Owning a home is a dream for any Indian. The decision to rent or buy a home is one of the most significant financial decisions individuals make for their families. It is a complex decision as this decision is more driven emotionally. Other factors that play an important role in decision-making are increasing property prices and personal preferences. This article will dive into the advantages and disadvantages of each option and provide calculations to help you make an informed decision regarding your rent vs. buy home decision.

Table of Contents

Thoughts that Drive the Rent vs Buy Home Decision- Fear, Savings, Tax Planning

- What if the property price increases in the future? Probably, I can afford it now with a longer loan tenure and not later (fear)- A fear of the possibility of not owning a house makes the individual prefer the buy home option. Owning a home makes them feel secure.

- Why should I pay rent rather than buy the home and pay EMI (savings)? – By buying a home, I can reduce the EMI portion overall and, side by side, own my dream home. All the money spent on rent is an expense; I don’t accumulate anything in return. The feeling that rent money does not give anything in return drives the decision.

- With a home purchase, I can take tax benefits and own a house – A win-win situation (tax planning) – Owning a house can help in better tax planning drives the decision.

Rent vs Buy Home – Advantages & Disadvantages

Rent vs Buy Home- Renting a Home

Renting a home has many advantages and disadvantages; let’s explore them.

Advantage

🔹Flexibility: One of the most significant advantages of renting a home is flexibility, especially for those who value flexibility. If you stay in a different city (outside your home city), primarily due to your job, you most likely know the importance of flexibility. If not home town, then any city that calls with better career opportunities renting a home gives the flexibility to move around. Whereas, if you own a house, you would prefer to stick to the same city.

🔹Lower Initial Costs: An initial security deposit is way lower than the initial down payment (20%) when you buy a home.

🔹Predictable Monthly Expenses: By staying on rent, you have fixed monthly rental payments, which simplifies budgeting and financial planning. Unlike owning a house, being the owner, you may get unexpected property repairs and maintenance costs.

🔹Minimal Responsibilities: Being a tenant, you are free from any responsibilities like Property maintenance, taxes, and other legal obligations.

🔹Tax Benefit: You can take the HRA (House Rent Allowance) tax benefit as a salaried individual; this helps you reduce your overall rent expenses.

Disadvantage

🔸Limited Control: As a tenant, you have limited control over the property. You may be unable to make any changes or renovations without the owner’s consent.

🔸Unexpected Home Change: As a tenant, you fear that the owner may ask you to leave the place with prior notice as per agreement; this makes the tenant feel insecure.

Rent vs Buy Home- Buying a Home

Buying a home is considered a symbol of financial stability and success in India. Let’s discuss the advantages and disadvantages.

Advantage

🔹Ownership: Owning a home is a dream for every Indian. Owing a house with an equated monthly option feels like an easy option. However, owning a house without planning can give you financial stress.

🔹Tax Benefits: Being a homeowner, you can benefit from tax deductions under sections 80C (Principal Repayment) and 24(b) (Interest on Home Loan) of the Income Tax Act. However, certain conditions must be fulfilled to take the tax benefit.

| Deduction Type | Section | Maximum Deduction | Max Tax Saving (30% Slab) | Conditions |

| Principal | 80C | 1,50,000 | 45,000 | One should not sell the property within five years post position. |

| Interest | 24(b) | 2,00,000 | 60,000 | The property’s construction must be finished within five years |

Disadvantage

🔸High Initial Costs: You must be ready to pay high initial costs, including down payment, registration fees, stamp duty, and other legal expenses.

🔸Less Flexibility: Moving to another city becomes challenging once you buy a house, and you may choose to lose good career opportunities. If you take a call and move, your family may not want to move, or you might not want to rent out the home as you have made it with love, which leads to double the expenses, i.e., loan EMI and rent in another city.

The Cost of – Renting vs Buy Home

| Cost of Renting | Remarks | Cost of Buying | Remarks |

| Rent | Between Rs. 20,000 – 50,000. Depending upon the city and location. | Down Payment | 20% of the house value |

| Security Deposit | Depending upon the city, It’s between 2-10 months of rent. | Home Loan Interest | 8% or more (floating rate) |

| Registration Fees and Stamp Duty | Max 10% (depending upon the city) | ||

| Homeowners Insurance | Depending upon the loan amount | ||

| Property Tax | Depending upon the property location, land price, etc | ||

| Maintenance and Repairs | 1-2% of home value per annum | ||

| Interior Designing cost | Minimum Rs. 5 lakhs (very basic) |

From the above list, you can quickly realize that owning a home is much costlier than staying on a rent. Does that mean you should never own a house?

