With the recent change in the debt mutual fund taxation rule, debt funds look less attractive as they no more are eligible for long-term indexation benefits. With this change, investors are exploring strategies that could help them avoid taxes. So, should they consider a hybrid mutual fund instead of a debt mutual fund? In this article, I will clarify the types of hybrid mutual funds you may consider replacing your debt fund.

Types of Hybrid Mutual Funds

As per SEBI, the hybrid mutual fund has seven sub-categories. Please refer below table that clearly explains the percentage holding of equity and debt in each sub-category.

| Hybrid Fund Types | Equity Exposure | Debt Exposure |

|---|---|---|

| Balanced Hybrid Fund | 40% – 60% | 40% – 60% |

| Aggressive Hybrid Fund | 65% – 80% | 20% – 35% |

| Dynamic Asset Allocation or Balanced Advantage Fund | 0% – 100% | 0% – 100% |

| Multi-Asset Allocation Fund | 10% – 90% | 10% – 90% |

| Conservative Hybrid Fund | 10% – 25% | 75% – 90% |

| Arbitrage Fund | Min. 65% | – |

| Equity Savings | Min. 65% | Min 10% |

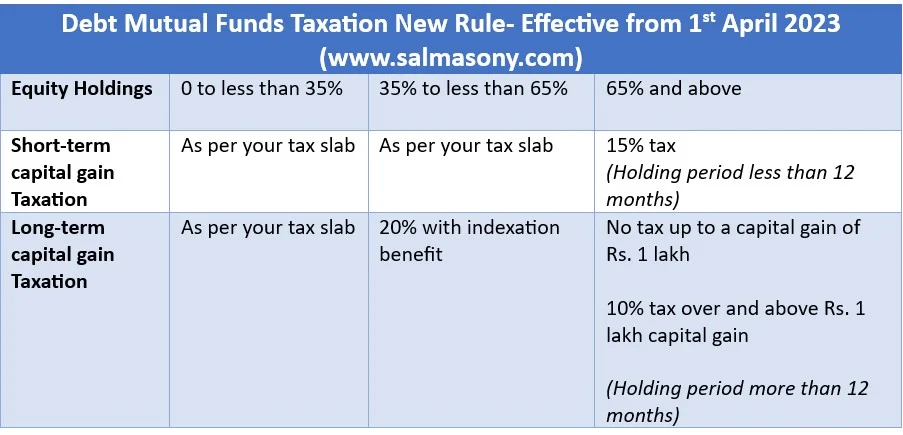

Now let’s analyze the applicable changes in the debt fund taxation from 1st April 2023.

The amendment to finance bill 2023 created three categories of mutual funds based on equity holding for Taxation purposes.

Earlier, for taxation purposes, a mutual funds scheme with less than 65% of exposure in equity was considered debt funds, and all the funds, even with 100% exposure in debt, were qualified for long-term indexation benefits.

If you observe closely, its pure debt and conservative hybrid funds having equity holding between 0-25% have an impact due to a change in taxation rule in a debt fund. So, if you have to consider replacing a debt fund/ conservative hybrid fund to avoid taxes, then it needs to move to a fund having equity exposure of 35% or above.

Now, let’s look at each hybrid category and analyze them.

📖 Read More: Debt Mutual Funds Taxation New Rule from 1st April 2023

Which Hybrid Fund Should You Consider Replacing the Debt Fund to Avoid Tax?

Always remember, when you invest in a debt fund, your priority is safeguarding your invested principal. Considering this, let’s analyze each category and find a good fit for debt fund replacement.

Balanced Hybrid Fund: Here, investment in equity & equity-related instruments is between 40% to 60%, and in Debt instruments, 40% to 60%. Balanced Hybrid Fund can freely increase their equity exposure up to 60%, which clearly shows it could not be considered a replacement for a pure debt mutual fund.

Aggressive Hybrid Fund: Here, investment in equity & equity-related instruments is between 65% to 80%, and in Debt instruments, 20% to 35%. Aggressive Hybrid Funds can freely increase their equity exposure by up to 80%. So, this is not a good alternative to pure debt funds from an asset allocation perspective.

Dynamic Asset Allocation or Balanced Advantage Fund: Investment in equity/ debt is managed dynamically, i.e. (equity & equity-related instruments are between 0% to 100%, and Debt instruments are between 0% to 100%). Dynamic Asset Allocation or Balanced Advantage Funds can increase their equity exposure up to 100%. Again, this is not a good alternative to pure debt funds from an asset allocation perspective.

Multi-Asset Allocation Fund: This fund invests in at least three asset classes with a min. allocation of 10% in each asset class. Multi-asset funds may invest in several traditional equity and fixed-income strategies, index-tracking funds, financial derivatives, and commodities like gold. The structure of this fund clearly shows it cannot be an alternative to pure debt.

Conservative Hybrid Fund: Here, investment in equity & equity-related instruments is between 10% to 25%, and in Debt instruments between 75% to 90%. Conservative Hybrid Funds can freely increase their equity exposure up to 25% (if you invest Rs. 100, Rs. 25 is at risk), whereas your expectation from a debt fund is that your principal is at no risk. This hybrid fund cannot replace a pure debt instrument.

Arbitrage Fund: The scheme follows an arbitrage strategy, with a minimum 65% investment in equity & equity-related instruments.

Arbitrage is the concurrent purchase-sale of an asset to take advantage of the price differential in the two markets and profit from the price difference of the asset on different markets or in different forms. Hence, Arbitrage funds are a good choice for careful investors who want to benefit from a volatile market without taking on much risk.

An arbitrage fund can replace a debt mutual fund for short-term parking. However, for long-term investing, there may be better choices.

Equity Savings Fund: Here, Equity and equity-related instruments are a minimum of 65%, debt instruments a minimum of 10%, and derivatives (min. for hedging to be specified in the SID).

Equity saving schemes invest in debt, equity, and arbitrage instruments. Combining the equity and arbitrage position in the equity market, they try to maintain overall equity exposure above 65% to attract lower taxation as applicable to pure equity funds. But given their structure, they are less safe than a debt fund but still safer than pure equity funds.

Conclusion

Refrain from blindly investing in any of the above-discussed hybrid fund categories instead of debt funds to save tax. You may find a short-term solution to reduce your tax liability by replacing your debt mutual funds. I suggest looking at the bigger picture. Plan your finances based on your financial goals, and financial planning can help you. All matters are achieving your financial goals on time.

Important Articles Related to Personal Finance

- 9 Strategies: How To Close Home Loan Early

- 5 Safe & Best Short Term Investment Plan 2023

- Debt Mutual Funds Taxation New Rule from 1st April 2023

- All About Sukanya Samriddhi Yojana Benefits

- All About Mahila Samman Savings Certificate 2023

- Best Mutual Fund Performance And Selection Technique

- NPS Tax Benefit 2023: Under Old Tax Regime

- Tax Saving Mutual Fund

- Emergency Fund: Where to Invest and Why have It

- Income Tax New Regime Or Old Regime: For Salaried Employees

- Money management tips for beginners

- Tax Planning For Salaried Employees

- Investment Planning For Salaried Employees

- Mutual Fund KYC Online Registration

- How To Invest In Direct Mutual Funds?

- How To Start SIP Investment In Mutual Funds?

- 5 Mutual Fund Types: Learn To Choose The Right Fund For You