Retirement planning may sound like a stage where you sit back and relax. It might be your dream to retire much earlier than the regular retirement age in India, that is, 58 or 60.

While talking to many youngsters who want to retire early, my first question is, why do you want to retire early? In most cases, it’s due to their hectic job schedule or not enjoying what they do. So, is there any other alternative so that you can enjoy your work? We will discuss this intensely, along with the benefits of retirement planning and steps to early retirement.

What is Retirement Planning?

Retirement planning is about setting financial goals and making strategic decisions to ensure a comfortable and secure retirement. Retirement planning is not limited to creating a corpus that will take care of your living expenses at retirement but also taking care of all other responsibilities beforehand so that you don’t have to work after retirement to fulfill these responsibilities.

Retirement planning involves understanding your financial needs and goals, determining how much money you will need to maintain your desired lifestyle during retirement, and then taking steps to save and invest to meet those needs.

What is the Right Early Retirement Age?

There is no specific age defined as proper early retirement. In India, retirement is usually at age 58 or 60. Any period before 55, 50, 45, or even earlier is considered early retirement and commonly known among youngsters as FIRE (Financial Independence, Retire Early).

However, retiring early may look attractive as it can buy you time, but it needs a lot of work. The work you would do in 25 years will probably be done in 15 years.

While working with multiple early retirement clients, retiring anywhere between 52-55 could be possible for many who enjoy their work and plan to retire 3-8 years earlier than the usual retirement age.

Here are your three starting points:

- Start early by saving 50-70% of your income.

- Invest your savings wisely.

- Work on your spending habits and live a financially disciplined life to make the most of it.

In short- Save more, spend less, and invest wisely.

Benefits of Retirement Planning

Retirement planning offers numerous benefits that can positively impact your financial well-being and overall quality of life during your retirement years. Here are a few key advantages:

- Financial Goal Achievement: As mentioned earlier, retirement planning is not limited to creating a corpus that will take care of your living expenses at retirement; in this process, you automatically work towards other financial goals with the financial planning process.

- Financial Security: Retirement planning is a well-calculated strategy covering all expected and unexpected situations. Hence, it reduces the risk of running out of money.

- Tailored Retirement Lifestyle: Well-planned retirement is based on numbers that help you understand what lifestyle you must live- travel-focused, relaxing-focused, etc.

- Emergency Planning: A well-structured retirement plan can adapt to life changes, such as unexpected expenses, ensuring you remain financially resilient.

- Healthcare Coverage: It allows you to consider healthcare costs and plan for health insurance to cover medical expenses in retirement.

- Long-Term Financial Stability: It helps to account for inflation and rising costs in your retirement budget, ensuring your financial stability over the long term.

Guide to Early Retirement

To achieve early retirement, working on your other goals is essential, followed by an early retirement goal. To make it simple, divide your goals into two parts:

- One-time goal: Goals that can be completed at once are one-time goals—examples: House purchase, child education, child marriage, etc.

- Recurring goals: Goals that keep coming with time are recurring goals. Annual vacation, car purchase (once in 8-10 years), etc.

The shorter the list of your goals and realistic, the faster you can achieve early retirement.

Here are the two steps to work on simultaneously for early retirement:

Step1: Work toward all one-time & recurring goals

In the true sense, if you wish to retire early, you must be very selective. Your goals must be realistic. Example: Going for an international vacation every year and buying a luxurious house can push away your early retirement goal.

Step 2: Work on early retirement number

Considering you have taken care of all other financial responsibilities, including life insurance, medical insurance, and emergency fund, let’s understand how to work for early retirement with the calculation.

Senario:1- Fully Retire

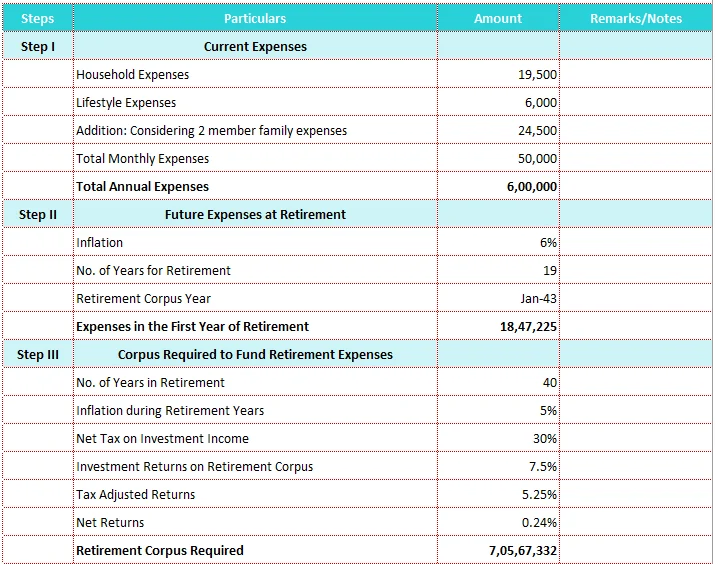

Let’s understand how Kiran (unmarried) can retire early.

