Best Mutual Funds Apps in India

This article is about helping investors know the best mutual funds apps in India that can quickly help you invest in direct mutual funds.

The mutual fund industry is growing fast, and if you are still confused or looking for the right time to start investing in Mutual Funds, then the right time is Now.

Those days are gone when investment needed a physical presence, and you can transform your direct mutual fund investment journey by using the best mutual funds apps in India.

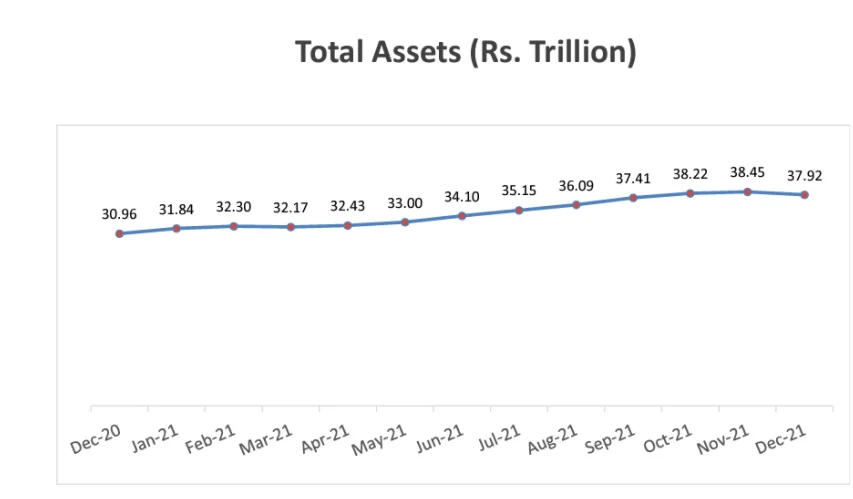

Data shows the assets managed by the Indian mutual fund industry have increased from Rs. 30.96 trillion in December 2020 to Rs. 37.92 trillion in December 2021. That represents a 22.46 % increase in assets over December 2020, which is enormous.

Source AMFI

Here I’m listing the top 3 best mutual funds apps in India that I have personally used and will continue to use for direct mutual fund investment. One of the most important criteria for selecting the best mutual funds apps for myself and my clients is safety and ease of operation.

1. myCAMS by CAMS (Computer Age Management Services)

CAMS is a mutual fund registrar responsible for your mutual fund unit holdings listed under the CAMS registrar. Therefore, completely safe.

Pros:

- myCAMS app is among the top best mutual funds apps in India that help you invest in the direct mutual fund for multiple PAN, and it works based on email ID. So, if you and your partner use the same email ID at the time of investment, then both the holdings will reflect under the same login.

- myCAMS app gives you clear stats on how much you invested and the value of your fund and its return in XIRR (Extended Internal Rate of Return).

- myCAMS app gives you an option to transact- Purchase, additional purchase, SIP (Systematic Investment Plan), STP (Systematic Transfer Plan), SWP (Systematic Withdrawal Plan), Switch, SIP (Systematic Investment Plan) Pause.

Cons:

myCAMS app shows and gives the option to transact only in 17 funds that fall under CAMS, and they are:

- Aditya Birla Sunlife Mutual Fund

- DSP Blackrock Mutual Fund

- Franklin Templeton Mutual Fund

- HDFC Mutual Fund

- HSBC Mutual Fund

- ICICI Prudential Mutual Fund

- IDFC Mutual Fund

- IIFL Mutual Fund

- Kotak Mutual Fund

- L&T Mutual Fund

- Mahindra Mutual Fund

- PPFAS Mutual Fund

- SBI Mutual Fund

- Shiram Mutual Fund

- Tata Mutual Fund

- Union Mutual Fund

- WhiteOak Capital Mutual Fund

2. KFinKart by Karvy

Like CAMS, Karvy is also the registrar of Mutual Fund in India and offers the KFinKart app to its investors, among the best mutual funds apps in India. Both of them are the leading registrar who covers 80% of the fund house in India. Karvy app is simple to use shows beautiful graphs of your holdings, cost of investment, current investment value, and appreciation in amount and percentage.

