Managing your money can feel overwhelming. Between mutual funds, stocks, insurance products, and complex tax rules, it’s no surprise that many people look for professional financial advice. But here’s the catch – choosing the right financial advisor is not about who focuses on returns but who is legally obligated to act in your best interest.

In India, not every person who calls themselves a financial planner or “advisor” is authorized to practice. That’s why understanding advisor credentials, fee structures, and fiduciary responsibility is essential before you decide who will help you manage your money and reach your financial goals.

This blog will walk you through exactly how to find and choose a financial advisor in India, what red flags to watch for, and why working with a SEBI-registered investment advisor (RIA) is one of the safest ways to protect your wealth and make better financial decisions.

Why Do You Want a Financial Advisor?

The first step in choosing a financial advisor is being clear about why you need one. Your reason shapes the kind of financial services you require.

1. Ensuing financial foundation is strong

Before you even think about investing, a good advisor ensures you have the basics covered:

- Life insurance to protect your family,

- Health insurance for medical security,

- An emergency fund, and

- Provisions for dependent parents

2. Preparing for major life milestones

Marriage, having kids, or buying a home all bring new financial responsibilities. Advisors can help you create a plan to manage these life changes without unnecessary stress.

3. Planning for retirement

Building a comprehensive financial roadmap for retirement is one of the most common reasons people find a financial advisor.

4. Starting investments

If you are new to managing your investments, an advisor can explain different investment options, align them with your risk tolerance, and help you avoid costly mistakes.

5. Debt management

An advisor can help you find ways to save, restructure high-interest debt, and improve your overall financial situation.

Related: Smart Debt Management Strategies to Regain Control of Your Finances

6. Handling inheritance or sudden wealth

If you have received a windfall, professional financial guidance ensures the money is managed wisely instead of being spent recklessly.

7. Navigating taxes & estate planning

Tax planning and estate planning are complex areas where expert help can prevent legal trouble and optimize long-term benefits.

Look for these key financial advisor credentials

One of the biggest mistakes people make is assuming all advisors are the same. In India, there are two major designations to understand:

a) Certified financial planner (CFP)

A CFP is an academic certification. It shows that the person has studied financial planning, but it does not give them a license to practice as an investment advisor.

b) Registered investment advisor (RIA)- Licence to practice

A SEBI-registered investment advisor holds a license to practice. RIAs have a fiduciary duty—meaning they are legally obligated to act in the client’s best interest.

Important to note: While many RIAs also hold the certified financial planner credential, not every CFP is an RIA. If you want someone who can actually recommend or advise you on investment products and services, always look for the SEBI registration number.

This is the simplest way to choose the right financial advisor in India—focus on RIAs, not just academic titles.

Decide How Much You Can Pay Your Financial Advisor

Financial advisor fees in India are not uniform. Advisors typically charge in three ways:

1. Commission-based

They earn through commissions on financial products like mutual funds or insurance products. This often creates potential conflicts of interest because their income depends on what you buy or sell.

2. Fee-only

A fee-only financial advisor may charge a flat fee, an hourly fee, or a percentage of assets under management (AUM). Because they do not earn commissions, their advice is usually conflict-free and focused on the client’s best interest.

3. Fee-based (hybrid)

A mix of fees and commissions. While common, this still carries potential financial biases because of the incentives they receive.

If you want comprehensive financial planning without worrying about bias, a fee-only advisor is generally the safest choice.

How does a Financial Advisor Support Your Goals Over Time?

1. Young professionals

Advisors can help with goal-based investing, emergency funds, and investment portfolios designed to grow steadily.

2. Mid-career individuals

At this stage, retirement planning, children’s education funds, and portfolio management for large goals take priority.

3. Pre-retirement or retirement stage

The focus shifts to wealth preservation, tax planning, and estate planning. A good advisor ensures you can enjoy retirement without financial anxiety.

How to Prepare Before Meeting a Financial Advisor?

- Gather details about your income, expenses, assets, and liabilities.

- Decide what you want: a clear idea of short-, medium-, and long-term goals helps the advisor suggest the right financial plan.

- Be honest about your risk tolerance and expectations.

This preparation ensures you get maximum value from your first meeting.

Related: Financial Plan: How To Plan Personal Finance Better in 2025?

Why You Should Work with a SEBI Registered Financial Advisor?

When it comes to money, trust and regulation matter. A SEBI Registered Investment Advisor (RIA) is not just another financial planner—they are legally authorized by SEBI to provide investment advice, financial planning, and portfolio management in India.

Here’s why it’s critical to choose an RIA over unregistered advisors:

1. Legally authorized – Only SEBI-registered advisors can give investment advice in India. Working with unregistered advisors exposes you to risks and offers no legal protection.