He is 26 years old and would like to retire after 19 years (age 45). He would need Rs. 50,000 per month to take care of living expenses of himself & spouse as per today’s lifestyle. His life expectancy is 85.

When Kiran retires, he will need Rs. 7.05 Crore to care for his family’s needs until age 85.

To achieve this goal in the next 19 years, a monthly investment of Rs. 1.37 lakhs is required at 8%.

Senario:2- Partially Retire

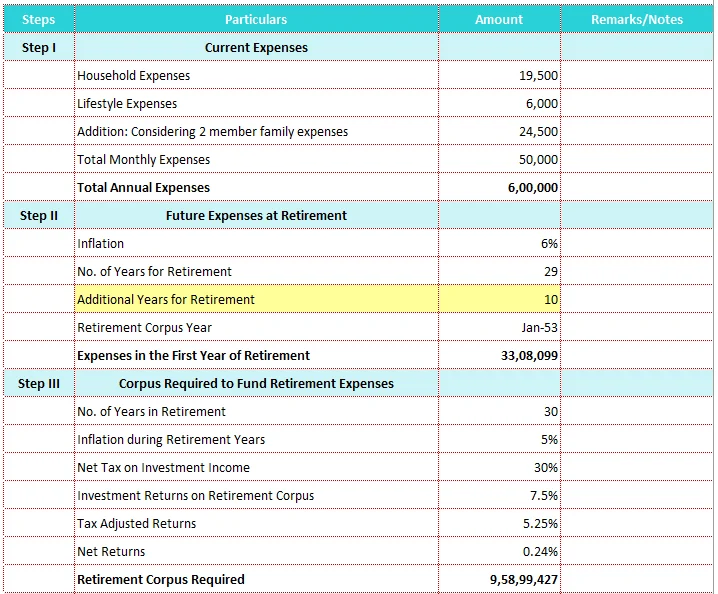

Let’s understand how Kiran (unmarried) can retire early.

He is 26 years old and would like to retire after 29 years (age 55). He would need Rs. 50,000 per month to take care of living expenses of himself & spouse as per today’s lifestyle. His life expectancy is 85.

When Kiran retires, he will need Rs. 9.59 Crore to care for his family’s needs until age 85.

To achieve this goal in the next 29 years, a monthly investment of Rs. 90,000 is required at 8%.

Here, partially retiring means, at age 45, you take up a low-paying job to take care of your living and let the accumulated portfolio grow for the next ten years to achieve its desirable corpus.

However, if you plan normal retirement at age 58, the journey will be easier as you will have 13 more years to invest (Age 45 to Age 58). Hence, the monthly investment needed for retirement corpus drops down drastically.

Steps To Work Towards Early Retirement

1. Set clear and realistic financial goals

Setting clear and realistic goals is a must. Understand your goals, the lifestyle you want to live in your retirement, and the retirement savings you need to achieve them.

2. Become debt-free

Ensure you are debt-free; that’s when early retirement will make sense, or you will continue working to pay EMIs. Do not get into the rat race of buying a home early in your career; work towards the right time to buy a home.

3. Live below your means

Everyone talks about economic inflation but not lifestyle inflation. Keep your expenses the same despite salary increments, which will help you save more.

4. Take professional advice

Early retirement is a critical decision; do not hesitate to seek professional help to make an informed decision.

5. Be patient and consistent:

Investing is a journey. Work on your spending and saving habits, be patient and consistent, give your best, and do not expect anything in the short term. Aim for financial independence; early retirement should be your last resort.

Conclusion

Everything in this world has phases. We take birth, grow, go to school, take up jobs, get married, and so on. We must work towards enjoying the journey we call life rather than running. We should enjoy each phase of our lives. If early retirement is not planned well (an activity that drives you to live), it can be a disaster.