Planning for retirement is a crucial aspect of financial planning, including exploring retirement investment options. In India, the importance of this aspect has grown significantly over the years because of changes in work style and the FIRE (Financial Independence, Retire Early) movement.

But before you jump in and start investing in any retirement investment option, it is essential to understand which phase you belong to so that you can select your retirement investment option accordingly. In this article, I will explain the life timeline phase, factors that impact retirement planning, and the investment choices you can make for planning your retirement.

Table of Contents

Life Timeline to Decide on Retirement Investment Option

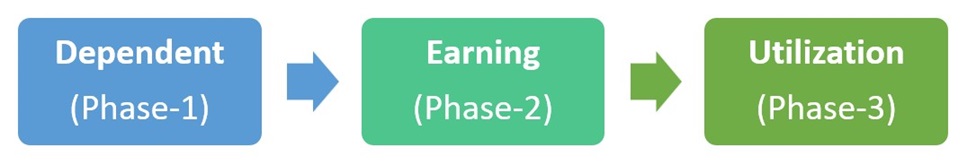

In our life timeline, everyone goes through a journey in phases. If I have to divide the life timeline, keeping retirement in mind, I would divide it into 3 phases.

✔️Phase 1: Dependent Phase

A phase of your life where you are dependent on your parents. You need to ask your parents for anything you want, and you will have to get their permission for anything you do. In this phase, no one thinks about retirement, but the next phase is where they can earn and spend without depending on their parents.

The moment they start earning, their dependency on their parents for finances goes away, which makes them move to the second phase of their lifeline.

✔️Phase 2: Earning Phase

The earning phase is one of the crucial phases of your life because this phase decides how your future will be in your retirement. The earning phase is also known as the accumulation phase.

In the earning phase, you go through a journey of spending, saving, investing, and accumulating wealth. Not planning well impacts you and your dependent family member’s financial future.

Financial planning is essential because most individuals are busy and take random investment advice. They live in the myth that their Employee Provident Fund (EPF) will take care of their retirement.

First, It is essential to understand how much retirement corpus you need to live a peaceful retirement and then choose the right retirement investment option for the accumulation phase to build the required retirement corpus.

✔️Phase 3: Utilization Phase

In this phase, you live a peaceful retirement life if you have planned your retirement well in your earning phase. It’s time to reap the fruit of your wealth accumulation by investing in a retirement investment option for the utilization phase. And, if you have not accumulated a retirement corpus well, you may end up working for money even at your retirement.

With this, you are now well aware of which timeline you are in. Let’s dive into factors that will impact your retirement planning.

Factors to Consider in Retirement Planning

🔹Retirement Goals: Set a clear and realistic retirement goal. Realistically consider each expense, such as household, lifestyle, and medical expenses, over and above medical insurance premiums. Your retirement corpus calculation should be based on the present value of these expenses.

🔹Inflation & Taxation: Account for inflation and income tax payable in your retirement corpus, pre and post-retirement. In the accumulation and utilization phase, investments ROI post inflation & post income tax payment should ideally outpace to accumulate the target corpus in the accumulation phase and maintain your purchasing power in retirement. Otherwise, your retirement corpus will erode before time.

🔹Time Horizon: Starting early for your retirement planning is a straightforward, easy, and proven strategy. In the retirement calculation, consider your time horizon until retirement. Longer time horizons allow for more aggressive investment strategies, while shorter ones may require more conservative choices.

🔹Risk Tolerance: Assess your risk tolerance and choose investment options that align with your comfort level. Take risks, but always a calculated risk.

🔹Diversification: Diversify your portfolio and consider a mix of equity and debt. Do not go 100% equity, considering retirement is a long-term goal. Like balanced food, a balanced portfolio is a must to sustain your retirement plan, even during the bad times.

🔹Professional Advice: If you find the entire process overwhelming, consider consulting a financial advisor to make well-informed decisions and create a customized retirement plan.

Retirement Investment Option – Accumulation Phase

Investment options that can help your retirement in the accumulation phase will undoubtedly differ from the investment plan you may opt for at retirement. So, let’s learn about the retirement investment option in the accumulation phase.

1. Employees’ Provident Fund (EPF)

Most salaried professions have EPF contributions and believe their EPF contribution will take care of their retirement. As an advisor, I have seen retirement planning come across as a scary goal with a considerable investment-required gap. With the remaining 15 years, it creates lots of pressure on salaried professions with another critical goal like child higher education on the radar. Hence, I strongly suggest you do not depend on EPF solely for your retirement.

2. National Pension Scheme (NPS)

The National Pension Scheme (NPS) is designed for retirement. Not many advisors recommend NPS due to its withdrawal condition. However, if you plan to retire at a regular age, like 58 or 60, there is no harm in considering it.