Pros:

- Everything in CAMS

- WhatsApp opt-in/out

- Option to link family’s folio

- Allow transaction in minor’s folio

Cons:

KFinKart shows and allows to transact in only 24 funds that fall under Karvy, and they are:

- Axis Mutual Fund

- Baroda Mutual Fund

- BNP Paribas Mutual Fund

- BOI AXA Mutual Fund

- Canara Robeco Mutual Fund

- Edelweiss Mutual Fund

- Essel Mutual Fund

- IDBI Mutual Fund

- Indiabulls Mutual Fund

- INVESCO Mutual Fund

- JM Mutual Fund

- LIC Mutual Fund

- Mirae Asset Mutual Fund

- Motilal Oswal Mutual Fund

- Nippon India Mutual Fund

- PGIM India Mutual Fund

- Principal Mutual Fund

- Quant Mutual Fund

- Quantum Mutual Fund

- Sahara Mutual Fund

- Taurus Mutual Fund

- UTI Mutual Fund

- ITI Mutual Fund

- Sundaram Mutual Fund

3. goMF by MF Utility

goMF is the app promoted by AMFI and is among the best mutual funds apps in India. Therefore, you can close your eyes and can trust them. goMF works on a PAN basis and not email ID.

To access the goMF app, you first need to open an account which MF Utility, and if your KYC is already in place, you can open it online.

Click here to open an MFU account.

The best part about the goMF app is that it allows the user to invest in 39 fund house schemes irrespective of which registrar it falls, be it CAMS or Karvy; you will find most funds here.

- Aditya Birla Sunlife Mutual Fund

- Axis Mutual Fund

- Baroda Mutual Fund

- BNP Paribas Mutual Fund

- BOI AXA Mutual Fund

- Canara Robeco Mutual Fund

- DSP Mutual Fund

- Edelweiss Mutual Fund

- Franklin Templeton Mutual Fund

- HDFC Mutual Fund

- HSBC Mutual Fund

- ICICI Prudential Mutual Fund

- IDBI Mutual Fund

- IDFC Mutual Fund Limited

- IIFL Mutual Fund

- Indiabulls Mutual Fund

- Invesco Mutual Fund

- ITI Mutual Fund

- JM Financial Mutual Fund

- Kotak Mutual Fund Kotak

- L & T Mutual Fund

- LIC Mutual Fund

- Mahindra Mutual Fund

- Mirae Asset Mutual Fund

- Motilal Oswal Mutual Fund

- NAVI Mutual Fund

- Nippon India Mutual Fund

- PGIM India Mutual Fund

- PPFAS Mutual Fund

- Quant Mutual Fund

- Quantum Mutual Fund

- Samco Mutual Fund

- SBI Mutual Fund S

- Sundaram Mutual Fund

- Tata Mutual Fund

- Taurus Mutual Fund

- Union Mutual Fund

- UTI Mutual Fund

- WhiteOak Capital Mutual Fund

Pros:

- All mutual funds (direct & regular) under one umbrella: Suppose you invest through a different distributor or even a direct mutual fund. In that case, once you open the MFU account, all the funds will automatically reflect here if the holding, tax status, nominee are the same.

- You can map your folios to your goals and view your mutual fund portfolio goal-wise.

- Raise complaints only which usually gets resolved within 24 hours.

- Good customer care support

Cons:

- Need a one-time effort for eCAN registration to open MF Utility account so that you can transact via the goMF app. Like CAMS and Karvy, goMF does not show the cost and return percentage but just the current value.

- Can do Goal mapping folio-wise; I appreciated scheme-wise mapping.

Conclusion:

goMF solves the problem of logging into two different apps (myCAMS & KFinKart) by covering most of the fund house under them and automatically feating the data linked to the PAN.

Even though goMF has a few essential features needed to make it more user-friendly, I still prefer to use goMF as it helps me plan and link all the funds based on the goals for myself and my clients.