KYC (Know Your Customer) is mandatory for all investors willing to invest in Mutual Funds. You can complete your KYC offline as well as online. If you are a first-time investor and want to invest in a Mutual fund, this article will guide you to perform Mutual fund KYC online registration using the CAMS portal.

If you are an existing investor and want to update your KYC, be it address change, name update, etc., you will have to get it done offline more.

Why is KYC mandatory in mutual fund investments?

KYC compliance is mandatory under the Prevention of Money Laundering Act, 2002. You can learn more about it in SEBI Master Circular.

Who is CAMS?

The complete form of the CAMS is Computer Age Management Services Limited (CAMS), a mutual fund transfer agency serving Indian asset management companies. The CAMS’s headquarters is in Chennai, and it was publicly listed in the stock market in October 2020 through an initial public offering (IPO).

Role of CAMS in Mutual Fund

CAMS plays a vital role in the mutual fund industry.

In India, you have mainly two RTA (Registrar and Transfer Agent) for mutual funds. They are CAMS and Karvy.

CAMS is a SEBI-registered RTA that functions as the custodian of investor data and provides transaction processing and customer care services. Hence, your data with CAMS is entirely safe.

How to do Mutual fund KYC online registration using the CAMS platform?

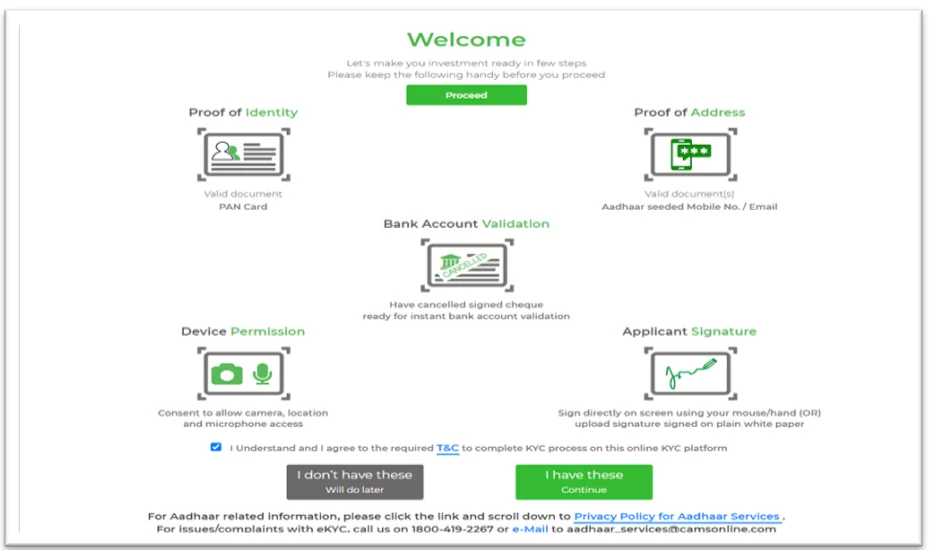

Here are the documents that you need to be ready with before CONTINUE:

1. PAN Photo

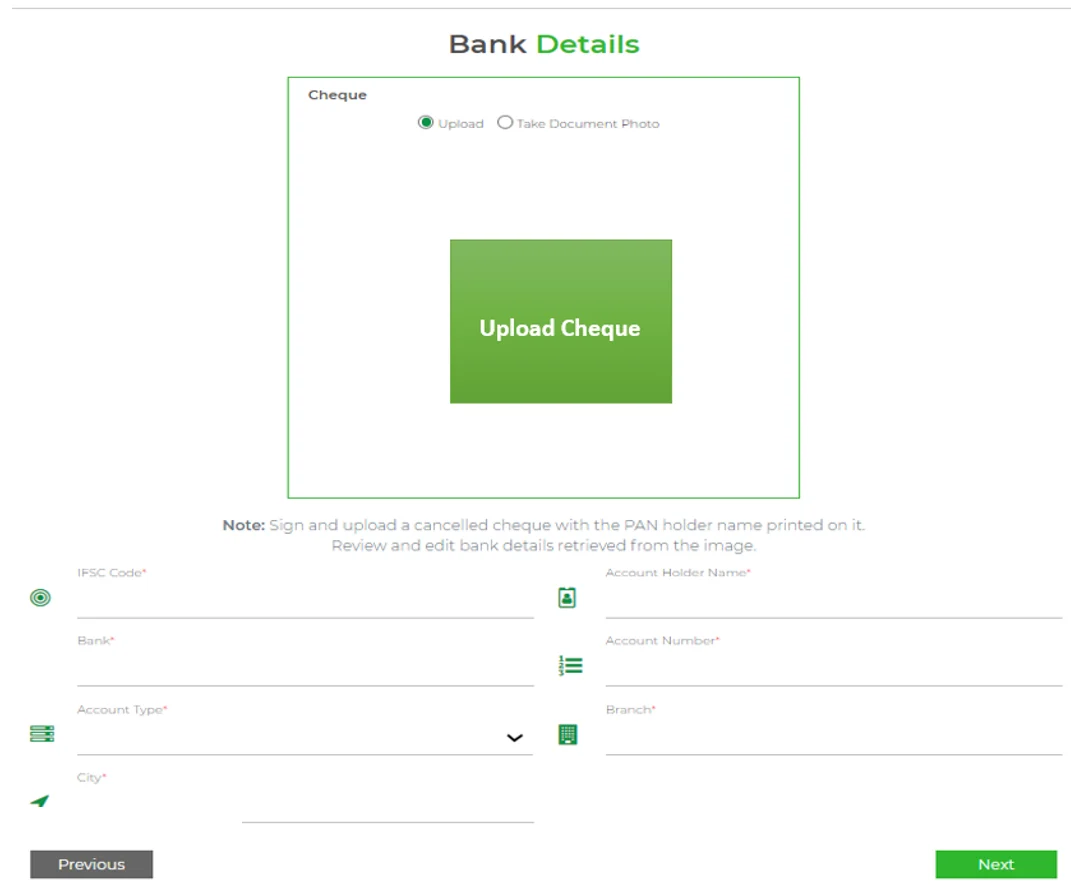

2. Cancelled cheque with signature

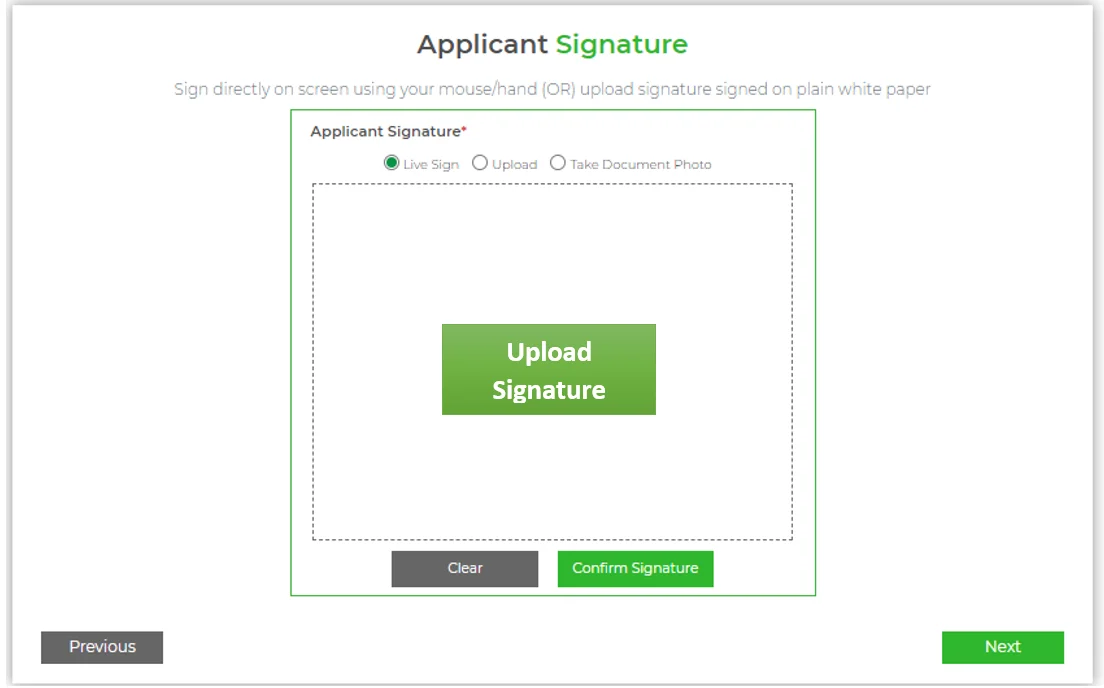

3. Your signature photo (make sure your signature in the photo should match the signature on the PAN Card).

4. Aadhar number and mobile seeded to Aadhar for 3 OTPs.

Step-1 Click on the given link https://www.camsonline.com/Investors/Transactions/KYC/Paper-less-KYC , scroll down, look for myCAMS (shown in the below pic), and click.

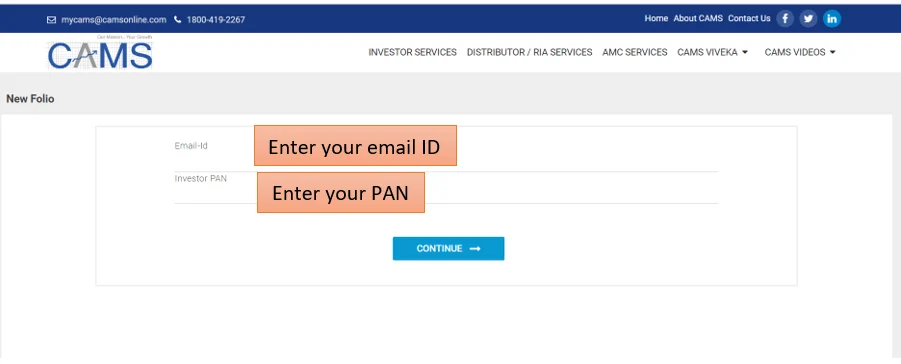

Step 2 Enter your email ID & PAN Number, then continue.

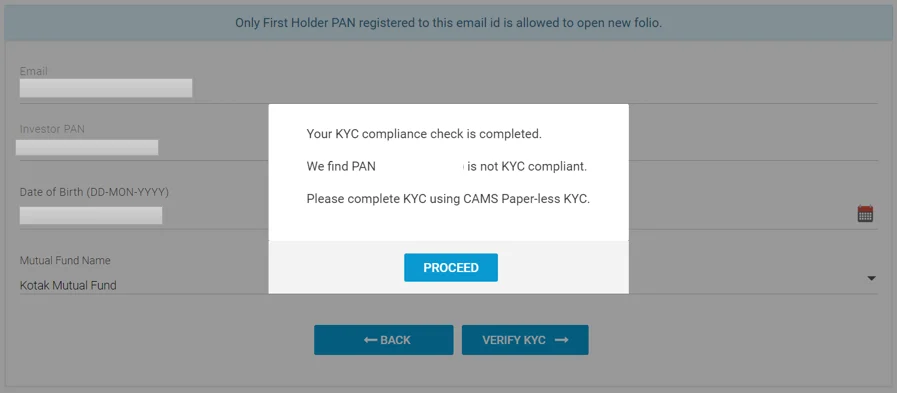

Step-3 Enter DOB as per PAN & select any one fund house- You may select Kotak MF, verify KYC, and proceed.

Hold on till the above message display, and you will be redirected to below welcome page.

