We are in the fastest-growing era. With the economic growth, the growth of disease is also certainly growing. The medical inflation (13.8%) in India is highest among the Asian countries. According to the Global Burden of Disease Study, critical illnesses account for 60% of deaths in India in most cases, draining out people’s years savings. In this article, we will discuss what is a Critical Illness policy and how it can safeguard your health and hard-earned saved money.

What is a Critical Illness?

Critical illness is a medical serious illness that is often life-threatening and significantly impacts a person’s health. With the development in the medical field, we have possible treatments that can save an individual’s life if diagnosed in the early stage. However, the treatments are not at one time but in a procession that can take several months, which is very expensive.

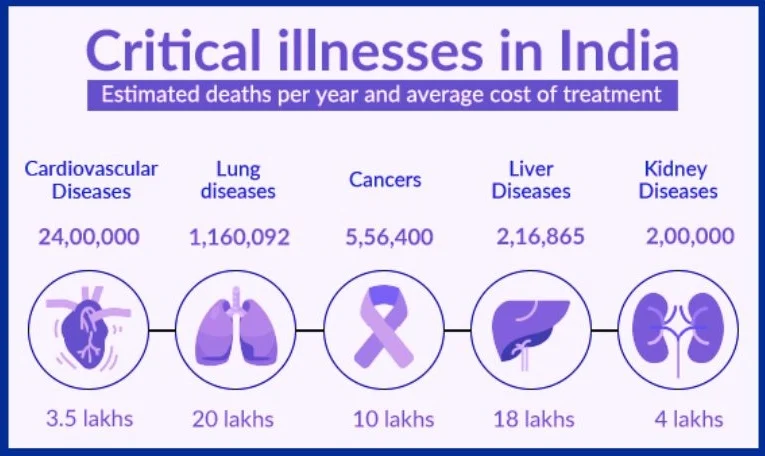

Common Types of Critical Illnesses

Cancer: This includes various forms of cancer, such as lung cancer, breast cancer, and more. The uncontrolled growth and spread of abnormal cells characterize cancer.

Heart Attack: A heart attack occurs when blood flow to a portion of the heart muscle is blocked, usually due to a clot in one of the coronary arteries. It can lead to heart muscle damage or even death if not treated promptly.

Stroke: A stroke happens when blood flow to the brain is disrupted due to a blood clot or bleeding in the brain. Strokes can result in brain damage, paralysis, or cognitive impairment.

Organ Failure: Critical illnesses can also involve the failure of vital organs such as the kidneys, liver, or lungs. Organ failure may require organ transplantation or ongoing medical treatment.

Neurological Diseases: Conditions like multiple sclerosis, major head trauma, and Parkinson’s disease are considered critical illnesses.

Understanding What is a Critical Illness Policy Insurance Terms

Covered Conditions: Ensure you read the policy document carefully and check the list of illnesses covered, as the diseases covered by different insurance companies may differ. If needed, take the help of your family doctor to understand the listed illness better. Usually, critical illnesses covered by standalone policies are more compared to those added as a rider, either in a regular health policy or term insurance policy.

Waiting Period: The Critical illness plan usually has a waiting period of 90 days; this means that one needs to complete 90 days after the policy purchase to claim against the critical illness policy.

Survival Period: Most Critical Illness cover policies have a survival period condition; this means you must survive for a specific period (typically around 28 days) after the diagnosis to become eligible for the claim payout. Survival period condition ensures that the policy only pays out for severe treatment.

Lump-Sum Payout: Upon the diagnosis of critical illness, the company pays the lump sum to the beneficiary that one can use for their treatment and take care of other financial obligations as one might take off from work while the treatment gets better faster.

Premium: Just like a health insurance plan, for critical illness insurance policies, you must make payments regularly to keep the policy active, and the insurance premium changes once every five years.

Important Read: How much health insurance do I need?

Source: Future Generali India Life Insurance

Should I Buy a Critical Illness Cover as an Insurance Rider or a Standalone Policy?

Most people believe the regular health insurance policy is sufficient for critical illness treatment. However, it is essential to know that most health plans cover the e-opinion or probably the expense incurred toward diagnosis, and once diagnosed with a critical illness, they do not fund treatment costs unless the critical illness is a part of the policy or you add it as a rider.

Who Can Benefit From Critical Illness Insurance Plan?

Here are two crucial points to consider while buying Critical Illness:

- High Treatment Cost: Usually, the critical illness treatment cost is higher, and a regular health insurance cover of Rs. 5 lakhs or 10 lakhs may not be sufficient to be covered by a health insurance policy, even if it is a part of it.

- Post-claim Policy Terminates: When you club critical illness insurance as a critical illness rider with health cover, it comes with a condition: “Once the critical illness claim is accepted, the cover for the beneficiary will be terminated with no subsequent renewals.”

So, if you make one one-time claim, you lose your regular health insurance policy. That’s why it’s suggested that you keep your health insurance and critical illness separate.

Many people also urge to include the Critical illness as a rider to life insurance plan. However, it may sound cost effective but it does not cover many illness. critical illness insurance plan provide covers multiple number of illness compared to standard health insurance or life insurance policy.

Essential Read: Checklist that will help you buy critical illness insurance

Conclusion

Critical illness may look like another expense added to your budget, but it is a safety net to safeguard your health and savings. You must opt for a critical illness insurance policy that will help you strengthen your financial foundation in your financial planning process.

Frequently Asked Questions

Q-1: Can I purchase a critical illness plan once I am diagnosed with an illness?

No, a critical illness plan must be bought before the diagnosis when you are in good health condition.