As announced in the last budget to empower women, the “Mahila Samman Savings Certificate 2023” is launched.

On Friday (31 March 2023), the Government notified Mahila Samman Savings Certificate 2023, which will allow women and minor girls to invest up to Rs 2 lakh for 2 years and earn a fixed interest of 7.5%.

In this article, I will be discussing everything you must know before you rush to invest in “Mahila Samman Savings Certificate 2023,” either for yourself or a girl child.

Features- Mahila Samman Savings Certificates 2023

Who is eligible to invest?

Individual girl or woman in whose name the account is held.

Type of Account

- A single-holder type account be opened by a woman herself.

- A single-holder type account be opened for a minor girl by their guardian.

Note: Joint account not allowed.

Where can you open the Mahila Samman Savings Certificate account?

To open the account, you will have to reach the post office or the notified bank.

Deposit limit of Mahila Samman Savings Certificate 2023

(i) A minimum of Rs. 1,000 and multiples of Rs. 100 one-time deposit.

(ii) A maximum limit of Rs. 2 lakhs.

(iii) An individual (woman or guardian of a minor girl child) can open multiple accounts in this scheme subject to the max. limit of deposit Rs. 2 lakhs and a time gap of 3 months between the existing account and the opening of another account.

For example, if you are opening an account for yourself or your minor child on 6 April 2023 for an amount. Rs. 1 lakh, then you can open another account only after 6 July 2023 with a balance of Rs. 1 lakh or part thereof.

Term of Mahila Samman Savings Certificate 2023

The term is for 2 years, from 31 March 2023 to 31 March 2025.

Interest Rate of Mahila Samman Savings Certificate

An interest rate of 7.5% p.a. is compounded quarterly and will get credited to the account.

Forms under Mahila Samman Savings Certificate

Form 1: For Account Opening

Form 2: For Account Closure on Maturity

Form 3: For Withdrawal

Form 4: For Premature Account closure

Maturity and Payment

(i) The account holder (woman or guardian of a minor girl child) is eligible to withdraw for a maximum of up to 40% of the qualified balance once after the completion of 1 year from the account opening date by submitting Form-3.

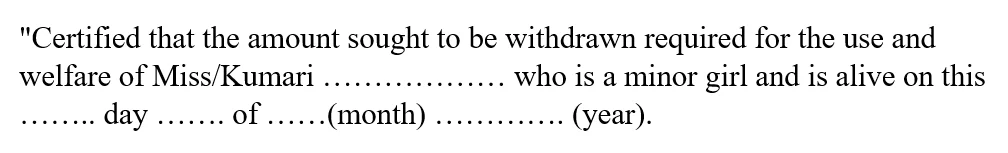

(ii) If the account was opened on behalf of a minor girl, the guardian can apply for the withdrawal by submitting the following certificate to the post office, namely:

English Version

Hindi Version

(iii) Upon maturity account holder (woman or guardian of a minor girl child) will have to apply for withdrawal by submitting Form-2.

Premature closure of Mahila Samman Savings Certificate Account

(1) Premature closure of account is allowed only in the following cases:

- On the account holder’s death (woman or guardian of a minor girl child).

- In extreme cases like medical support in life-threatening diseases of the account holder or on the guardian’s death.

Note: In case of premature withdrawal in the above two points (a) & (b), the interest payable remains the same.

(2) Premature withdrawal for any other reason; withdrawal is allowed only after 6 months from the date of opening of an account. In such case, the account shall be eligible only for the interest rate of less than 2% as a penalty of 5.5% (7.5% – 2%).

Taxation of Mahila Samman Savings Certificate 2023

So far, Govt. has not notified anything on the taxation front for Mahila Samman Savings Certificate 2023. By investing in this, you will not get tax benefits under section 80(c), and the interest payable will be taxed as per your tax slab.

Charges under Mahila Samman Savings Certificate 2023

| Type of transaction | Charges Payable (Rs.) |

|---|---|

| Receipt – Physical Mode | Rs. 40 |

| Receipt – e-mode | Rs. 9 |

| Payments | 6.5 paise per Rs.100 turnover |

Whether You Should Invest in Mahila Samman Savings Certificate 2023?

Here are three parameters on which basis you can make the decision:

1) If your income is up to Rs. 7 lakhs or you are opting for a new tax regime:

This means the tax benefit of the instrument is not your concern, and if your income is non-taxable, then the interest earned will not be taxed. Having an interest of 7.5% with post office investment safety is worth considering.

2) Attractive interest rate:

If the above point (a) makes sense in your income level, then compare the interest rate of bank Fixed Deposits (total bank deposits must not exceed Rs. 5 lakhs) and Post Office Term Deposit (TD) and choose the investment option wisely.

📖Must read: 5 Safe & Best Short-Term Investment Plans 2023

3) If you are looking to park your money for the short-term and liquidity is not the constraint:

Many investors are of a spending nature and look for investment options where accessing funds may take work. They can also consider it provided you have created your emergency fund.

Conclusion

All the investments are good; it is essential to understand whether they suit you. For that, it is vital to have clarity on your goals so the purpose of the investment can quickly be decided, along with little number crunching can help you make a wise financial decision.

Important Articles related to Personal Finance

- Debt Mutual Funds Taxation New Rule from 1st April 2023

- Best Mutual Fund Performance And Selection Technique

- NPS Tax Benefit 2023: Under Old Tax Regime

- Tax Saving Mutual Fund

- Emergency Fund: Where to Invest and Why have It

- Income Tax New Regime Or Old Regime: For Salaried Employees

- Money management tips for beginners

- Tax Planning For Salaried Employees

- Investment Planning For Salaried Employees

- Mutual Fund KYC Online Registration

- How To Invest In Direct Mutual Funds?

- How To Start SIP Investment In Mutual Funds?

- 5 Mutual Fund Types: Learn To Choose The Right Fund For You

Important Calculators

Frequently Asked Questions

Q-1: Who is eligible to invest in Mahila Samman Savings Certificate 2023?

Individual girl or woman in whose name the account in Mahila Samman Savings Certificate account is held.

Q-2: What is the interest rate of Mahila Samman Savings Certificate 2023?

An interest rate of 7.5% p.a. is compounded quarterly and will get credited to the account.

Q-3: What is the minimum investment limit for Mahila Samman Savings Certificate 2023?

A minimum of Rs. 1,000 and multiples of Rs. 100 one-time deposit.

Q-4: What is the maximum investment limit for Mahila Samman Savings Certificate 2023?

A maximum limit of Rs. 2 lakhs.

Q-5: How many times a year can an account holder invest in Mahila Samman Savings Certificate 2023?

Only once at the time of opening the account. However, they can open multiple accounts in this scheme, subject to the max. limit of deposit Rs. 2 lakhs and a time gap of 3 months between the existing account and the opening of another account.