Investors looking to invest in mutual funds themselves or with expert guidance that focuses on you, not on selling financial products, should opt for a direct mutual funds plan.

A direct mutual funds plan was introduced in India in 2013 before that investors had no other choice than to invest through a broker/ distributor.

Table of Contents

Types of Mutual Funds Plan

Mutual funds give you two plan options to invest:

🔹Regular Plan: Investment in Mutual Fund via broker/distributor.

🔹Direct Plan: Investment in mutual funds without any help or under the guidance of experts who do not sell/distribute mutual funds. A direct mutual funds plan can help you generate approx. 1% more return (due to eliminating the commission payable to a broker) at the same level of risk if invested via a broker (Regular Plan).

The direct and regular plans are managed by the same fund manager, have the same portfolio, and are part of the same mutual fund scheme. The only difference is having different expense ratios (recurring expenses incurred by the mutual fund scheme).

Identify your existing investment – Regular or Direct Plan?

If you are an existing mutual funds investor, invested by yourself, and unsure whether your investment is in a direct or regular plan, then this section is for you.

Step#1: Look for your mutual fund investment statement or log in to the portal if you invested online.

Step#2: Check the scheme name; if it does mention Direct.

Example:

In Direct Plan

🔹Axis Short-Term Fund-Direct Plan

🔹Axis Short-Term Fund-Direct

In Regular Plan

🔹Axis Short-Term Fund-Regular Plan

🔹Axis Short-Term Fund-Regular

🔹Axis Short-Term Fund

If the scheme does not have direct or regular mentions, it is a regular plan(invested via broker/distributor).

(The above scheme name is for illustration purposes only)

If you do not find a Direct mention in the scheme name, that means your investment is via a broker/distributor.

Don’t break your heart 💔 if you don’t find Direct mentioned in the scheme name. The first step you should take is to stop SIP in a regular plan, if any.

⚠️Note: Do not switch your existing investment to a Direct plan without expert guidance because switching to a Direct Plan is considered a sale even though money doesn’t hit your bank account.

Consequences of switching from a regular Plan to a direct Plan without planning:

🔸You may have to pay capital gain tax

🔸You may end up paying an exit load

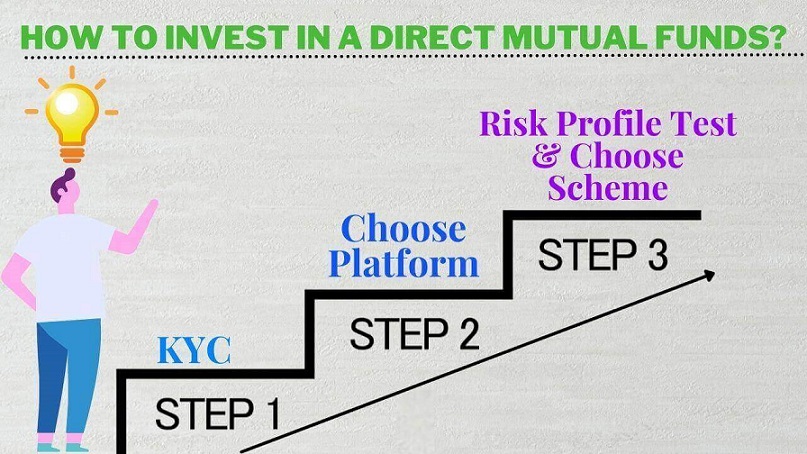

How To Invest In Direct Mutual Funds?

Investing in direct mutual funds is an easy process.

