If you have ever changed jobs or are planning to or simply wonder what will happen to your gratuity if you do so, then you must know the gratuity new rules 2025 that bring in some of the biggest reforms in decades. And honestly, these changes finally make gratuity fairer, faster, and more inclusive, especially for India’s growing contract, gig, and platform-based workforce.

Let’s break everything down in simple, everyday language.

What Is Gratuity?

Gratuity is a one-time lump sum payment your employer gives you as a “thank you” for your long-term service. It’s not linked to performance – it’s a statutory right under the Payment of Gratuity Act, 1972.

You receive gratuity when you:

- Retire

- Resign

- Are laid off

- Face disability

- Or in case of death, your family receives it

To put it simply, gratuity is your employer’s way of saying, “Your years with us mattered.”

Gratuity Formula

Gratuity = (Last drawn basic salary + DA) X 15 X Years of service ÷ 26

15 represents the number of payable days used for calculation.

Practical Example – Gratuity Payment Calculation

Let’s say your basic + DA is Rs. 1 lakh

Old Rule

Not eligible if you completed only 3 years.

New Rule

Eligible if you are a fixed-term or contract employee.

Rs. 1,00,000×15×3÷26 = Rs.1,73,077

You would receive this gratuity upon 3 years of completion of the service, which was impossible under earlier rules.

Basic Eligibility

You qualify for gratuity if you meet the minimum service period and leave your employer for any approved reason, such as retirement, resignation, death, or disability.

The Old Gratuity Rules – What Employees Dealt With (Until Nov 2025)

Key Features of the Old System

1. Minimum 5 Years of Continuous Service

As a permanent employee, you had to complete 5 consecutive years of service with the same employer (except in cases of disability or death). However, for fixed-term employees, there were no special provisions (basically, they were not eligible for gratuity).

2. Limited Coverage

Only permanent employees were covered.

Contract staff, freelancers, and gig workers were mostly left out.

3. Lower Calculation Base

Many companies structured salaries in a ways that kept basic + DA low, reducing your eventual gratuity payout.

4. Delayed Processing

There was no strict digital system or penalty for delay, leaving employees waiting for months.

Gratuity New Rules 2025 – What’s Changed?

To make it easy I have created in a tabular form comparison of Old Vs New Gratuity Rules 2025.

| Feature | Old Rule | Gratuity New Rule (2025) |

|---|---|---|

| Eligibility Period | 5 years | 1 year for fixed-term & contract staff |

| Coverage | Only permanent employees | Includes gig, platform, migrant, and contract workers |

| Wage Definition | Basic + DA | Basic + DA (Must be minimum 50% of total wage) |

| Payment Timeline | Often delayed | Mandatory digital payout within 30 days + interest for delay |

| Tax-Free Limit | ₹20 lakh (private) | Limit remains, but higher practical payouts due to revised wage structure |

| Special Cases | Death/disability allowed exceptions | Same, but now with faster payouts |

Source: PIB Notification (PDF)

Gratuity New Rules 2025 – How the New Rules Help Employees

1. Earlier Access to Gratuity

For permanent employees, there is no change; they still need to complete five uninterrupted years with the same employer (except in cases of disability or death). However, for fixed-term, GIG, and contract employees, this reform provides relief from the lack of a special provision that allows eligibility after just 1 year; this is huge for India’s young, mobile workforce.

2. Higher and Fairer Payouts

The new rule makes it mandatory to follow Salary structure basic + DA (50% of total wages), this leads to bigger payouts at the end of service (gratuity & PF) a significant win for all employees.

Salary structures must now follow a rule:

Basic + DA must form at least 50% of total wages.

This directly increases gratuity calculations and your future payout. However, this change may affect your take-home pay if your current Basic Pay + DA is less than 50% of your total wages.

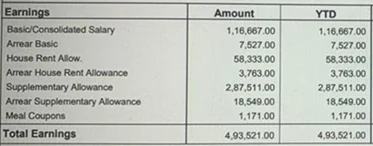

Here is an example of how salary will be impacted:

Basic Pay (1,16,667) + DA (0) = Rs. 1,16,667

Total Earnings/ Wages = Rs. 4,93,521

Percentage of (Basic Pay + DA) = 23.63%

In this case, the employer will have to restructure the salary component (considering CTC remains the same). With this change, your EPF contribution will also increase, which will impact your monthly take-home.

And, if your Basic Pay + DA is already 50% of total wages, then take-home will have no impact.

3. Digital Processing with Penalties for Delay

As per the new gratuity rules, employers must:

- Process gratuity digitally

- Release payment within 30 days

- A delay in payouts will result in an annual interest penalty for employers.

This ensures employees get what they deserve, on time.

4. Expanding to the New Workforce

For the first time, Organized, unorganized, gig workers, and platform workers (like delivery partners) fall within the gratuity net.

5. Stronger Family Protection

In case of death or permanent disability:

- No minimum service requirement

- Family or nominee receives immediate payout

Conclusion- Why These Reforms Matter

As a fee-only financial advisor, I have guided hundreds of families in their financial journeys. I genuinely believe these new rules make the system more equitable and future-ready.

Job changes are more frequent now. Short-term roles are common. And career paths are rarely linear anymore. The 2025 gratuity reforms acknowledge this reality. They protect employees who used to slip through the cracks—contract staff, gig workers, and anyone whose role didn’t fit traditional definitions.

As you plan your career and long-term finances, keep gratuity in your overall wealth-building strategy. It may seem like a future payout, but it can significantly support retirement planning, family security, and financial stability.

Whenever you’re reviewing your salary structure or planning major career moves, ensure your gratuity benefits stay optimized.

If you want personalized guidance on how gratuity fits into your larger financial plan or help reviewing your salary breakup to maximize your benefits, I’m here to assist. Your peace of mind matters, and a well-structured financial plan can make a world of difference.

FAQs on Gratuity Rules 2025

Q-1: Who gains the most from the new rules?

Employees with shorter tenures—fixed-term, contract, gig, and platform workers benefit the most since eligibility now starts at just 1 year.

Q-2: Will my gratuity be processed automatically?

Yes. Employers must process gratuity digitally within 30 days. If they delay, they must pay interest.

Q-3: How can I increase my gratuity payout?

Ensure your salary structure follows the new rule: Basic + DA ≥ 50% of total wages. This leads to higher gratuity calculations.