Table of Contents

How to start SIP investment in Mutual Funds? – Salma Sony, CFPCM

SIP stands for Systematic Investment Plan, and people often use SIP as a synonym for Mutual Fund.

Any instrument (FD, RD, PPF, etc.) is a SIP (Systematic Investment Plan) if invested systematically.

Why is SIP used as a synonym for Mutual Fund?

The classic example is Xerox; people often use “Xerox” instead of photocopy.

The process, which made photographic copies onto plain, uncoated paper, had been known for some time, but this was its first commercial application. The product brought so much success, and the name “Xerox” was used as a synonym for photocopy.

Same way, SIP became a synonym for Mutual Fund.

As you know the history behind SIP, let’s learn how to start SIP investment (step-by-step) in a Mutual Fund?

Step 1: Complete your Know Your Customer (KYC)

To invest in mutual funds—whether through a SIP or lump sum—you will first need to become KYC-compliant.

The KYC can be done online and offline:

a) Online KYC

Online KYC is known as eKYC. You can do eKYC via KARVY or through any fund house (investment limit of Rs. 50,000 per annum per AMC).

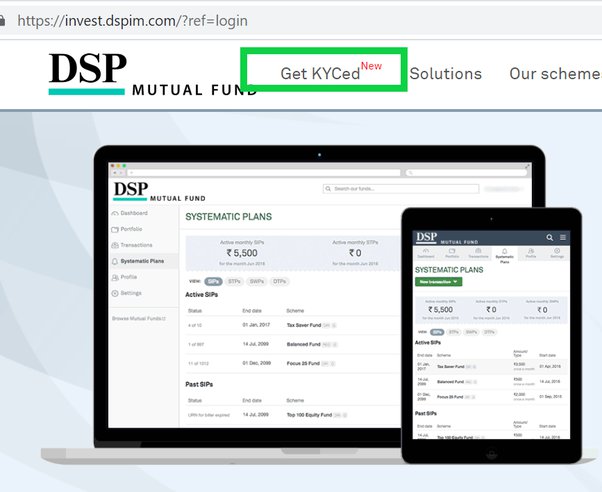

Many fund houses ask for initial investment when performing eKYC using their portal; however, DSP does not. Hence, I am providing you with the DSP eKYC portal as it is effortless with no initial investment requirement.

Limitation of the eKYC

If you have decided to start your investment journey, you must immediately act on it without any delay, and eKYC will be the fastest way to get there. However, there is a limitation of the investment amount in the case of eKYC, that is maximum of Rs. 50,000 p.a. per fund house. So, if you wish to invest more than Rs. 50,000 p.a. each fund house, then you must do your KYC offline.

b) Offline – KYC

You can do offline KYC by submitting the below documents to CAMS or Karvy or any fund house near your place:

- 🔹 A physical KYC form (stick passport size photo)

- 🔹Self-attested PAN

- 🔹Address proof

Step 2: Open MF Utility Account/login to fund house portal

To open MF Utility Account, fill eCAN form or visit the fund house website to create a fund house login where you wish to invest and start a SIP investment.

Note: You can open an MF Utility account online only when your KYC / eKYC is in place.

(Read more: best mutual funds apps in India to know why I use MF Utility and recommend my clients for direct mutual fund investment.)

Step 3: Register for a SIP in the Direct plan Mutual Fund

- 🔹Login to MF Utility or Fund house portal

- 🔹Register one-time mandate for auto-debit of SIP amount

- 🔹Go to the SIP option

- 🔹Choose scheme

- 🔹Choose frequency

- 🔹Choose SIP From and To date

Direct Plan Mutual Fund helps you generate more returns than a regular mutual fund plan. Hence, choose your investment options carefully.