Mutual funds are one of the most popular instruments gaining attraction among retail investors and are best suited for goal-based investing. In the 2024 budget, significant changes were introduced in how mutual funds are taxed. This article will teach about the revised mutual fund capital gain tax.

Budget 2024: Revised Tax on Mutual Fund Gains

Based on Budget 2024, for taxation purposes, mutual funds have been divided into three categories, i.e., Mutual fund based on portfolio, Mutual fund holding period, and Mutual fund based on listing. Let’s understand each of the topics in detail.

Mutual fund: Based on the portfolio, it includes equity mutual funds, debt mutual funds, and other mutual funds.

- Equity Mutual Funds: At least 65% of its portfolio is invested in the Indian stock market.

- Debt Mutual Funds: More than 65% of their portfolios are invested in bonds or money market instruments.

Note: If FOF (Funds of Fund) portfolio holding invests 90% of its investment in the Indian stock market, it will fall under Equity Mutual Funds, and if it invests 65% or more in debt, it falls into the debt mutual fund category.

- Other Mutual Funds: Mutual funds that do not fulfill the above criteria then will be considered other mutual funds. Example: FOFs (that hold less than 65% in debt), International, gold funds, ETFs

Mutual Fund Holding Period – Short-Term and Long-Term

Understanding the holding period is essential, as it defines whether short-term or long-term capital gain tax will apply to you.

Equity Mutual Funds: There are no changes in the holding period for equity mutual funds.

- Short-term Holding: If the holding period of the equity mutual fund is 12 months or less, then the gain that arises on selling the units will be considered a Short-Term Capital Gain (STCG)

- Long-term Holding: If the holding period of the equity mutual fund is more than 12 months, then the gain arising on selling the units will be considered as Long-Term Capital Gain (LTCG).

Debt Mutual Funds:

- Budget 2024 simplified the debt mutual fund taxation. Debt mutual funds will be taxed as per applicable slab rates, irrespective of their holding period for units bought after April 1, 2023.

Other Mutual Funds:

- Short-term Holding: If the holding period of other mutual fund is 24 months or less, then the gain that arises on selling the units will be considered a Short-Term Capital Gain (STCG)

- Long-term Holding: If the holding period of other mutual funds is more than 24 months, then the gain arising from selling the units will be considered as Long-Term Capital Gain (LTCG).

Mutual Fund Based on Listing: Listed or Unlisted

Budget 2024 has simplified the holding period of listed and unlisted securities by eliminating 36 months that were earlier applicable. Now it’s only 12 months and 24 months.

Listed financial assets/ securities: Listed financial assets held for more than 12 months will be classified as long-term. Securities eligible for these are as follows:

- Equity Mutual Funds

- Stocks

- Equity ETFs

- Gold ETFs

- Bond ETFs

- Listed Bonds

- InVIT

- REITs

- SGB (Sovereign Gold Bonds)

Unlisted financial assets and all non-financial assets: Unlisted financial assets and all non-financial assets held for 24 months or more will be classified as long-term. Securities eligible for these are as follows:

- Physical Gold

- Gold Mutual Funds

- Real Estate

- Unlisted Stocks (Indian or Abroad)