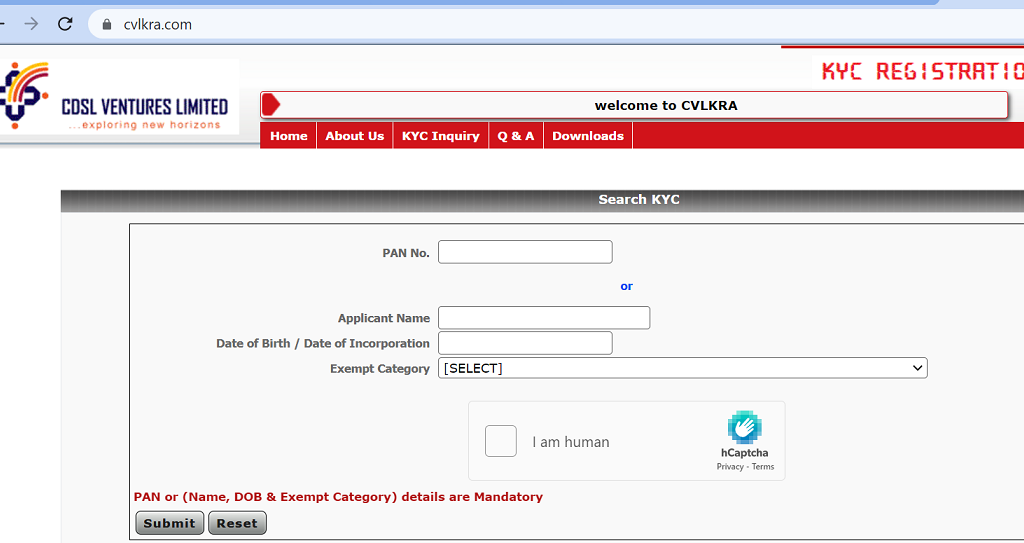

Step#1: Check your KYC status in CVLKRA by inserting your PAN No. and hitting the submit button; if your KYC is in place, it will show your PAN No and when it was done.

If you don’t find any details, then initiate eKYC.

Step#2: Open MF Utility account by filling eCAN form after your KYC / eKYC is complete

You can invest in direct mutual funds one-time (lump-sum) or via SIP.

(Read More: Best Mutual Funds Apps In India)

Lumpsum Investment in Direct Mutual Funds Plan Via MF Utility

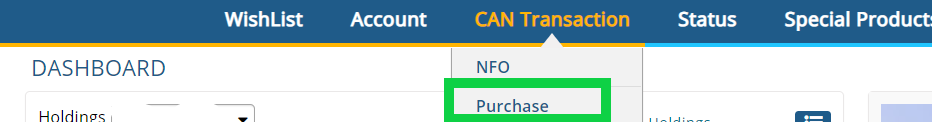

To purchase log in to MF Utility.

