Generally, the primary objective of investment for investors is wealth generation. However, keeping such a vague objective leads to confusion, and that’s why having a clear and realistic investment objective plays a crucial role that not only helps you achieve the objective of wealth generation but also helps in choosing the right investment by taking calculated risks based on your risk tolerance level.

In this article, we will dive deep into and understand the possible investment objectives for investors for their investment portfolios.

Table of Contents

What is the Meaning of Investment?

An investment is an asset that helps you grow your money.

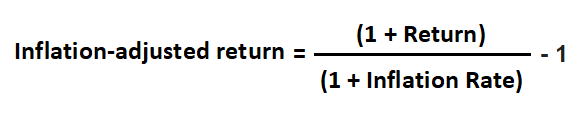

Any investment is said to be appropriate only when it can at least deliver you the growth to the extent so that you don’t lose the value of that money.

In a simple word, it makes sense to invest in those investments that can at least deliver positive returns post-inflation.

Let’s look at the example below to understand investing in which options make sense and which do not.

Let’s look at the below example, to understand investing in which options make sense and which it does not.

| Investment Options | Expected Investment Return | Inflation | Inflation-adjusted Return |

| Option-1 | 5% | 6% | -0.94% |

| Option-2 | 7% | 6% | 0.94% |

| Option-3 | 10% | 6% | 3.77% |

| Option-4 | 12% | 6% | 5.66% |

= (1.05/1.06)-1

= -0.94%

Hence, we learned from the above example that investing in option 1 is not even an option. However, most Indian investors invest in option 1, like FD, RD, insurance plans, etc.

With this, let’s understand the different investment objectives and why investors opt for them.

What is the Objective of Investment?

✅To Safe guide your money

One of the significant investment criteria is to safeguard the principal. Gone are those days when debt investments like FD, PPF, EPF, etc., used to deliver 8-10% returns. When investors invest in a debt investment like FD, PPF, EPF, RD, etc., that can directly relate to the safety of their principal (invested amount/money), and that’s why these investments, including all small savings investments, are so popular as they are backed by Govt. securities.

The trend of investing in such instruments has been followed for decades, and unfortunately, investors fail to understand these investments are highly exposed to inflation risk. Hence, it is time to plan your finances before investing.

✅To grow your money significantly

The other primary objective of the investment is to grow money in a sizable corpus in the long run. It suites young and long-term investors who are ready to take risks by investing in growth-oriented assets like equity mutual funds, direct stocks, etc., to secure their financial future.

However, the most common mistake they make before investing is not understanding the investments withdrawal process. Most people invest in insurance plans and cannot withdraw money (or can at a huge loss) when they need it, so they end up taking a loan. Hence, the best way to invest is based on financial planning. A random investment may help you accumulate wealth in the long term but cannot give clarity on how you can achieve your goals on or before time, or if you can access your funds when required, and if your financial future is secure in a true sense.

✅To earn regular income

Regular income needs typically come at the time of retirement when you would like to enjoy your life without worrying about your expenses. It is the time when your hard-earned money takes care of you. At this point, income-generating assets like a house (rental income), Mutual Funds with Monthly Income Plans (MIPs), and Post office Monthly Income Schemes (MIS) make more sense.

✅To minimize the tax burden

The majority of investors make their investment decisions based on these criteria without understanding whether they need to invest in a tax-saving investment option or not. The most common investments sold in the name of tax savings are insurance policies, PPF, and ELSS.

Note: By investing more, you cannot save more taxes. It would be best if you could learn the Tax Saving Investment Options and strategy before investing.

✅To meet your financial goals

Investing based on your life goals can help you achieve your goals your short-term and long-term goals.

It is important to understand your financial goals, and investing based on that can help you make your financial foundation strong and achieve all your goals on or before time.

It’s time to wake up, understand your goals, plan, and then invest rather than invest and then try to link those investments to the goals.

Generalizing Your Personal Finance Won’t Help; Invest Only In Those Products Which Suit Your Life Goals.

Category of Investment

Investments are basically categorized into four parts and each category has its own objective of investment:

✅Debt

Debt is a safe asset class where the objective of investment is the safety of the principal (invested money). Hence, well suited for short-term goals.

✅Equity

Equity is a risky asset class where the objective of investment is the growth of the principal (invested money). Equity investments are subject to market risks. Hence, well suited for long-term goals.

✅Gold

The value of gold ultimately depends on its supply and demand, and it has no value of its own. Physical gold is preferred by Indian families as a secure and stable investment and is also highly liquid.

However, the physical gold is exposed to risks like storage, theft, making charges, and more. Mutual funds, digital gold, and gold ETFs are not delivered in the physical form; it does not carry any of these risks.

Investment in gold has the potential to beat inflation over a long period. It is a safe haven when economic growth is slow and when traditional asset classes such as equity and debt are underperforming. Having 5-7% of gold in your portfolio is always good. Hence, the objective of investment is to balance the portfolio and give a sense of security.