Individuals who are planning to retire early also find no harm in contributing Rs. 50,000 p.a., which helps them save over and above EPF as well as save income tax of Rs. 15,000 p.a. (if you are in the 30% tax bracket and have opted for the old regime) and Rs. 10,000 p.a. (if you are in a 20% tax bracket and have opted for the old regime). So, this investment option works well for retirement planning and availing tax benefits under section 80C of the Income Tax Act.

3. Public Provident Fund (PPF)

The Public Provident Fund is a popular government-backed investment option. PPF is a long-term savings scheme with a tenure of 15 years, which can be extended in blocks of 5 years, and that’s why investing in PPF to diversify your retirement portfolio is a great choice.

4. Mutual Funds

A Mutual Fund is a financial instrument that pools money from investors and helps them invest in an asset class such as equity, debt, or gold. For retirement planning, you may consider investing in an equity mutual fund (large cap, mid cap, flexi cap, index fund) or solution-oriented mutual fund designed for retirement planning.

Retirement Investment Option – Utilization Phase

1. Senior Citizens Savings Scheme (SCSS)

SCSS is explicitly designed for seniors 60 and above. It offers higher interest rates compared to other fixed-income options. And also credit quarterly interest on a defined date that assures regular income.

SCSS has a maturity period of 5 years, which can be extended once for an additional three years. One can invest up to Rs. 30 lakhs. SCSS can be one of your good choices in the utilization phase only if you plan to retire at age 60; in the case of early retirement, this cannot be opted.

2. Monthly Income Scheme (MIS)

The Post Office Monthly Income Scheme is a savings scheme that offers monthly interest payments. It is suitable for retirees looking for a regular source of income. The tenure of an MIS account is 5 years.

3. Annuity Plan / Pension Plan

An annuity is a pension plan that provides periodic payments in exchange for a lump sum investment. The life insurance company offers annuity plans under a pension scheme. It works opposite to regular investment. In a typical investment, you aim to invest monthly/quarterly/annually and expect a wealth accumulation in the long run. However, in an annuity plan, you invest lumpsum and receive regular income.

An annuity is of two types:

Immediate Annuity: In this, you invest and immediately start getting the payout. Example: LIC’s Jeevan Akshay.

Deferred Annuity: In this, you buy and out for payout at a later date. While planning your retirement, in the accumulation stage nearing your retirement (5-7 years), you can opt for this option for better ROI. Example: Jeevan Shanti

Annuities can be fixed or variable, depending on your preference at the time of option payout / buying the plan.

4. Government of India (GOI) Bond

These bonds are of two types: taxable and non-taxable:

- Taxable Bonds: The interest payable is taxed, and that’s why the interest of these bonds is higher.

- Non-Taxable Bonds: The interest payable is non-taxed, and that’s why the interest of these bonds is low compared to the taxable bonds.

5. Debt Mutual Funds

Debt mutual funds can be a good option for parking most of your retirement corpus as your funds remain in debt and hence safe, and you can opt for the SWP (Systematic Withdrawal Payment) option for a monthly payout. You can also actively make changes like changes in the amount required or pause and stop the payout, if needed.

6. Fixed Deposit (FD)

Fixed deposit is considered a safe and easy-to-access investment for retirees. You may park some portion of your fund for medical needs or emergencies in a fixed deposit.

Challenges in Retirement – Utilization Phase

- Inflation: It erodes the actual value of savings. Hence, carefully plan your investment in your utilization phase. Ensuring that investments outpace inflation is essential. Ensure you mindfully invest your corpus to withdraw income during retirement.

- Healthcare Costs: Rising healthcare costs are a significant concern for retirees. Ensure you plan for your medical expenses over and above medical healthcare policies.

- Longevity Risk: With increasing life expectancy, there is a risk of outliving your savings. Despite adequate planning and investing, you may encounter this risk. Hence, it is to save over and above retirement corpus need.

Conclusion

Gone are those days when the child was taking care of their parents. We must plan our retirement carefully and choose the best investment options for retirement so that we all live together because we want to, not because we lack funds.

Frequently Asked Questions

Q-1: What role do annuities play in retirement planning?

Annuities are insurance products that provide a guaranteed stream of income for a specified period or for life. They can be part of a retirement strategy to ensure a steady income flow.

Q-2: Can I access my retirement savings before retirement age without penalties?

Early withdrawals from retirement accounts may result in penalties and taxes. However, certain exceptions or hardship provisions may apply depending on the type of investment. For example, you can read the NPS New Rule For Partial Withdrawal.

Q-3: How should I adjust my investment strategy as I approach retirement?

It would be best if you shifted towards more conservative investments as retirement approaches to protect your savings.

Q-4: What are the best investment plans for retirement?

The best retirement plan can be created by combining multiple investment products like SCSS, MIS, FD, Bond, pension fund, etc.