Most investors choose debt mutual funds over FDs because of their attractive tax rule. From 1st April 2023, the new taxation rule of a mutual debt fund is getting effective, which means the mutual debt fund will not have added advantage on the taxation ground compared to deposits like Fds / RDs. It may sound worrying; however, it’s not. In this article, I will discuss the debt mutual funds taxation new rule, the old rule, and how it will impact your mutual fund portfolio.

What are Debt Mutual Funds?

A debt mutual fund is a fund that invests primarily in bonds or other debt securities.

However, for taxation purposes, mutual funds scheme with less than 65% of exposure in equity are considered debt funds. They are considered equity mutual funds if the equity exposure is 65% or more.

Debt Mutual Funds Taxation – Old Rule till 31st March 2023

The old taxation rule of debt mutual funds is based on its holding duration, where capital gain in debt mutual fund (having holding less than 36 months) which is also called short term capital gain to be taxed as per income tax slab.

Capital gain in debt mutual fund (having equal to or more than 36 months holding period) which is also called long term capital gain to be taxed at flat 20% with indexation benefit.

| Fund Category | Short Term Capital Gain (STCG) | Long Term Capital Gain (LTCG) |

|---|---|---|

| Debt | Less than 36 months | More than & equal to 36 months |

| Taxation | As per slab | Flat 20% with indexation benefit |

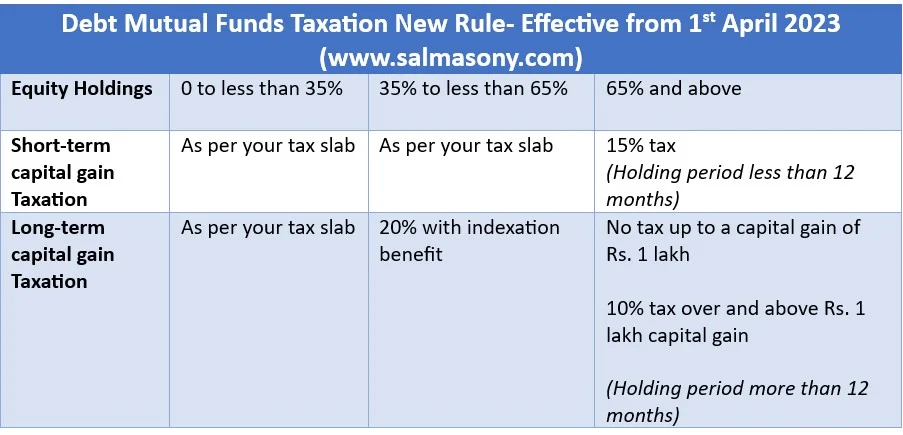

Here is the change in taxation rule for debt mutual funds based on the percentage of holding of the equity that I have explained below.

Debt Mutual Funds Taxation – New Rule Effective from 1st April 2023

The amendment to finance bill 2023 created three categories of mutual funds based on equity holding for Taxation purposes.

a) Category-1: Equity* holding equal to or more than 65%

As we understood above, any mutual fund holding 65% or more in equity fall under equity mutual funds for taxation purposes. Hence, there is no change in this category. You continue to get long-term capital and get benefits.

b) Category-2: Equity* holding less than 65% and more than equal to 35%

This category falls under debt mutual funds for taxation purposes. However, tax rules remain the same in this. Here you have to pay tax on capital gain based on old taxation rules. For the short-term capital gain, the tax payable is as per the tax slab, and for the long-term, you get to pay a flat tax of 20% with an indexation benefit.

c) Category-3: Equity* holding less than 35%

This category falls under debt mutual funds for taxation purposes, and here is the significant change.

Earlier, the taxation for this category was the same as Catagory-2. However, effective from 1st April 2023, the long-term capital gain benefit has been removed; this mean does not matter for how long you hold the funds upon a capital gain; you will have to pay tax based on your tax slab.

However, any investment in this category until 31st March 2023 will continue to attract old tax rules (flat tax of 20% along with indexation benefits if they hold the funds for 36 months or more).

Close-ended debt mutual funds that used to plan their strategy based on taxation rules will no more get this benefit from 1st April 2023.