Step-1: Go to CAN Transaction, then click on Purchase

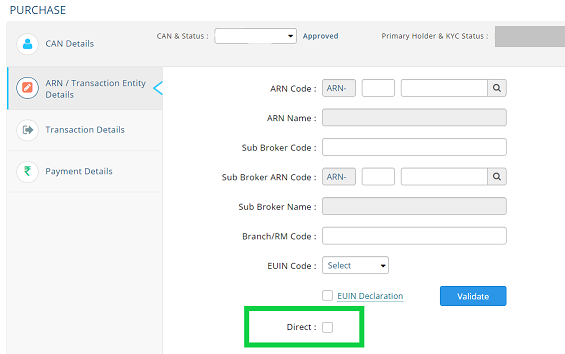

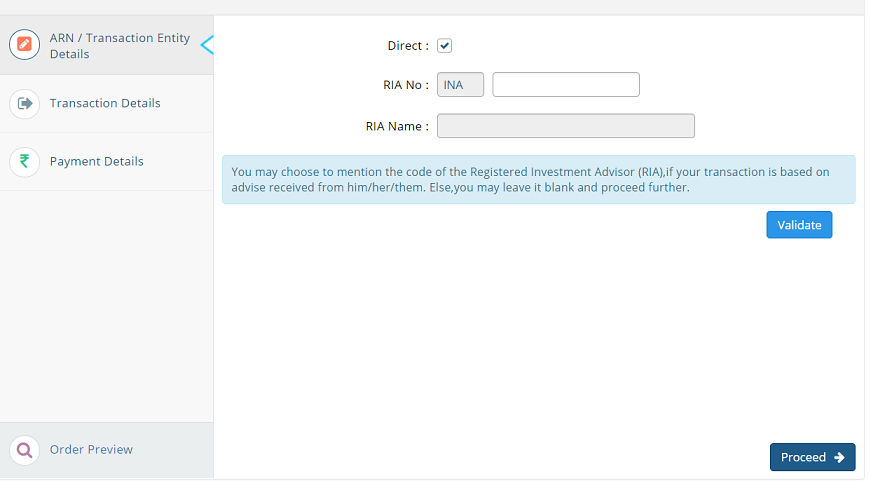

Step-2: Click on Direct

Step-3: Proceed

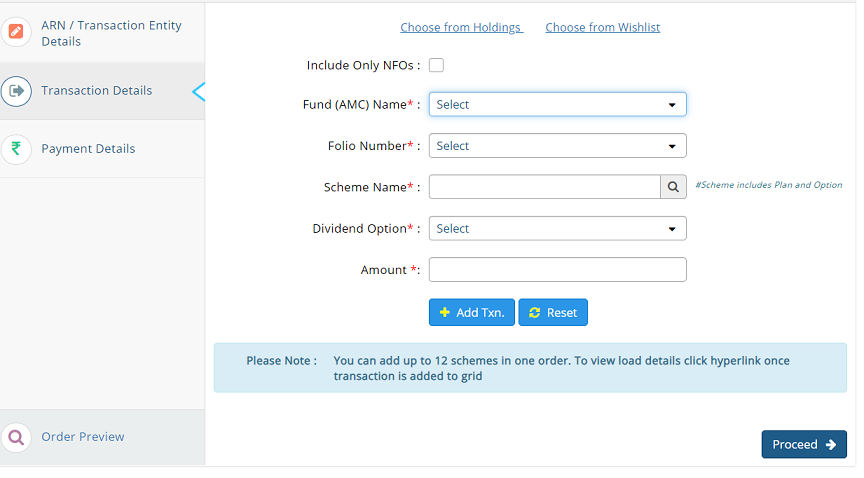

Step-4:

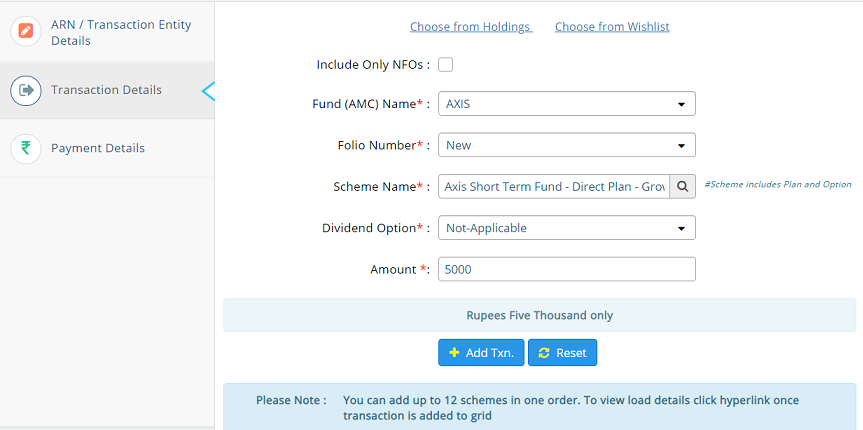

🔹Select the AMC

🔹Select the existing folio or create a new folio (if you have an existing folio, then select the same)

🔹Select scheme name

🔹The moment you select the growth option, the dividend option will not be applicable

🔹Enter the amount: If creating a new folio, then purchase a small amt. and then add balance (just as a precaution starting with small amt.)