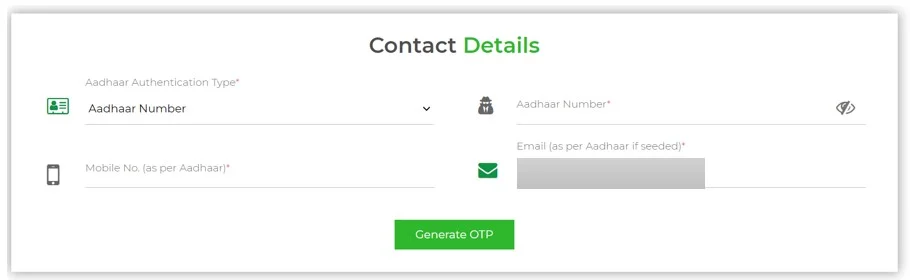

Step-4 Type Aadhar and the mobile number seeded to Aadhar, then submit to get OTP and enter OTP to proceed further.

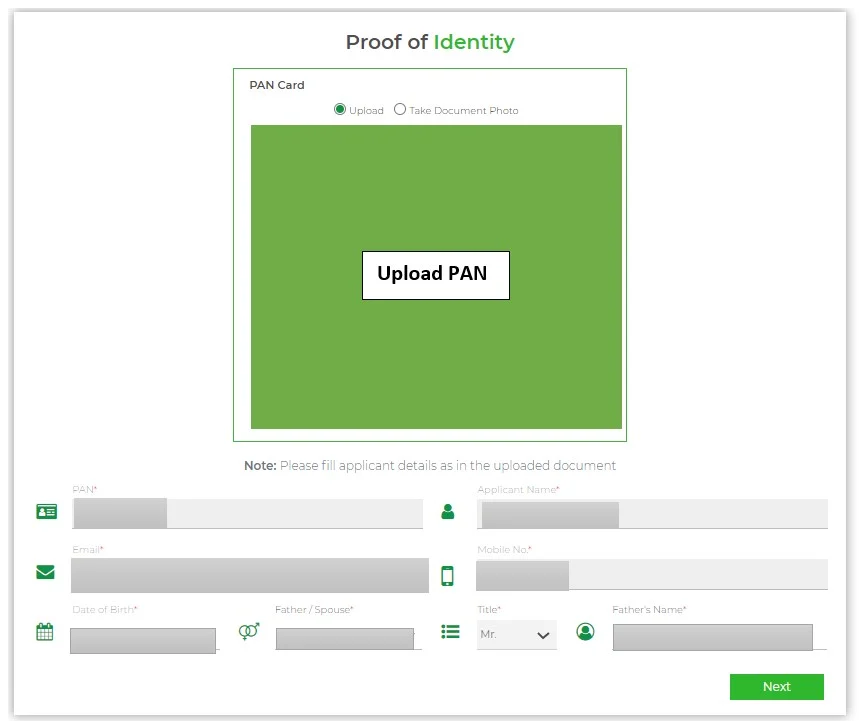

Step-5 Upload PAN photo, and all the data will be automatically fetched, then verify the data and proceed.

