You might wonder why anyone would leave their money with mutual funds unclaimed. However, you will be amazed that the Indian MF industry has an unclaimed amount of Rs.26,000 crore in FY 2023. In this article, I will discuss unclaimed mutual funds in India, how to check them, and the steps to recover them.

Table of Contents

What are Unclaimed Mutual Funds?

When an investor fails to encash their dividend or redeem their cheque before it becomes invalid, the amount is categorized as unclaimed.

🔹Unclaimed Dividend: When an investor fails to encash their dividend before it becomes invalid.

🔹Unclaimed Redemption: When an investor fails to encash their cheque before it becomes invalid.

However, there are situations where investors have made their investment but forgotten, or the beneficiary isn’t aware, so they never claim after the investor’s death. In such situations, the investment continues to stay invested forever in an open-ended fund and never falls into the unclaimed mutual fund category.

Reason for Unclaimed Mutual Funds

There are numerous reasons for unclaimed mutual funds. Here are the most common ones:

1) Change in address of the investor.

2) Name mismatch in bank account and mutual fund records.

3) The bank account associated with the mutual fund has closed.

4) Not sending the received cheque to the bank for clearing within time.

What Happens to Unclaimed Mutual Funds?

The unclaimed funds have accumulated over time, creating a considerable pool of idle money. However, the good part is there is a way to check and claim the same.

You must know three situations to understand what happens to unclaimed mutual funds:

a) Open-ended Mutual Fund Scheme (Growth & Dividend Re-Investment Option)

You need not worry in this case, as this will continue to stay invested until you redeem.

b) Open-ended Mutual Fund Scheme (Dividend Re-Investment Option)

If you or your family have stopped receiving dividend payouts directly to your bank account, the possible reason could be that your bank account linked to a mutual fund has become dormant or closed. In this case, you must immediately update your bank account details to claim unclaimed and future dividends.

c) Closed-ended Mutual Funds Scheme, Target Maturity Mutual Funds & FMPs

They will fall under the unclaimed catalog if investors fail to redeem the cheque before it becomes invalid.

📖💡Read More: Investment Planning For Salaried Employee

The Process to Claim the Unclaimed Dividend and Redemption

SEBI has made it compulsory for AMCs to provide the details of unclaimed investments on their websites. You as an investor can check unclaimed sum either by vising AMC’s website (refer to AMFI link single point of AMCs links which will redirect to the respective AMC’s; however, not all the links are working) or registrar’s website CAMS & KFintech.

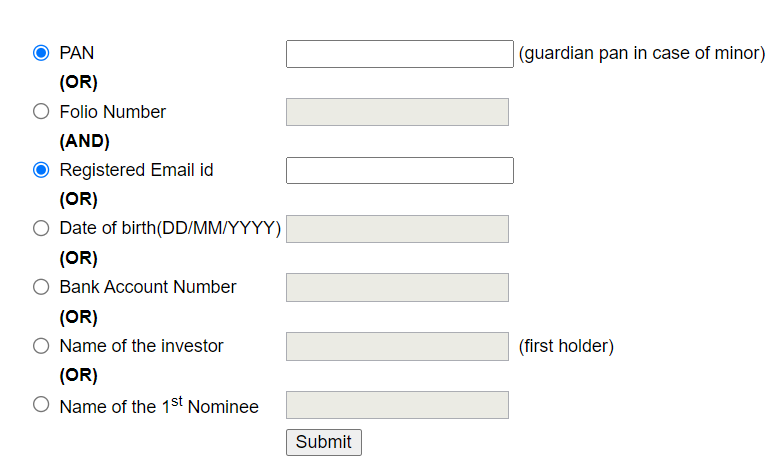

To check the unclaimed money status, you must provide basic details like PAN number or Folio Number and registered email id or DOB or bank account number or investor name or name of the 1st nominee.

To claim such unclaimed redemption or dividend amount, an investor must comply with the requirements stated in the “Unclaimed redemption/dividend claim form” and submit it after completion.

After submitting the form, investors will receive the initial unclaimed amount along with interest earned by deployment in permitted instruments by SEBI (Overnight scheme / Liquid scheme / Money Market Mutual Fund scheme floated by Mutual Funds specifically for the deployment of the unclaimed amounts) until three years from the date of the instrument.

SEBI circular clearly states that AMCs will not be permitted to charge any exit load in this plan, and the TER (Total Expense Ratio) of such plans will be capped as per the TER of the direct plan of such scheme or at 50bps, whichever is lower.

Investors, who claim these amounts after three years, shall be paid the initial unclaimed amount along with the income earned on its deployment till the end of the third year. After the third year, the income earned on such unclaimed amounts shall be used for investor education.

To claim the interest, you must approach the Investor Education and Protection Fund Authority.

Here is the link that describes the claim procedure.

Conclusion

To avoid your hard-earned money falling into unclaimed funds, make sure that you don’t miss the following:

- Update your KYC regularly if there is any address change.

- In case of a name change (in case of marriage), update KYC and apply for a name change with each fund house separately (note, by updating KYC, your name will not get updated in the AMC record.

- Update your contact details (if changed).

- Update nominee- name as per nominee PAN (don’t leave nomination blank)

To update contact details and nominees online, use MF Central.

Important Articles Related to Personal Finance