Example:

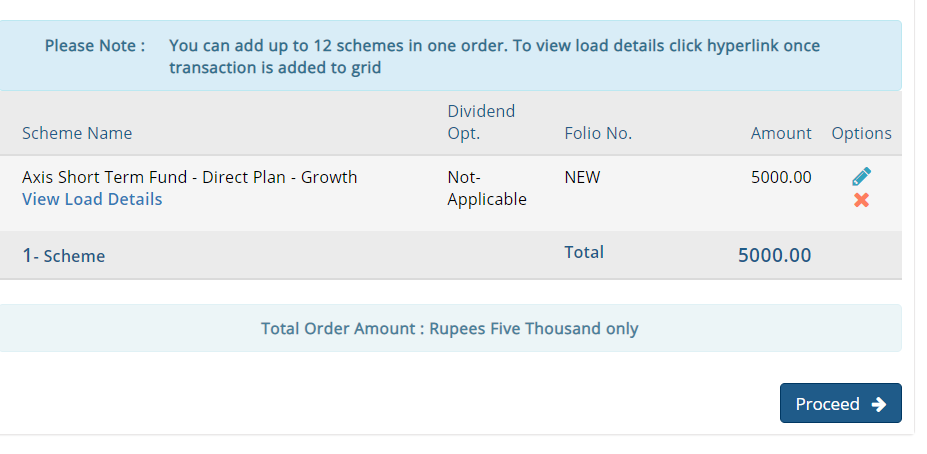

Here you can add up to 12 transactions, then Add Trn and Proceed.

This is how it looks like after Add Trn; now proceed:

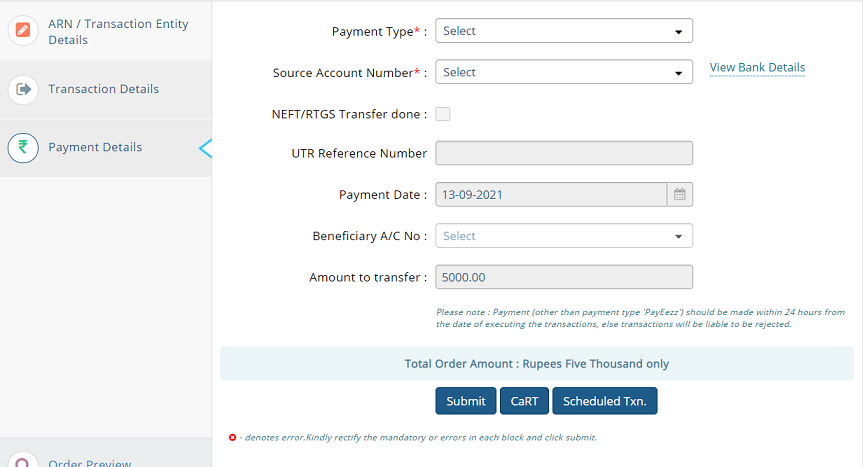

Step-5: Select the payment type followed by the source account number and submit

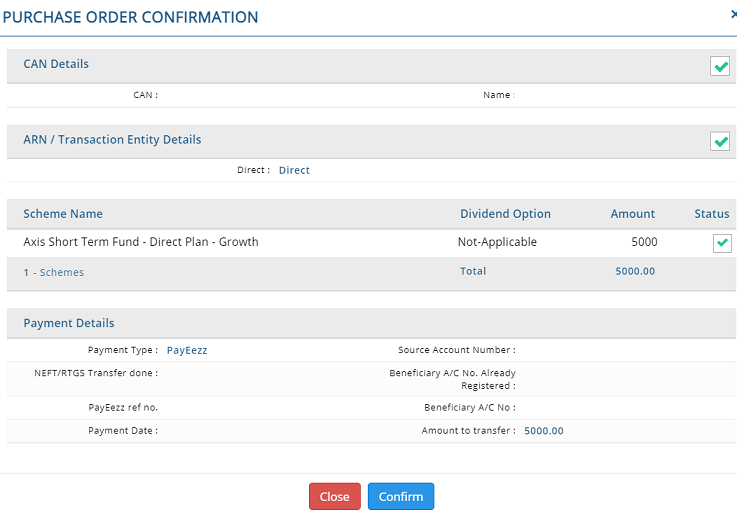

Step-6: Check the details and confirm.