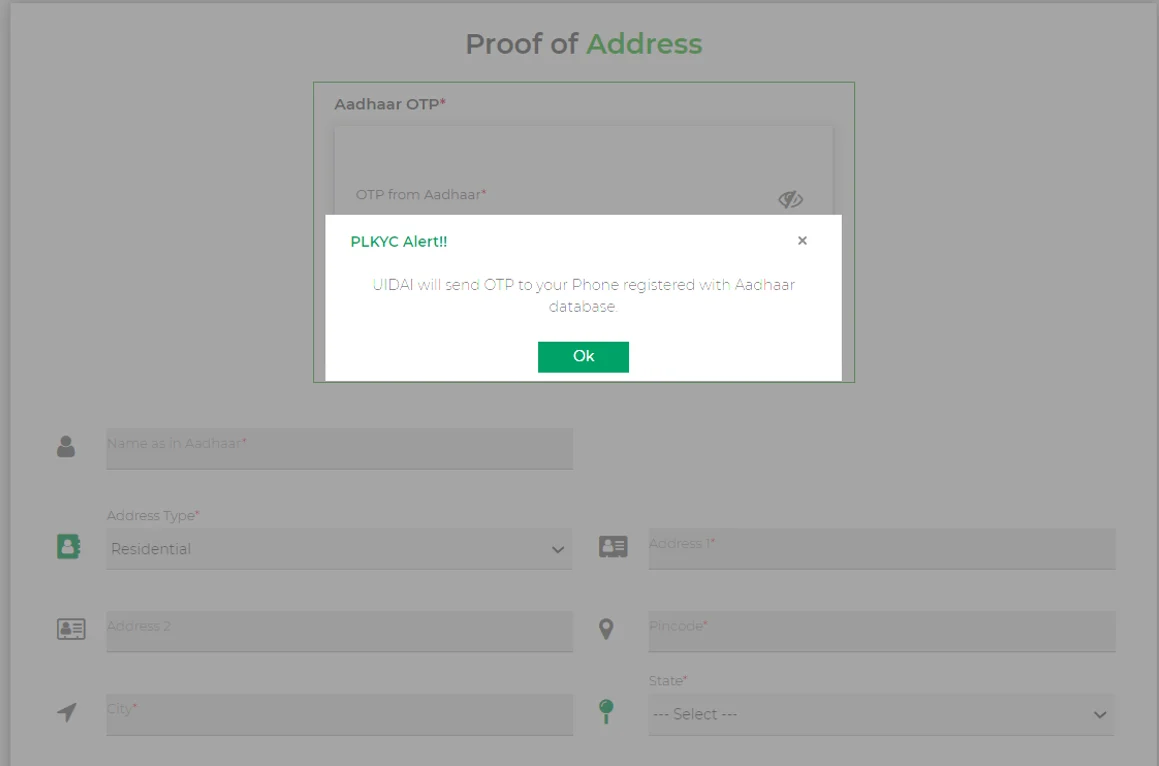

Step-6 Enter OTP sent to Aadhar to fetch the address updated in Aadhar

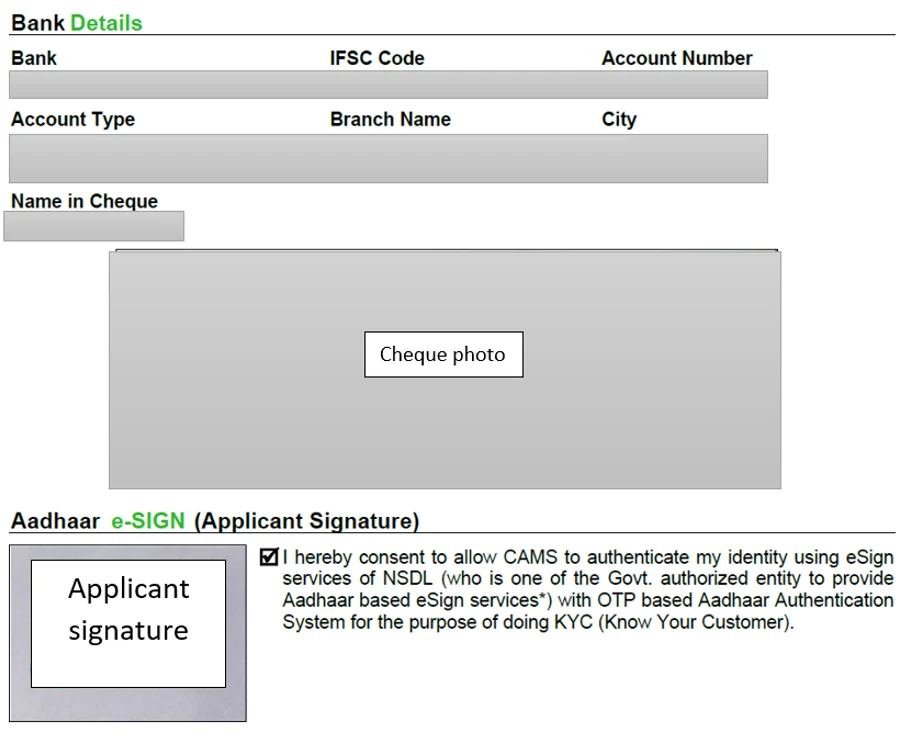

Step-7 Upload the signed canceled cheque photo, and all the data will be automatically fetched. Verify the data and proceed.