2. Fiduciary duty – Fee-only RIAs earn through transparent financial advisor fees, not commissions. Their only obligation is to act in the client’s best interest.

3. Risk profiling & suitability – RIAs must conduct detailed risk tolerance and goal assessments before recommending any financial products.

4. Strict compliance – They follow SEBI’s regulations, disclose all fees, undergo annual audits, and maintain proper records. This safeguards clients against potential conflicts of interest.

5. No hidden commissions – Unlike brokers or distributors, RIAs do not push products like mutual funds or insurance products for incentives they receive.

6. Qualified and experienced – To become an RIA, individuals must meet SEBI’s strict education, certification, and deposit requirements, ensuring credibility and competence.

By choosing a SEBI-registered financial advisor in India, you protect yourself from mis-selling, ensure unbiased advice, and align your money with your short and long-term financial goals.

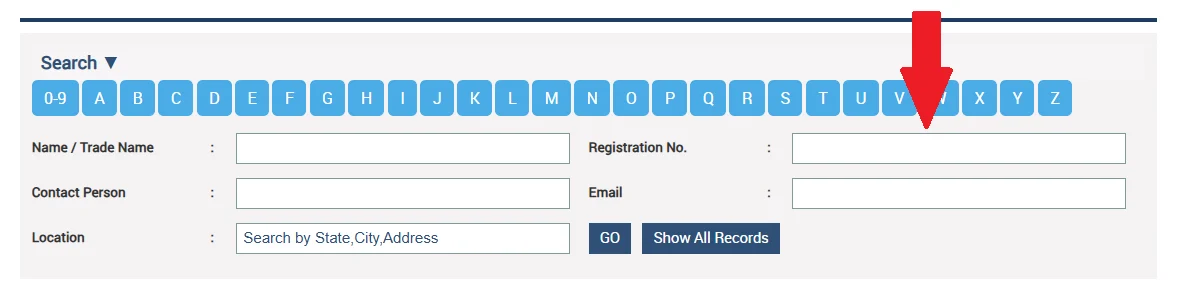

How to validate if the person you are talking to is a SEBI-registered financial Advisor?

1. Ask for their registration number.

2. Verify it on SEBI’s official website.

Here is the SEBI directory to verify the SEBI registration number.

3. From 1st October 2025, SEBI has made it mandatory for advisors to use standardized UPI IDs (example: @valid) for fee collection.

By working with a SEBI-registered financial advisor, you can be sure your advisor is subject to strict disciplinary actions if they violate fiduciary duty.

5 Questions to Ask a Financial Advisor Before Hiring

Before committing, it’s a good idea to ask:

- Are you registered with SEBI?

- How do you charge (flat fee, hourly, or AUM fee)?

- Will you act in my best interest at all times?

- What experience do you have with clients in a similar financial situation?

- What happens if I’m not satisfied with your financial guidance?

Red Flags While Choosing a Financial Advisor

Watch out for these warning signs:

- Guarantees of high returns – No advisor can guarantee future investment performance.

- Lack of registration with SEBI – Always verify.

- Vague or hidden fee structures – Advisors should disclose all charges clearly.

- Collecting fees without a written and signed agreement – A compliance violation.

- Skipping risk profiling – Every advisor must assess your goals and risk tolerance.

- Over-promotion of specific products – Could signal commission-driven motives.

Conclusion

Choosing a financial advisor in India is one of the most important financial decisions you will ever make. The right advisor is not the one who dazzles with promises but the one who prioritizes your financial goals, acts with fiduciary duty, and is registered with SEBI.

By focusing on credentials, understanding financial advisor fees, and asking the right questions, you can find a financial advisor who genuinely helps you plan to reach your financial goals—without bias, hidden agendas, or unnecessary risks.

At the end of the day, the goal is simple: help you plan, manage your money wisely, and give you advice that supports your financial security and future peace of mind.

FAQ: How to Choose a Financial Advisor?

Q-1: Who are Fee Only Financial Advisor?

A fee-only financial advisor is an SEBI registered investment advisor who operates on a transparent and straightforward model. Unlike financial planners in India who earn commissions or fees based on product sales, fee-only financial advisors charge a flat fee for their financial services, ensuring unbiased financial advice that aligns with clients’ financial goals. This structure eliminates conflicts of interest, putting the client’s best interests ahead of everything else.

Q-2: How to select a financial advisor?

When it comes to money, trust and regulation matter. The first step in choosing a financial advisor is clarifying why you need one. Your reason shapes the kind of financial services you require. Once you are clear about your need, explore a SEBI-registered financial advisor ( talk to 2-3 max) and go with the advisor with whom you align the most.

Q-3: How do you know a financial advisor is good?

You can check the client reviews (Google reviews/video testimonials) to help you understand how people are benefiting from the advisor’s service.