Note:

🔹If you select net banking, it will take you to the bank login to complete the payment.

🔹If it is PayEezz, this will be the last step (it may take up to 2 working days to debit your bank account).

Congratulations, you have successfully initiated a one-time purchase in Direct Mutual Funds.

SIP Investment in a Direct Mutual Funds Plan Via MF Utility

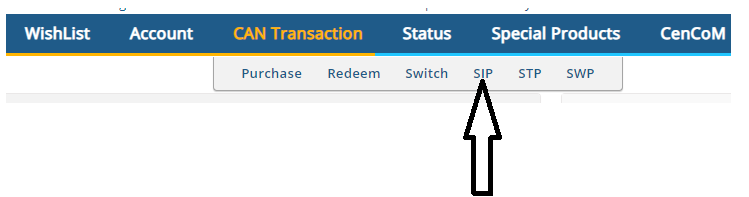

Step-1: Login to MF Utility and go to SIP under CAN Transaction

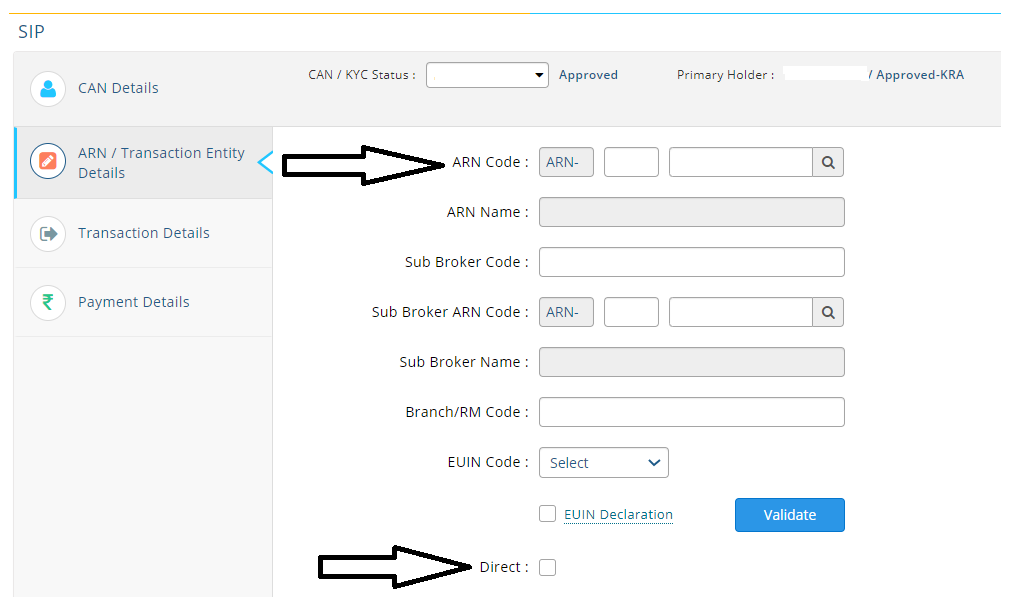

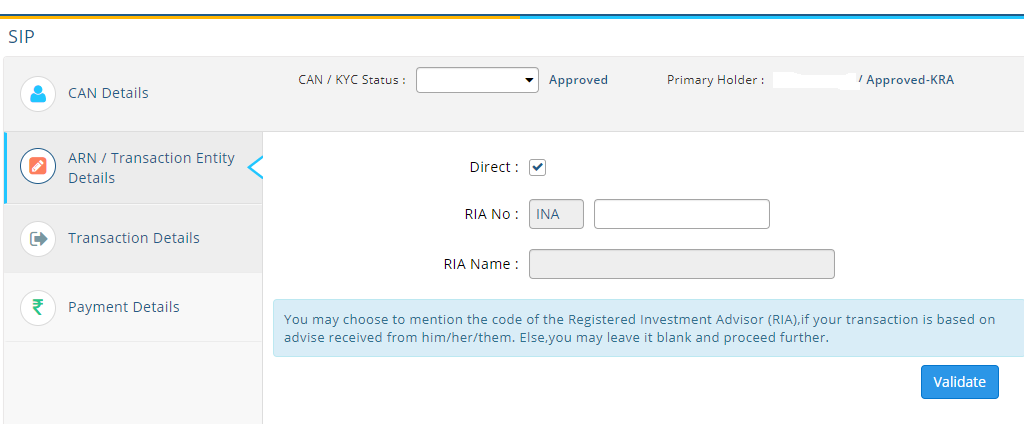

Step-2: Under ARN/ Transaction Entity Details – Select Direct to invest in a Direct Mutual Funds Plan

The below screen will appear when you select a direct mutual funds plan

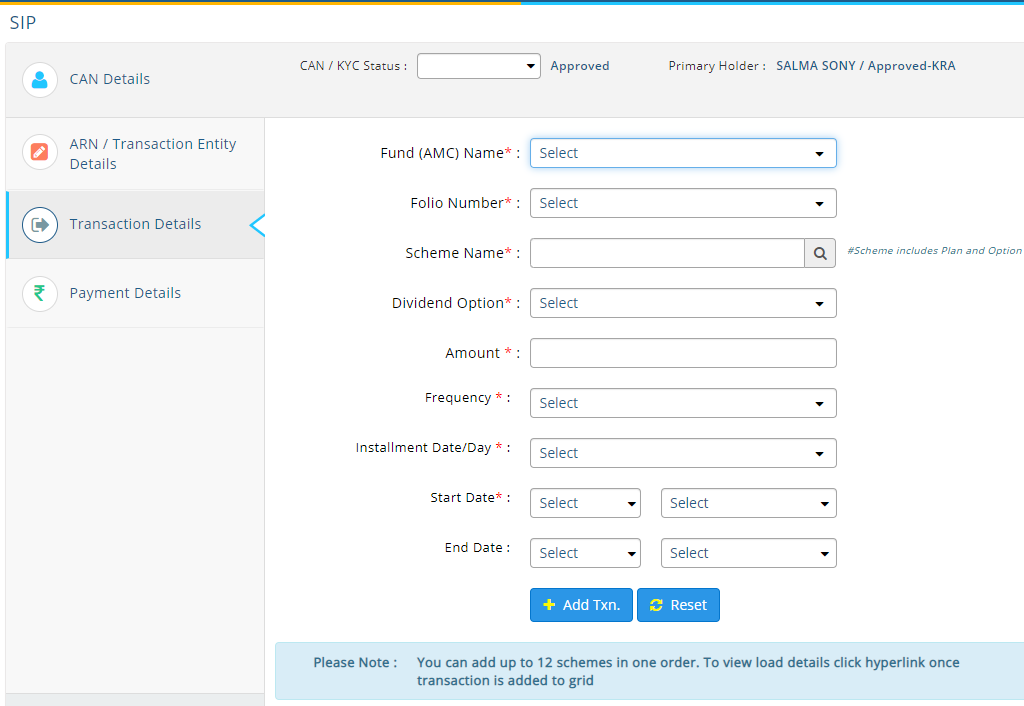

Step-3: Under Transaction Details, select the AMC -> Folio Number -> Scheme name -> Amount -> Other details & Add Transaction.

