Tracking error vs tracking difference are two critical components used to analyze the performance of an index fund relative to its underlying benchmark index. They provide insights into how closely the fund is able to replicate the performance of the index it aims to track. We will learn more about them in this article by plotting the figures into graphs.

What is a Tracking Error?

Tracking error calculates the index fund volatility with respect to the benchmark.

Technically, tracking error measures the annualized standard deviation of the difference in returns between the index fund and its benchmark index. It quantifies how much the fund’s performance deviates from its tracking index. Tracking error is typically expressed as a percentage. Per the Securities and Exchange Board of India (SEBI) guidelines, tracking errors must be within a 2% level.

A higher tracking error indicates a more significant deviation from the benchmark, suggesting that the fund is not replicating the index closely. Conversely, a lower tracking error means better tracking. Hence, lower tracking error is good.

What is the Tracking Difference?

Tracking difference, however, represents the differences in returns between the index fund and its benchmark over a specified period.

Calculating tracking difference is simple: Subtract the benchmark total return from the Index fund total return.

Tracking difference= Return of the index fund portfolio for the given period −Return of the benchmark for the given period

A positive tracking difference implies that the fund outperformed the index, while a negative tracking difference indicates underperformance. It measures the fund’s overall performance relative to the benchmark.

Typically, tracking difference is negative for the index fund due to management fees, transaction costs, etc. However, sometimes, you may find a positive tracking difference, which is not considered good for passive funds.

You can find index fund tracking difference data from the AMFI site.

Comparing Tracking Error Vs Tracking Difference

Tracking difference and tracking error are both critical for investors to assess how effectively an index fund mirrors the performance of its benchmark.

Here are the key differences:

| Particulars | Tracking Error | Tracking Difference |

|---|---|---|

| Focus | Emphasizes the volatility in the differences between the fund and the index returns. | Represents the average performance difference over time. |

| Calculation | Involves standard deviation, capturing the dispersion of returns. | Utilizes the arithmetic mean to calculate the average difference in returns. |

| Interpretation | High tracking error suggests potential risk and divergence from the benchmark. | Provides a direct measure of the fund’s average outperformance or underperformance. |

Factors Affecting a Tracking Error of Index / Passive Fund

- Management Fees: The expense ratio and other fees associated with managing the fund can contribute to tracking errors. Higher fees can lead to underperformance compared to the index.

- Transaction Costs: Costs incurred from buying or selling securities within the fund’s portfolio can affect tracking errors. Frequent trading or higher transaction costs can contribute to deviations from the index.

- Cash Holdings: If the fund holds cash or uses sampling strategies instead of holding all the securities in the index, it can introduce a tracking error. Variations in cash levels or the choice of sampled securities can impact performance.

- Market Impact: The fund’s trading activities in the market, especially for less liquid securities, can cause tracking errors. More considerable market impact from trades may result in deviations from the index.

- Dividend Reinvestment: Differences in how dividends are reinvested, whether immediately or at set intervals, can contribute to tracking errors.

Is Tracking Difference Better than Tracking Error to Evaluate Index Funds?

Tracking difference and tracking error are both important metrics for investors to assess how effectively an index fund is mirroring the performance of its benchmark.

To better understand this, let’s take an example. The table below shows the Index Fund Returns, NIFTY 50 Return, and Tracking Difference of the fund over three years:

| Tracking Difference of an Index Fund Over a 3 Years | |||

| Fund Name | Index Fund Return | NIFTY 50 Returns (Benchmark) | Tracking Difference |

| Fund-A | 9% | 10% | -1% |

| Fund-B | 8% | 10% | -2% |

As we know, the lower the tracking error, the better the fund is mirroring the index. With this, Fund-A looks like a better choice. However, deciding only based on tracking differences won’t be right.

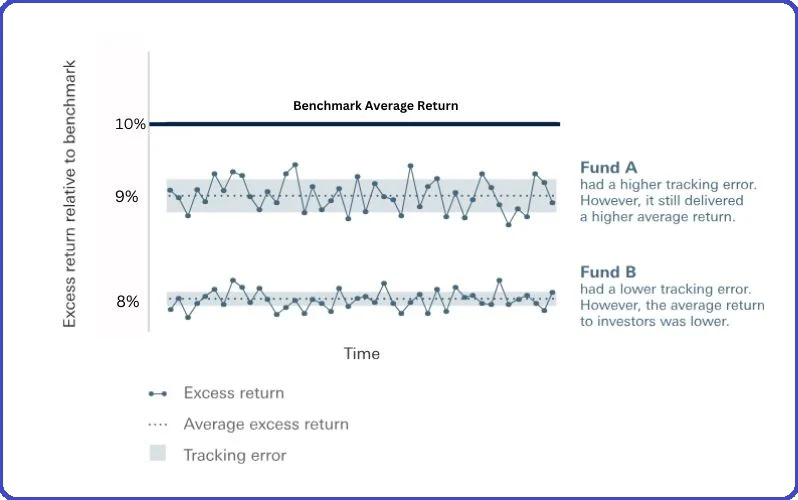

Let’s understand tracking errors better in pictorial form.

If you observe, the Fund A and Fund B grey backgrounds represent the tracking error, which is higher in Fund A due to high volatility; this means higher risk, so higher return.

On the contrary, the tracking error is lower in Fund B due to low volatility; this means lower risk, so lower return.

Source and credit: Vanguard AMC

With this, If your main goal is to achieve overall returns over the long term, tracking difference is a more critical measure than tracking error. However, it would be best if you prioritized low volatility for the short term, that makes tracking error more critical.

How Often Should Investors Review Tracking Error And Tracking Difference?

Investors should regularly review tracking error and tracking difference as part of their ongoing monitoring of their investment portfolios. The frequency of these reviews can depend on various factors, including the investment horizon, the specific characteristics of the index fund, and the investor’s preferences. Here are some considerations:

- Long-Term Investors: A semi-annual or annual review of tracking error and tracking difference may be sufficient for financial planning long-term investors with a buy-and-hold strategy.

- Short-Term Investors: Investors who actively manage their portfolios or have a more tactical approach may benefit from more frequent reviews, such as quarterly or monthly assessments; this can help them make timely adjustments based on changing market conditions.

- Market Volatility: More frequent reviews may be required during heightened market volatility or significant economic events. Volatility can affect tracking error, especially in the short term.

- Benchmark Changes: Any adjustments or changes to the benchmark index should trigger a review of tracking error and tracking difference; this is important to ensure that the fund meets the investor’s objectives.

Conclusion

Tracking error measures the volatility rather than performance while tracking difference measures the difference between an index fund returns and the benchmark. Investors should consider both metrics when evaluating an index fund’s performance and ability to deliver the desired investment outcomes.

Frequently Asked Question

Q-1: What is the ideal range for tracking error in index funds?

A low tracking error is preferred for some investors, particularly those who prioritize closely mirroring the index. An ideal range might be relatively narrow, such as 0.1% to 0.5%.

Q-2: Can tracking difference be negative?

Yes. Tracking differences are typically negative for the index fund due to its management cost, etc.