As India’s financial literacy grows, people understand that buying life insurance or creating a will is a proactive step one needs to take to safeguard their family’s financial future. Making a Will is a part of estate planning that is often ignored. In this article, I will guide you on how to create will in India and share the Sample Will that you can download.

Table of Contents

What is a Will?

“Will” is defined in Section 2(h) of the Indian Succession Act 1925 to mean the “legal declaration of the intention of the testator with respect to their property, which they desire to be carried into effect after their death.”

Simply put, WILL is a legal document that outlines a person’s wishes regarding the distribution of their assets and properties after their death. It allows individuals to specify how to divide their money, real estate, investments, and personal belongings among their chosen beneficiaries.

Who Can Draft a Will?

Any person with a sound mind and a major (above age 18) can create a will. Here are some criteria for individuals who can create a will in India:

🔹Sound Mind: The individual creating the Will (known as the testator) must be of sound mind, understanding the implications and consequences of making a will.

🔹Age: The person must be above the age of 18. Minors are not legally allowed to create a will.

🔹Free Will: The Will should be created voluntarily, without under the influence of others.

🔹Capacity: The testator should have the mental capacity to comprehend the nature of the Will and its effects.

Once these criteria are met, most individuals can create a will to distribute their assets and specify how they wish their estate to be handled after passing.

Essential Components of a Will

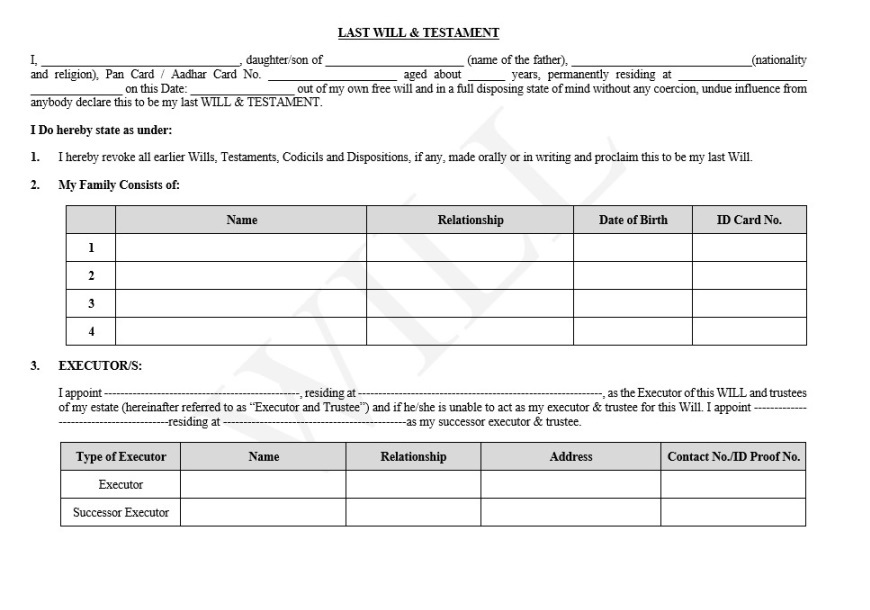

✔️Testator: The person making the Will is the testator. The testator’s rights are limited to what they own legally, and the WILL comes into effect only after the testator’s death.

✔️Beneficiary: The beneficiary is the person whose name is mentioned in the WILL to receive a portion of the deceased testator’s estate.

✔️Executor: The person whose name is mentioned in the Will to handle the estate of the deceased testator is an Executor.

✔️Codicils: A testator can change the Will’s contents several times before death. Such changes to the Will are called Codicils.

✔️Probate: Probate is a copy of a will certified under the seal of a court.

✔️Successor Executor: A successor executor is the substitute executor. The successor executor is a safety net and steps in when the executor is unavailable for various reasons such as death, incapacity, refusal to act, etc.

Types of Will in India

Mainly there are two types of Will in India:

- ☑️Privileged Will: A Will created by a soldier, airman, or mariner aged 18 years or more and engaged in actual warfare or at sea is a Privileged Will.

- Privileged will need not be witnessed or notarized and may be written or made by word of mouth. However, a will made by word of mouth shall be null at the expiration of 1 month after the testator is still alive.

- ☑️Unprivileged Will: Other than the Privileged Will, it must be in writing and signed by the testator in two witnesses’ presence.

How to Create Will in India?

Creating a will in India involves a structured process to ensure its legal validity. Here is a guide on how to create a will in India:

Steps to Create Will in India:

- Consider the Requirements

- 🔹Ensure you are of sound mind and above the age of 18.

- 🔹Understand the assets you wish to distribute and the beneficiaries you want to include.

- Drafting the Will:

- 🔹You can write the Will yourself or seek legal professional advice.