Note: At a time, you can set up max up to 12 SIPs

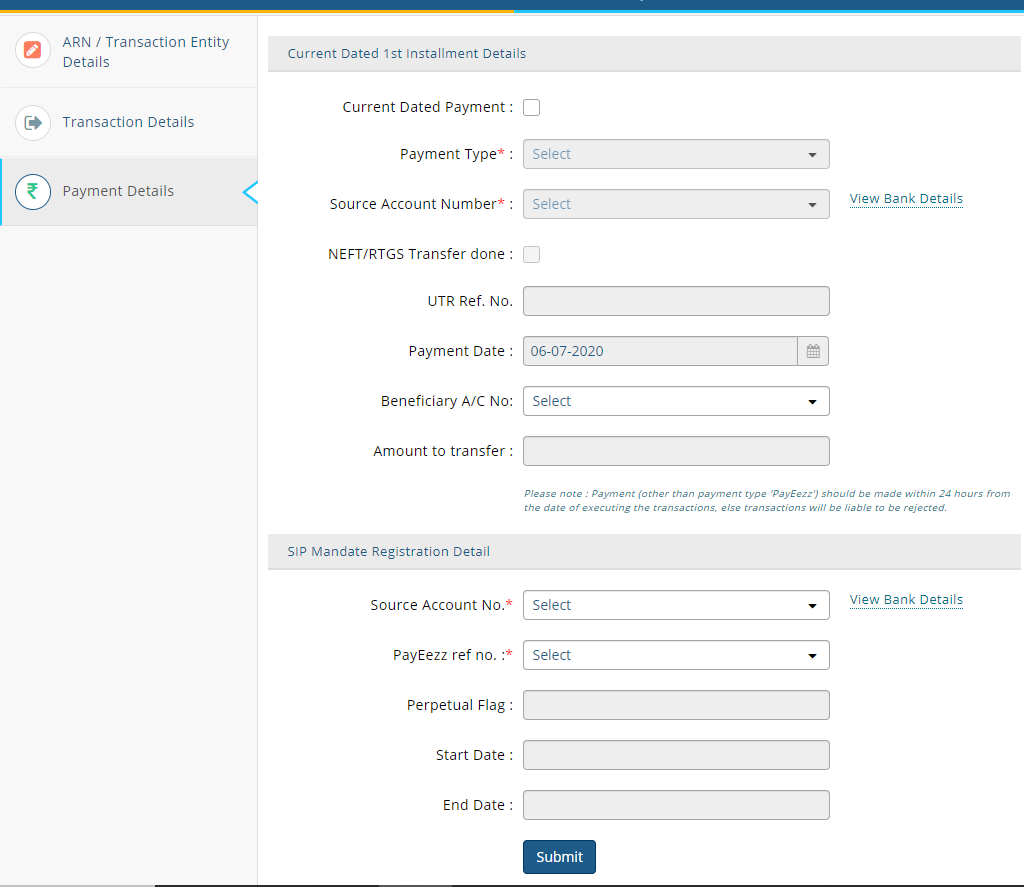

Step-5: Choose the current dated 1st installment; if you wish to pay the first installment immediately, and if not, then leave this section blank and fill SIP Mandate details only and submit.

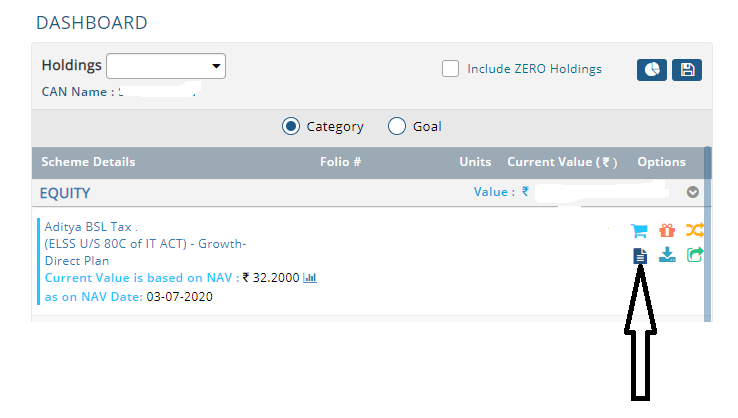

Alternatively, you can also go directly to the dashboard and click SIP next to the scheme for which you wish to set up SIP (this will help avoid filling in a few basic information manually).

Congratulations, you have successfully initiated SIP investment in Direct Mutual Funds.

⚠️Note: The above method will select a broker or direct investment mode, whichever is already there for the existing scheme. Make sure to opt for a direct mutual funds Plan only.