✅Real Estate

Real estate involves investment in land or buildings (commercial and residential) or Real Estate Investment Trust (REIT). Real estate as an asset class presents a number of management issues, like property maintenance and legal clearances. It is exposed to liquidity risk and is impacted by economic cycles.

| Objective of Investment | Suitable Investment |

| Growth and appreciation in value | Equity shares and equity funds, Real estate, gold |

| Regular income | Deposits, Debt instruments and debt funds, Real estate |

| Liquidity | Cash, Bank deposits, Short-term mutual fund schemes |

| Capital preservation | Cash, bank deposits, Ultra-short term funds |

Types of Investment and Risk Involved in it

Many investment options are available in the market, which ultimately fall into the above-mentioned four categories.

From our school days, we have heard of high-risk high returns. Let us name a few investments, their category, and the risk involved in them

| Sl. No. | Investment Options | Investment Category | Lock-in period for | Risk factor |

| 1 | Public Provident Fund (PPF) | Debt | 15 years | Low |

| 2 | Fixed Deposit (FD) | Debt | 5 years | Low |

| 3 | Employee Provident Fund (EPF) | Debt | Retirement | Low |

| 4 | Senior Citizen Savings Scheme (SCSS) | Debt | 5 years | Low |

| 5 | Sukanya Samriddhi Yojana (SSY) | Debt | Till girl child reaches 21 years of age (partial withdrawal allowed when she reached 18 years) | Low |

| 6 | Life Insurance Policies | Debt | 5 years | Medium |

| 7 | Unit Linked Insurance Policy (ULIP) | Equity | 5 years | High |

| 8 | ELSS Mutual Funds | Equity | 3 years | High |

| 9 | Stocks | Equity | NA | High |

| 10 | NPS Scheme | Hybrid | Retirement | High |

| 11 | Gold ETF | Gold | NA | Low |

| 12 | Gold Mutual Funds | Gold | NA | Low |

| 13 | Gold Bond | 5 Years (maturity: 8 years) | Low | |

| 14 | Physical Gold | NA | Low | |

| 15 | Real Estate Investment Trust | Real Estate | Depends on scheme | Medium |

| 16 | Residential & Commercial Properties | Real Estate | NA | Medium |

Where Should You Invest, And How Much Should You Invest?

You must be wondering, there are so many financial investments available, so why should you even bother about where you should invest? However, even if you are investing in numerous instruments, you might not be able to realize them when you need them.

In the initial part of this post, we understood the investment objective very well, and one of the most crucial investment objectives is to meet your financial goals. When you have clarity on your life goals, the amount of money you need to meet that goal, by when you want to achieve the goal, and the risk you are willing to take to achieve them, that’s when you will get your answer on where to invest and how much to invest.

Why Should You Invest?

You need to invest to meet your life goals that are tied up with numbers, which means you need money to achieve them.

Example: House purchase goal, Child higher education goal, Vacation goal, Own marriage goal, Child’s marriage goal, Retirement goal, Passive income goal, etc.

Conclusion

Investing may create some wealth for you, but investing based on your goals will help you achieve your goals and create well, too.

Start your financial planning today.

FAQ

Q-1: What does investment mean?

An investment is an asset with the goal of capital appreciation or income generation. Capital appreciation means an increase in the value of an asset over a period.

Q-2: What are the different types of investment?

Here, I’m listing a few of them:

🔹Bonds

🔹Direct stocks/shares

🔹Fixed Deposits

🔹Post office Kisan Vikas Patra

🔹Mutual Funds

🔹National Pension System (NPS)

🔹Post Office Monthly Investment Scheme

🔹Public Provident Fund (PPF)

🔹Senior Citizens’ Savings Scheme

🔹Money Market Instruments

Q-3: What is the objective of investment?

🔹To Safe guide your money

🔹To grow your money significantly

🔹To earn regular income

🔹To minimize your tax burden

🔹To meet your financial goals

Q-4: How to start my investment journey?

Understanding the investment objective is the first step in planning your investment. Follow the below steps:

🔹Identify your goals: The amount of money you need to achieve the goal

🔹Identify your goal year: After how many years you will need money

🔹Understand your risk appetite

🔹Choose investment based on your years to reach goals and risk appetite: For short-term goals, go safe; for long-term goals, take risks based on your risk profile

Q-5: What are the key Objectives of Investment?

The key objective of the investment is to plan responsibly for tomorrow for a secured financial future. Putting your money aside and planning investments to keep up with inflation can help you achieve your goals.

Q-6: How do I create wealth for my family’s future goals?

Financial Planning is the best way to secure and create wealth for your family’s financial future.

Q-7: Can investing help with tax planning?

Yes, of course. With tax planning, you understand your source of income well, including capital gains, plan investment accordingly, and take tax benefits, keeping the income tax rule in mind.