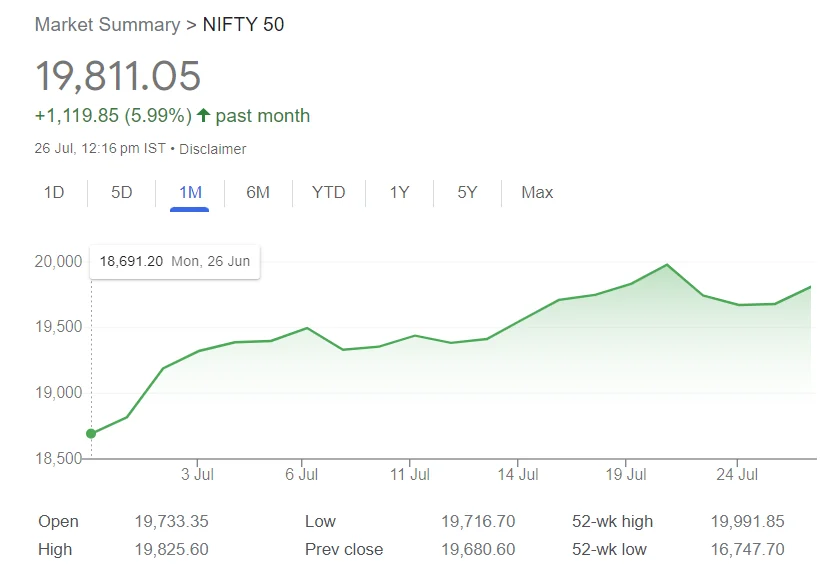

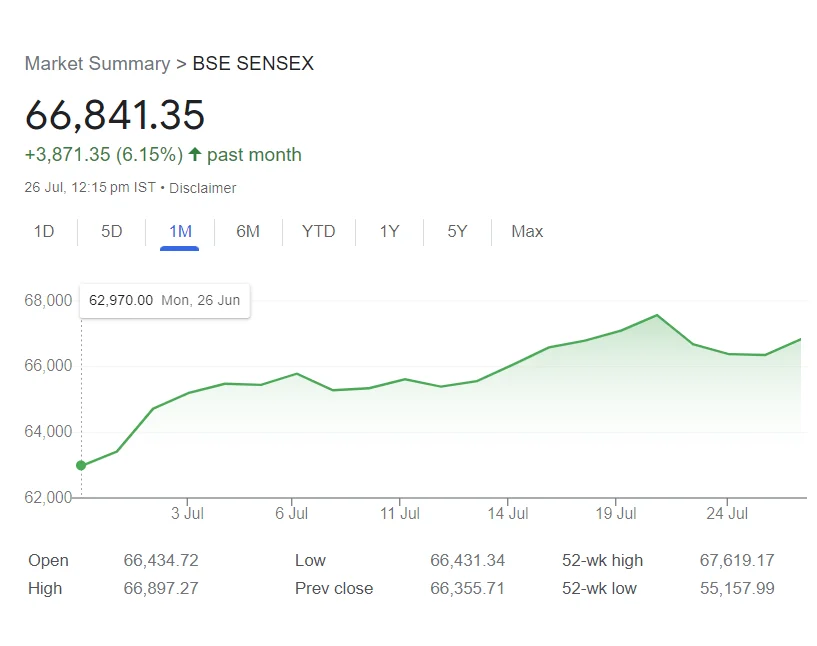

Indian stock market, in a matter of 1 month, has become an all-time high. Many investors, especially those willing to start investing, wonder if they should hold back or invest. In this article, I will discuss how to invest when the – Sensex and Nifty all time high and the action investor should consider.

Sensex and Nifty All Time High Historical Data

If you look at the below Sensex history, you will find it’s not the first time market has hit all time high. Fluctuation is a feature of the market. When you invest in the market, this is the path you will have to go through. Every time “All time high has hit another All new time high.”

In the below table, the first new all time high was in 2008 (after the market crash), followed by 2019, and now 2023; this is normal.

| Sensex History | ||

|---|---|---|

| Year | High | Low |

| 2023-2024 | 67,619.17 | 58,793.08 |

| 2019-2020 | 42,273.87 | 25,638.90 |

| 2008-2009 | 17,735.70 | 76,97.39 |

However, when it comes to investing, more than numbers, human behavior impacts their investing decision.

A recent market crash due to COVID-19 that is 23rd of March 2020 (that we can relate to very well), investors who had money and courage to invest at that time must already be sitting with good returns.

So, the question is, what was your behavior during the market crash in 2020? Unfortunately, investor behavior change with the market change.

- Bull Market: Becomes aggressive

- Bear Market: Becomes conservative

However, it should be otherwise.

However, your behavior may not be in our control regarding money and investing decisions. That’s why planning your finances based on your financial goal can contribute to securing your financial future. Financial planning can help you plan your finances in a 360-degree manner looking at all the aspects, as well as help in behavioral control that is mostly not possible when you invest randomly.

What Should You Do Now at Sensex and Nifty All Time High?

For Goal-Based Investors

- Review all your long-term goals. It might be possible when you started investing toward your goals, it was long-term, and now it might be short-term (within three years). It’s better to book a profit and secure your goals.

- For long-term goals (5 years and more), if your goal-wise equity exposure has increased, rebalance either by booking a profit and re-invest in debt or utilizing fresh money to invest in debt. You can use your bonus receipt for rebalancing.

- Take this opportunity to clean up junk investments in your portfolio.

For Random Investors

- Overall, rebalance your portfolio

- Take this opportunity to clean up junk investments in your portfolio.

Sensex and Nifty All Time High- Should you Rebalance Your Portfolio?

Rebalancing is all about maintaining your equity and debt exposure in your portfolio. Assume you want to maintain equity at 60% & debt at 40% in your portfolio.

Step -1: Overall, find out your equity-debt ratio.

Possibility-1: Equity exposure is within 60%

No action is required in this scenario.

Possibility-2: Equity exposure is more than 60%

Suppose you found it’s due to a market rally; equity exposure has increased from 60% to 70%.

Here you need to reduce your equity exposure by 10% either by :

- (i) Increasing debt investment by utilizing excess cash available to you.

- (ii) Increase debt SIP and pause equity SIPs.

- (iii) Selling equity (consider clearing non-performing investment) and re-investing in debt.

Step-2: After identifying the action required, take action.

Sensex and Nifty All Time High- Should You Stop Your SIPs ?

- Continue your SIPs for long-term goals.

- If equity exposure has exceeded in your portfolio, then consider following the possibility-2 steps mentioned above.

Conclusion

The market will continue to hit all time highs and lows and beat its record. Ultimately what matters is how you manage these highs and lows. To live a financially peaceful life, consider investing based on your goals. Regarding financial planning, I must say, “Financial Planning Karo, return ki chinta na karo.”

Important Articles Related to Personal Finance

- Maximize Your Tax Savings With Tax Harvesting Mutual Funds

- 18 Common Tax Filing Mistakes You Must Avoid FY 2022-23 (AY 2023-24

- ITR For Salaried Person: Which ITR Should I File For FY 2022-23 (AY 2023-24)?

- Tax Planning For Salaried Employees

- Unclaimed Mutual Funds In India: An Overview And Steps For Recovery

- 9 Strategies: How To Close Home Loan Early

- 5 Safe & Best Short-Term Investment Plan 2023

- Debt Mutual Funds Taxation New Rule from 1st April 2023

- All About Sukanya Samriddhi Yojana Benefits