Post office savings scheme (POSS), as the name defines, is a savings scheme primarily offered by Indian Post. It is also known as a small savings scheme. Under POSS, many small investment options are designed to provide safe and convenient savings and investment options for the Indian public. The interest rates of these savings schemes are revised quarterly.

Popular Post Office Savings Scheme

Here is the summary of the post office scheme:

- Savings Account: India Post offers savings accounts that work like savings accounts with any bank with competitive interest rates. These accounts provide a safe place to deposit money and earn interest.

- Recurring Deposit Account (RD): RD accounts allow individuals to save a fixed amount of money every month for 5 years and can be further extended to another 5 years by giving an application at the concerned Post Office. The government sets interest rates that are generally higher than those offered by regular savings accounts.

- Time Deposit (TD): Post office fixed deposit known as a Time Deposit (TD) and offer deposits for various tenures, starting from 1 year, 2 years, 3 years, and 5 years. The government sets the interest rates on these fixed deposits, typically higher than savings Account rates.

- Monthly Income Scheme (MIS): The Monthly Income Scheme is a post office savings scheme that offers monthly interest payments. It is suitable for individuals looking for a regular source of income. The tenure of an MIS account is 5 years.

- Public Provident Fund (PPF): PPF is a long-term savings scheme with a tenure of 15 years, which can be extended in blocks of 5 years. It offers tax benefits and competitive interest rates. Deposits made in a PPF account are also eligible for deductions under Section 80C of the Income Tax Act.

- Senior Citizens Savings Scheme (SCSS): SCSS is a dedicated investment option for senior citizens and offers a higher interest rate than other post office schemes. The maturity period for SCSS is 5 years and can be extended once for an additional 3 years.

- National Savings Certificate (NSC): NSC is a fixed investment scheme with a lock-in period of 5 years. It provides tax benefits under Section 80C.

- Kisan Vikas Patra (KVP): KVP is a savings certificate scheme that doubles the investment amount after a specified period (usually 115 months). Someone looking to double their money in the long run with safety can opt for KVP.

- Sukanya Samriddhi Yojana (SSY): SSY is a government-backed savings scheme to benefit the girl child. Parents or legal guardians can open an account in the name of a girl child and contribute until she reaches 21. Here is the detailed article on Sukanya Samriddhi Yojana.

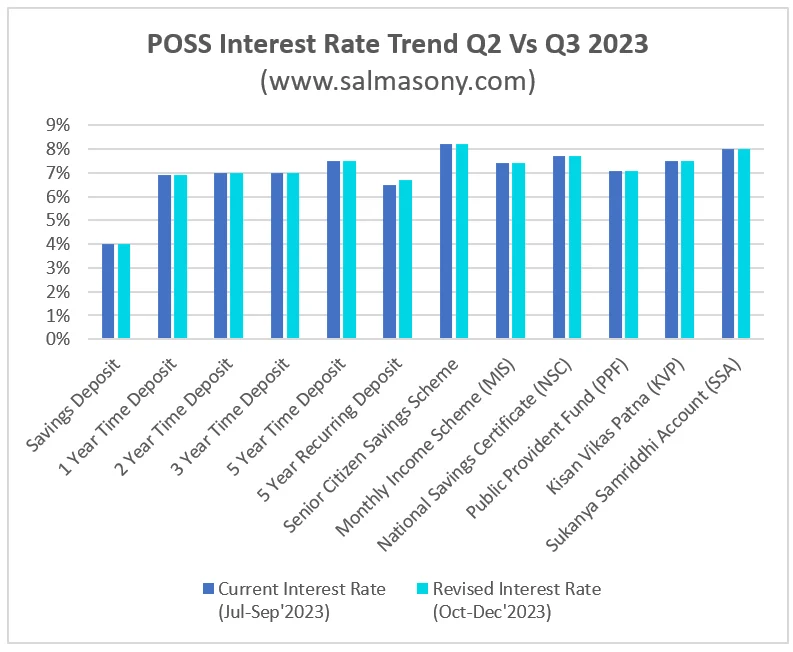

Post Office Savings Scheme Latest Interest Rates

These post office instruments are considered safe and are backed by the Government of India. They offer various features and benefits, making them suitable for different financial goals and investment horizons. The interest rates on these instruments may vary and are subject to periodic revisions by the government. It’s essential to check the latest interest rates and terms before investing.

