

Step-3: Fill in empty boxes as follows and submit (Selected bank name will appear):

Max Amt: 1,00,00,000 (1 Cr.)

Start Date: Most early date

Until cancel: Yes

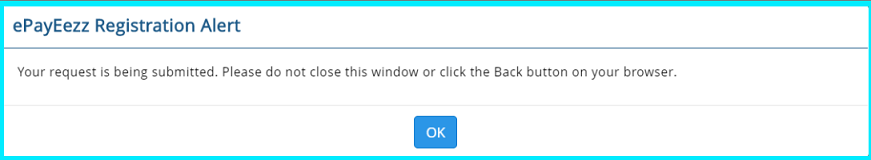

Step-4 Click OK, and it will direct you to the below window

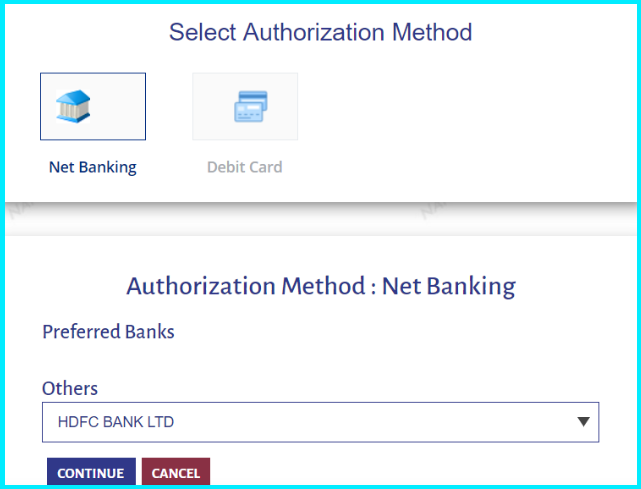

Step-5 Complete Mandate Approval Gateway by opting for Net banking or a Debit card (registered bank to be selected for net banking/ debit card option).

Make sure, after entering Net banking or a Debit card followed by OTP, let the window return to the MFU page (DO NOT Refresh Or Close the window until then).

Now, you can use PayEezz immediately for your SIP- setup.

Invest in Direct Mutual Funds Online: Selecting Mutual Funds

🔸Log into Your MFU Account: Access your MFU account using created login credentials.

🔸Browse the List of Available Mutual Funds: Explore the list of mutual funds available on MFU.

🔸Investment Goals and Risk Profile Assessment: Determine your financial goals, risk tolerance, and investment horizon before selecting mutual funds. Financial planning is the best way to get started with your investment journey. It will help you choose the suitable funds for your goals so for

🔸Choose Investment Mode (e.g., Lump Sum or SIP): Decide whether you want to invest a lump sum amount or set up a Systematic Investment Plan (SIP).

🔸Enter Investment Amount: Specify the amount you want to invest in each fund.

🔸Provide Transaction Details (Bank Mandate and SIP Start Date, if applicable): Set up your bank mandate for SIP investments and specify the SIP start date if you choose this option.

🔸Review and Confirm Your Investment: Double-check your investment details and confirm your transactions.

💡Step-by-step one-time and SIP investment in Direct Mutual Funds Plan Via MF Utility.

Conclusion

Investing in direct mutual funds through MF Utility is a convenient and cost-effective way. By following the steps above, you can get started with your mutual fund investing smoothly.

Note investing involves risks; aligning your investments with your financial goals and risk profile is essential.