💡Pro Tip: Learn How to Invest in direct mutual funds and earn up to 1% extra returns

Step-8 Upload Signature, confirm the signature and proceed by clicking next.

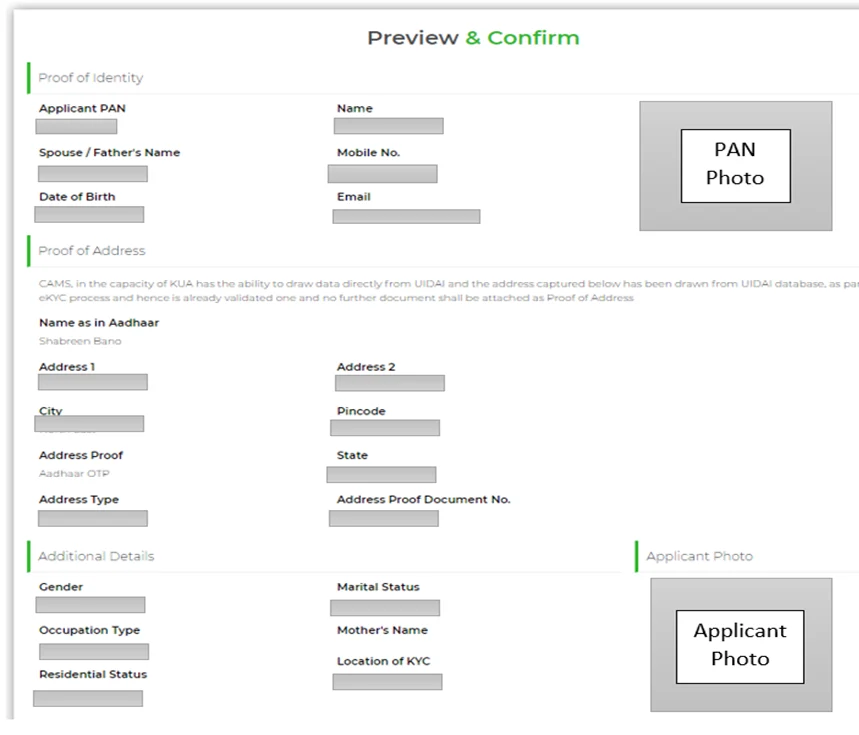

Step-9 After entering all the details, a form will be previewed in the below format. Please cross-check and e-sign by clicking on the e-sign button.