| Post Office Savings Schemes Latest Interest Rates Oct-Dec 2023 | |||||||||

| Sl No. | Scheme Name | Tenure | Qualify for 80C Tax Benefit | Min Deposit | Max. Deposit | Current Interest Rate (Jul-Sep’2023) | Revised Interest Rate (Oct-Dec’2023) | Increase/ Decreased Interest Rate | Compounding Frequency |

| 1 | Savings Deposit | NA | Upto ₹ 10,000 | Minimum Rs. 500 for opening | No Limit | 4% | 4% | – | Annually |

| 2 | 1-Year Time Deposit | 1 Year | No | ₹ 1,000 | No Limit | 6.9% | 6.9% | – | Quarterly |

| 3 | 2-Year Time Deposit | 2 Years | No | ₹ 1,000 | No Limit | 7% | 7% | – | Quarterly |

| 4 | 3-Year Time Deposit | 3 Years | No | ₹ 1,000 | No Limit | 7.0% | 7.0% | – | Quarterly |

| 5 | 5-Year Time Deposit | 5 Years | Yes | ₹ 1,000 | No Limit | 7.5% | 7.5% | – | Quarterly |

| 6 | 5 Year Recurring Deposit | 5 Years | No | ₹ 100 | No Limit | 6.5% | 6.7% | 0.20% | Quarterly |

| 7 | Senior Citizen Savings Scheme | 5 Years | Yes | ₹ 1,000 | 30 lakhs | 8.2% | 8.2% | – | Quarterly and Paid |

| 8 | Monthly Income Scheme (MIS) | 5 Years | No | ₹ 1,000 | Single Account- 9 lakhs Joint Account- 15 lakhs | 7.4% | 7.4% | – | Monthly and paid |

| 9 | National Savings Certificate (NSC) | 5 Years | Yes | ₹ 100 | No Limit | 7.7% | 7.7% | – | Annually |

| 10 | Public Provident Fund (PPF) | 15 Years | Yes | ₹ 500/ year | 1.5 Lakhs/year | 7.1% | 7.1% | – | Annually |

| 11 | Kisan Vikas Patna (KVP) | 115 Months | No | ₹ 1,000 | No Limit | 7.5% | 7.5% | – | Annually |

| 12 | Sukanya Samriddhi Account (SSA) | 21 years | Yes | ₹ 250/ year | 1.5 Lakhs/ year | 8.0% | 8.0% | – | Annually |

| Note: KVP invested amount doubles in 115 months (9 years & 7 months) | |||||||||

Source: POSS

Benefit of Post Office Savings Scheme

Investing in post office schemes offers several advantages, making them a popular choice for many investors. Here are some of the key benefits of investing in post office schemes:

Safety and Security: Post office schemes are backed by the Government of India, making them one of the safest investment options. The capital invested, along with the interest earned, is considered secure.

Start Small: Post office schemes offer options to start their saving journey with as small as Rs. 100. RD & NSC have the option to start with Rs. 100, whereas long-term investments like PPF can start with Rs. 500 p.a and SSA with Rs. 250 p.a.

Steady Returns: Post office schemes offer competitive and predictable returns, often with fixed interest rates. This predictability can be especially appealing for conservative investors who prefer stable returns over market volatility.

Tax Benefits: Some post office schemes, such as the Public Provident Fund (PPF) and National Savings Certificate (NSC), offer tax benefits. Investments made in these schemes are eligible for deductions u/s 80C of the Income Tax Act, reducing your taxable income and helping in tax planning.

Variety of Options: India Post provides a range of schemes, each catering to different financial goals and time horizons. You can choose from savings accounts, fixed deposits, recurring deposits, and long-term savings schemes like PPF.

Accessibility: Post office branches are widespread and easily accessible, even in rural areas. This accessibility makes investing in these schemes convenient for individuals from all backgrounds.

No Market Risk: Post office schemes are not linked to stock markets. Hence, there is no market risk. It’s the safest investment option.

Steady Income: Post office schemes like the Monthly Income Scheme (MIS) and Senior Citizens Savings Scheme (SCSS) provide a steady source of income, making them suitable for retirees or those seeking periodic payouts.

Earmarked Savings: Some schemes, like the Sukanya Samriddhi Yojana (SSY), are designed for specific purposes, such as saving for a child’s education or marriage. A goal-based investing instrument that you may consider in your financial planning.

Flexible Tenures: Post office schemes offer a range of tenures, allowing you to choose the one that best aligns with your investment horizon. Whether you need short-term or long-term savings options, there is likely a scheme that suits your goal.

Conclusion

With inflation gradually rising due to increased crude oil prices, the government has opted to maintain the existing interest rates for most of the schemes.