*Equity exposure to Indian stock market, ETFs & Equity Mutual Faunds

Here is the list of the funds having no or less than 35% equity holdings that will be impacted by the Debt Mutual Funds Taxation New Rule from 1st April 2023

| Scheme Type | Portfolio holding | Mutual Fund Type |

|---|---|---|

| Overnight Fund | 100% Debt | Open-ended |

| Liquid Fund | 100% Debt | Open-ended |

| Ultra Short Duration Fund | 100% Debt | Open-ended |

| Low Duration Fund | 100% Debt | Open-ended |

| Money Market Fund | 100% Debt | Open-ended |

| Short Duration Fund | 100% Debt | Open-ended |

| Medium Duration Fund | 100% Debt | Open-ended |

| Medium to Long Duration Fund | 100% Debt | Open-ended |

| Long Duration Fund | 100% Debt | Open-ended |

| Dynamic Bond | 100% Debt | Open-ended |

| Corporate Bond Fund | 100% Debt | Open-ended |

| Credit Risk Fund | 100% Debt | Open-ended |

| Banking and PSU Fund | 100% Debt | Open-ended |

| Gilt Fund | 100% Debt | Open-ended |

| Floater Fund | 100% Debt | Open-ended |

| Fixed Maturity Plans (FMPs) | 100% Debt | Closed-ended |

| Conservative Hybrid Fund | 10% to 25% investment in equity & equity related instruments; and 75% to 90% in Debt instruments | Open-ended |

Debt Mutual Funds Taxation New Rule from 1st April 2023 – Should you worry about your existing investment?

The answer is NO, as this rule is effective from 1st April 2023. For your existing debt mutual portfolio, you will continue to get long term (holding period of more than 36 months) capital gain benefit that is flat tax at 20% along with indexation benefits.

Debt Mutual Funds Taxation New Rule from 1st April 2023 – Should you still consider investing in Debt Mutual Funds?

It would be wrong to say yes or no; let’s compare a few features of FDs / RDs and understand if it still makes sense to go for debt mutual funds.

Safety

Safety is the biggest concern when investing in a debt category; however, today’s new investors sometimes ignore the safety factor.

As most banks are insured under DICGC, FD/RDs are secured up to Rs. 5 lakhs. Beyond Rs. 5 lakhs, your deposit has risk exposure.

Regarding debt mutual funds, it depends upon which type of mutual debt fund you invest in. If it is liquid funds or overnight funds, then you can consider your money to be safe. Most other types of debt funds have risk exposure like credit risk, default risk, interest risk, etc.

Liquidity

Online FD / RDs or Flexi FDs are pretty liquid. At any point in time, you can have the money in your account. However, it may take 1-3 days for the amount to get credited when it is a debt mutual fund.

Suppose you are someone looking for flexibility and instant liquidity with no penalty. In that case, you can go for Flexi FD. Suppose you would prefer to park it separately, which you choose to touch only in case of for emergency. In that case, you may go for debt mutual funds as it allows for partial withdrawal, and exit load will not be applicable after a certain period.

Taxation

From 1st April 2023, debt mutual funds will have no added advantage above FDs / RDs. However, a Debt mutual fund is still a winner because a capital gain will arise only when you redeem/withdraw the debt mutual fund. However, in FDs, it is on an accrual basis (the TDS is deducted at the time of credit of interest and not when the FD matures. So if you have an FD for 4 years – banks shall deduct TDS at the end of each year) as FD interest falls under income from other sources.

Set off & carry forward capital gains and losses

In debt mutual funds, the gain is considered capital gains; hence, you can set off and carry forward the capital gain and losses. However, this benefit is unavailable with FDs as interest income comes under the head – income from other sources.

Conclusion

Considering all the above points, the mutual debt fund still looks attractive. The choice of FD viz debt mutual fund can be quick when you invest more than just based on return, know the purpose of your investment and invest based on your goals.

Important Articles related to Personal Finance

- Best Mutual Fund Performance And Selection Technique

- NPS Tax Benefit 2023: Under Old Tax Regime

- Income Tax New Regime Or Old Regime: For Salaried Employees

- Money management tips for beginners

- Tax Planning For Salaried Employees

- Investment Planning For Salaried Employees

- Mutual Fund KYC Online Registration

- How To Invest In Direct Mutual Funds?

- How To Start SIP Investment In Mutual Funds?

- 5 Mutual Fund Types: Learn To Choose The Right Fund For You

Important Calculators