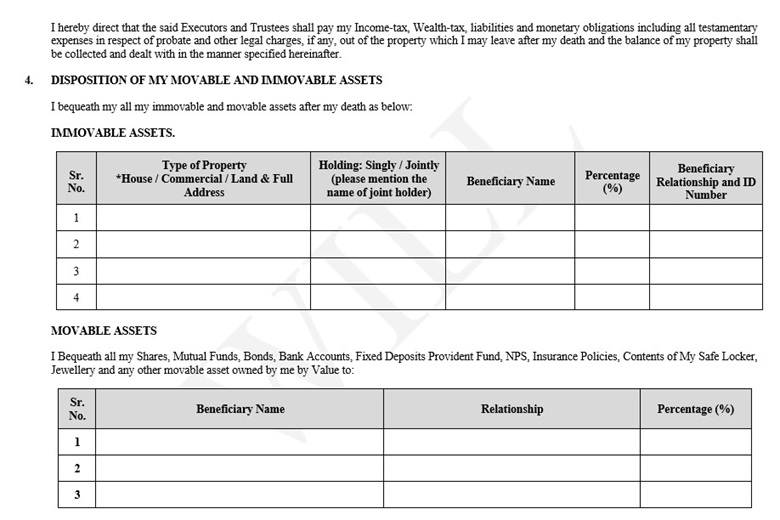

- 🔹The Will should clearly outline your assets and how you want them distributed among your beneficiaries.

- 🔹List the beneficiaries and their share of the assets.

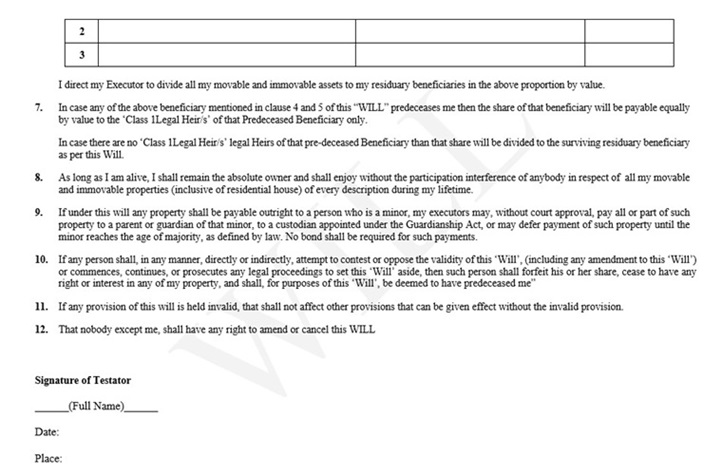

| IMMOVABLE ASSETS | |||||

| Sr. No. | Type of Property *House / Commercial / Land & Full Address | Holding: Singly / Jointly Please mention the name of Joint holder) |

Beneficiary Name | Percentage (%) | Beneficiary Relationship and ID Number |

| 1 | |||||

| 2 | |||||

| 3 | |||||

| 4 | |||||

| MOVABLE ASSETS | |||

| Sr. No. | Beneficiary Name | Relationship | Percentage (%) |

| 1 | |||

| 2 | |||

| 3 | |||

| 4 | |||

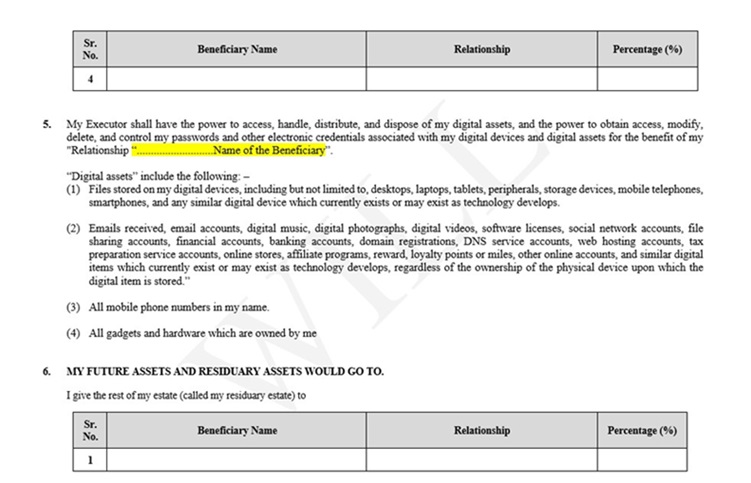

| FUTURE ASSETS AND RESIDUARY ASSETS | |||

| Sr. No. | Beneficiary Name | Relationship | Percentage (%) |

| 1 | |||

| 2 | |||

| 3 | |||

- Include Executor and Witnesses:

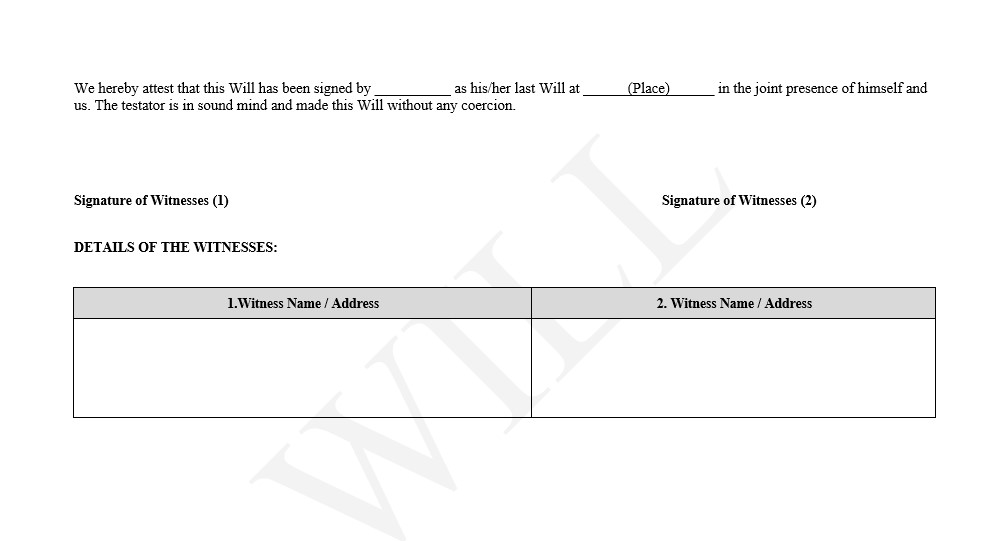

- 🔹A Will must be signed by the testator (the person creating the Will) in the presence of at least two witnesses.

- 🔹Witnesses should also sign the Will, confirming that they witnessed the testator signing it and that they believe the testator was of sound mind at the time.

- 🔹Appoint an executor, someone you trust, to carry out the instructions in the Will.

| Type of Executor | Name | Relationship | Address | Contact No./ID Proof No. |

| Executor | ||||

| Successor Executor |

- Date and Sign the Will:

- 🔹The testator should date and sign the Will at the end of the document.

- 🔹The signatures should be made in the presence of the witnesses, who should also sign and mention their full names and addresses.

- Revise and Review:

- Reviewing and updating your Will as circumstances change, such as marriages, births, or acquisitions of new assets, is essential.

Points To Consider While Creating Will in India

- You must have 2 witness.

- Preferably appoint an executor, someone younger than you. However, appointing an executor is not mandatory.

- Store the original Will in a safe and accessible place, and inform the executor (if any) of its location.

Is It Mandatory to Register Will in India?

Will registration is not mandatory; the law doesn’t require the Will to be registered for it to be considered legally valid. A will can be valid even if it’s not registered.

However, registering a Will can add security and credibility to the document as the process involves submitting the Will to the Registrar or Sub-Registrar. A registered will is stored with a government office and can be retrieved if the original is lost or tampered with.

To register, take the Will, witnesses, and required documentation to the Registrar’s office or register online by exploring the below-mentioned service provider or from your own research.

Points To Consider While Creating Will in India

- You must have 2 witness.

- Preferably appoint an executor, someone younger than you. However, appointing an executor is not mandatory.

- Store the original Will in a safe and accessible place, and inform the executor (if any) of its location.

Interesting Read: Process For Transmission of Mutual Fund Units Upon Unitholder’s Death

Who Can be the Executor?

The executor can be any person you trust to read the Will correctly and ensure asset distribution as you decide. Usually, in India, people appoint the family members they trust most as executors.

The role of an executor starts with the testator’s death and ends when all debts have been cleared, taxes have been paid, and assets have been distributed as per the Will.

- The executor works under the following rule of law:

- 1. The executor can refuse to take responsibility as an executor before they start the process.

- 2. The executor cannot back out once they take up the responsibility for executing the Will.

Checklist For Executors

Being an executor can be a lot of work. To follow up on many details. They need to act quickly and follow up on these details.

1. Locate the Will.

2. Avail of the services of a lawyer, if necessary.

3. Locate the beneficiaries listed in the Will.

4. Notify the associated creditors, if any.

5. Send notices to banks, mutual fund AMCs, post offices, etc.

6. Appraisal/ valuation of inventories.

7. File for life insurance.

8. Distribute assets.

9. Obtain receipts from all beneficiaries.

10. File legal documents.

Tip: If you are an Executor, keep a copy of all the records for at least 2-3 years.

I hope you found this article helpful and are ready to create your Will; in case you are unsure, don’t hesitate to get the help of legal professionals.