- Foreign Equity Funds

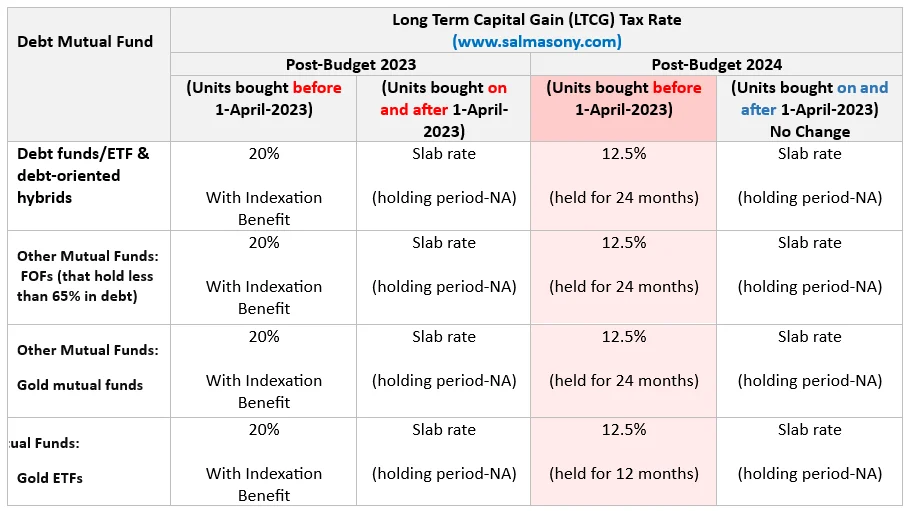

Budget 2024: Revised Tax on Mutual Fund Gains for FY 2024-25

| Fund Categories | Long Term Capital Gain (LTCG) Tax Rate | Short Term Capital Gain (STCG) Tax Rate | ||

| Pre-Budget 2024 | Post-Budget 2024 | Pre-Budget 2024 | Post-Budget 2024 | |

| Indian Equity Mutual Funds, & Equity-oriented hybrids, Equity ETFs | 10% (tax on capital gains above Rs 1 lakh if held for over 12 months) | 12.5% (tax on capital gains above Rs 1.25 lakh if held for over 12 months) | 15% tax on capital gains | 20% tax on capital gains |

| Debt funds/ETF & debt-oriented hybrids# | Slab rate (holding period-NA) | Slab rate (holding period-NA) | Slab rate (holding period-NA) | Slab rate (holding period-NA) |

| Other Mutual Funds FOFs (that hold less than 65% in debt) ## | Slab rate (holding period-NA) | Slab rate (holding period-NA) | Slab rate (holding period-NA) | Slab rate (holding period-NA) |

| Other Mutual Funds Gold mutual funds## | Slab rate (holding period-NA) | 12.5% (held for 24 months) | Slab rate (holding period-NA) | Slab rate (holding period-NA) |

| Other Mutual Funds Gold ETFs## | Slab rate (holding period-NA) | 12.5% (held for 12 months) | Slab rate (holding period-NA) | Slab rate (holding period-NA) |

##New rule applies from April 1, 2025—Your slab rate will be applied for redemptions made on or before March 31, 2025.

Budget 2024: How It Will Impact Your Investments Before July 23, 2024

(a) From the above table, we understood the below changes for Equity mutual fund

- Short-term Capital Gain tax (STCG) increased from 15% to 20 % on equity mutual funds.

- Long-term Capital Gain tax (LTCG) increased from 10% to 12.5 %, with the exemption limit increasing to Rs 1.25 lakh annually.

Impact:

- Short-term capital gain due to redemption of equity mutual fund on or before July 22, 2024, will attract a 15% tax and, from July 23 onwards, a 20% tax.

- Long-term capital gain due to redemption on or before July 22, 2024, will attract a 10% tax and, from July 23 onwards, a 12.5% tax.

(b) From the above table, we understand there are NO changes for the Debt mutual fund for units bought on or after 1-April-2023. Hence, the tax will be as per the applicable tax slab.

However, the indexation benefit has been removed for Long-Term Capital Gain (LTCG), which will be taxed at a flat 12.5% for units bought before 1-April-2023 and sold after 24 months. Units sold before April 1, 2025 will be taxed per the applicable tax slab.

(c) For Other mutual funds like Gold and ETFs, there are no changes for the short-term capital gain (STCG).

However, the indexation benefit has been removed for Long Term Capital Gain (LTCG) and will be taxed at a flat 12.5% for units sold on or after 1-April-2025. Units sold before April 1, 2025 will be taxed per the applicable tax slab.

Conclusion

If you observe closely, the taxation will be streamlined going forward, as there are now just three categories of mutual funds and two holding period categories. Additionally, indexation calculations will no longer apply.

In contrast, existing investors with unit holdings before July 23, 2024, for equity funds, and April 1, 2023, for debt funds may still be confused. If you work with a financial planner for your financial planning, then they will guide you.