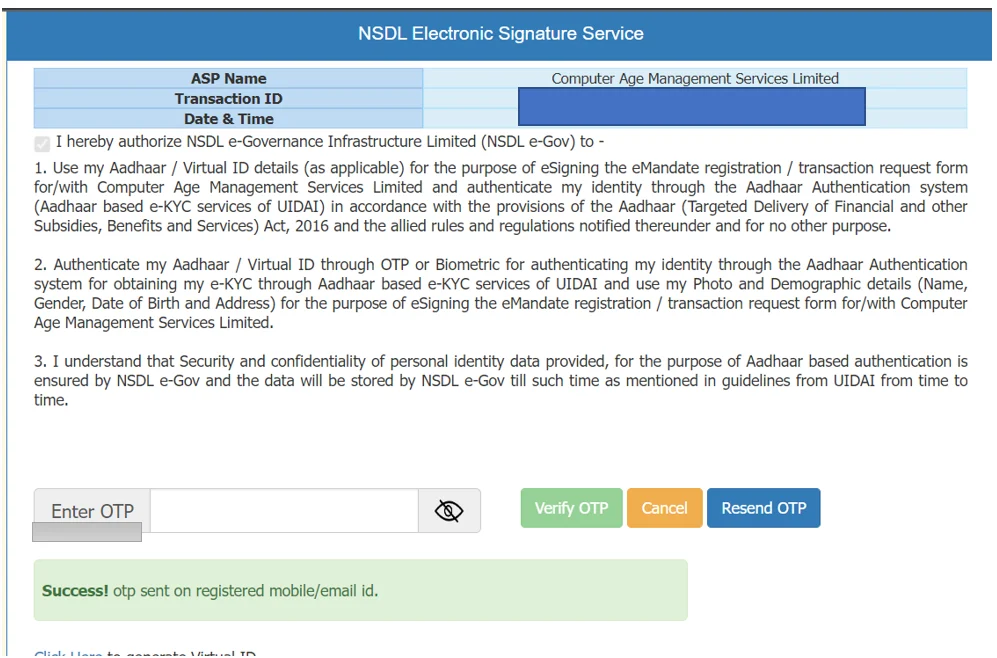

Step-10 After e-signature, the below NSDL window will appear. You need to enter your Aadhar first and submit it to get OTP. Once you enter the OTP, then WAIT for it to redirect to the CAMS website.

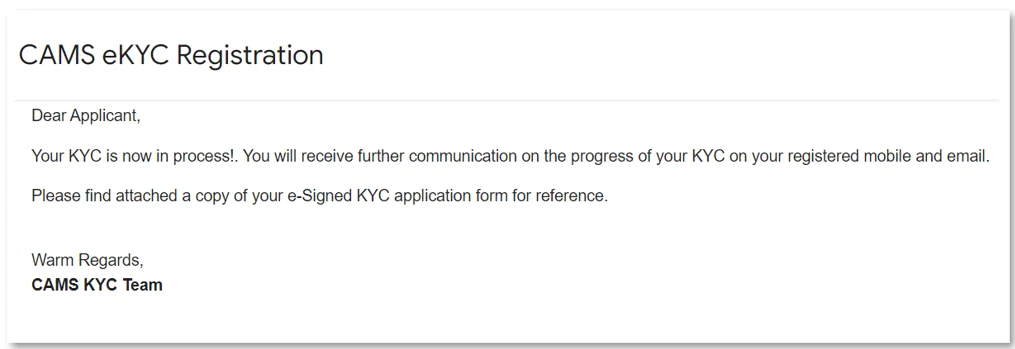

After successful redirection, you will get the below confirmation email with the attached e-form submitted.

Email Confirmation

Now, it’s time to relax and wait for CAMS to reply. Your eKYC registration confirmation email will come in a day if all is well.

Conclusion

With the digital revolution in the financial industry, starting a mutual fund investment is extremely easy. Complete your mutual fund KYC online registration using the CAMS platform without being bound to invest in any specific fund.

You can use the myCAMS app to start your investment in a direct plan.

Important Articles Related to Personal Finance

Frequently Asked Questions

Q-1: How to start a SIP investment in mutual funds?

Step 1: Complete your Know Your Customer (KYC). Step 2: Open MF Utility Account/login to the fund house portal. Step 3: Register for a SIP in the Direct plan Mutual Fund. Click here for step-by-step guidance on SIP investment in Direct Mutual Funds via MF Utility.

Q-2: How to invest in direct mutual funds?

Investing in a Direct mutual fund is now very easy. Step 1: Complete your Know Your Customer (KYC). Step 2: Open MF Utility Account/login to the fund house portal. Step 3: Make your first purchase in the Direct plan Mutual Fund. Click here for step-by-step guidance on investing in Direct Mutual Funds via MF Utility.

Q-3: How does mutual fund taxation work?

Mutual fund capital gain tax is applicable only when the gain is realized by selling the units. For any notional capital gain, tax is not applicable. Click here to learn more so that you can plan your investments aligned with tax planning.

Q-4: Which are the best mutual funds apps in India?

The mutual fund industry is growing fast, and you can easily start investing using trusted mutual fund apps in India. You can consider using myCAMS, Karvy App, and my favorite goMF app by MF Utility. Click here to learn about their pros and cons and why goMF by MF Utility.