The answer is -NO.

The best option to make owning a home more favorable is to maximize your down payment and buy a home only when your career doesn’t demand movement, when you are tired of change and want to stabilize. This way, you can focus on faster growth in your career, and it helps you save maximum downpayment. And, even if you stay in your hometown, buying a home in the initial stage of your career will cost you a lot.

When is the Right Time to Buy a Home?

Let’s understand it with a case study.

Assume you want to buy your dream home, which costs Rs. 1 Cr., inducing registration cost and stamp duty (10% of the property value) Rs. 1.10 Cr.

Now, let’s see how this works out for you:

| Property Buying Price | Rs. 1 Crore |

| Downpayment (20% of Rs. 1 Cr.) | Rs. 20 lakhs |

| Loan from the bank (80% of Rs. 1 Cr.) | Rs. 80 lakhs |

| Interest rate | 8% |

| EMI (Equated Monthly Instalment) | Rs. 66,915 |

| The total amount paid to the bank in 20 years | Rs. 1,60,59,650 |

| Interest amount paid to the bank in 20 years | Rs. 80,59,650 |

If you observe closely, the cost of loan funding(Rs. 80 lakhs) is equivalent to the loan amount (Rs. 80 lakhs) itself. Total tax savings of Rs. 20 lakhs; under section 80C – Rs. 9 lakhs and 24(b) – Rs.11 lakhs. Still, you will pay Rs. 60 lakhs interest to the bank.

The more significant the amount and longer the loan tenure, the more unfavorable will be the loan funding. Hence, consider preparing a minimum 50% downpayment or as maximum as possible.

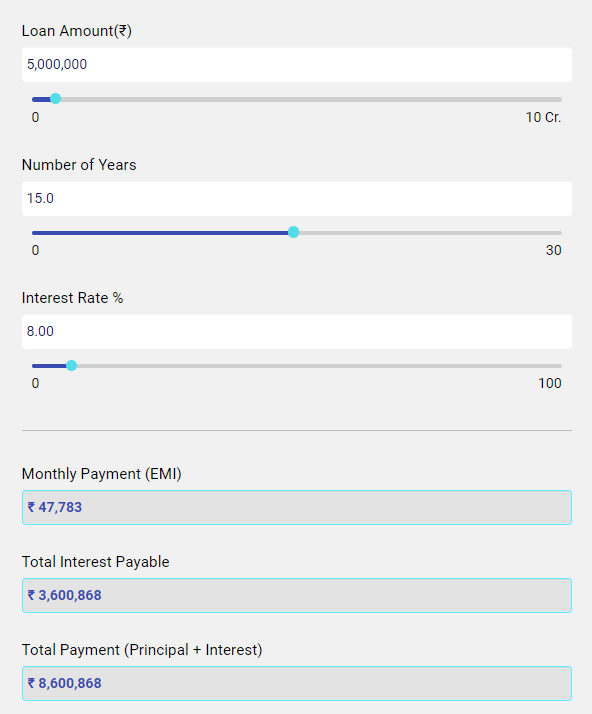

Below is the calculator screenshot, which shows 50 lakhs (50% of 1Cr.) of loan funding and reduces loan tenure from 20 years to 15 years. Your home loan funding cost can be reduced from 80 to 36 lakhs. (Save Rs. 44 lakhs in interest).

The right time to buy a home is when you are ready with a minimum down payment of 50% and your career is more stable. With this, if you can regularly pre-pay part of your home loan, it will be icing on the cake.

Conclusion

Buying your dream home is a milestone you must fulfill, but if you want to enjoy being in your own home, you must plan properly.

It would be best if you considered financial planning to plan all your goals like house purchase, child education, car purchase, retirement planning, etc. Otherwise, you might own a home, but with massive loans and insufficient cash flow to fund your other goals like children’s education and retirement planning, that will cause more stress than happiness in owning a home.