The Union government has authorized health coverage for all individuals aged 70 and older under the Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (AB PM-JAY).

Here’s a comprehensive guide to everything you should know: Who is qualified, what benefits are covered, how it will work if you already have insurance under Pradhan Mantri Jan Arogya Yojana, and how to apply.

Who Qualifies: Ayushman Bharat Pradhan Mantri Jan Arogya Yojana?

- Regardless of socio-economic status, all senior citizens aged 70 and older qualify to avail benefits under AB PM-JAY.

- Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (AB PM-JAY) has no income restrictions. Therefore, if you are a senior citizen, you can benefit from it regardless of your income level.

- Senior citizens who qualify will be issued a new, unique card specifically for Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (AB PM-JAY).

- Senior citizens already covered by AB PM-JAY, will be provided with the additional top-up coverage of up to Rs. 5 lakh per year, without the need to share it with family members under the age of 70.

- All other senior citizens aged 70 years and above will get a cover of up to Rs. 5 lakh per year on a family basis.

- Senior citizens aged 70 and older who are currently enrolled in other public health insurance schemes, such as CGHS, ECHS, or Ayushman CAPF, can choose to either keep their current scheme or switch to AB PM-JAY.

- Senior citizens aged 70 with private health insurance policies or are covered by the Employees’ State Insurance scheme are still eligible to receive benefits under AB PM-JAY.

Note: AB PM-JAY is implemented in all states and UTs except Odisha, West Bengal and NCT of Delhi.

Source: Press Release, Loksabha questions

Benefits Covered Under Ayushman Bharat Pradhan Mantri Jan Arogya Yojana

The cover under the scheme includes components of the treatment under the below-mentioned expenses:

- Medical examination, treatment, and consultation

- Pre-hospitalization

- Medicine and medical consumables

- Non-intensive and intensive care services

- Diagnostic and laboratory investigations

- Medical implantation services (where necessary)

- Accommodation benefits

- Food services

- Complications arising during treatment

- Post-hospitalization follow-up care up to 15 days

Source: nha.gov

How You Should Apply for Ayushman Bharat Pradhan Mantri Jan Arogya Yojana?

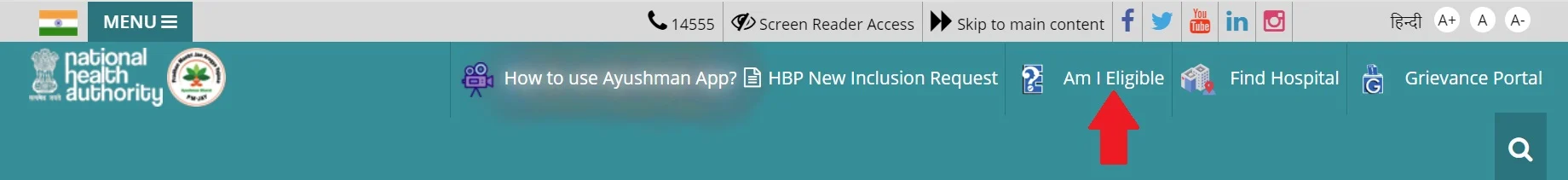

Step 1: Visit the official website of AB-PMJAY

Step 2: Click on the ‘Am I Eligible’ on the menu of the website

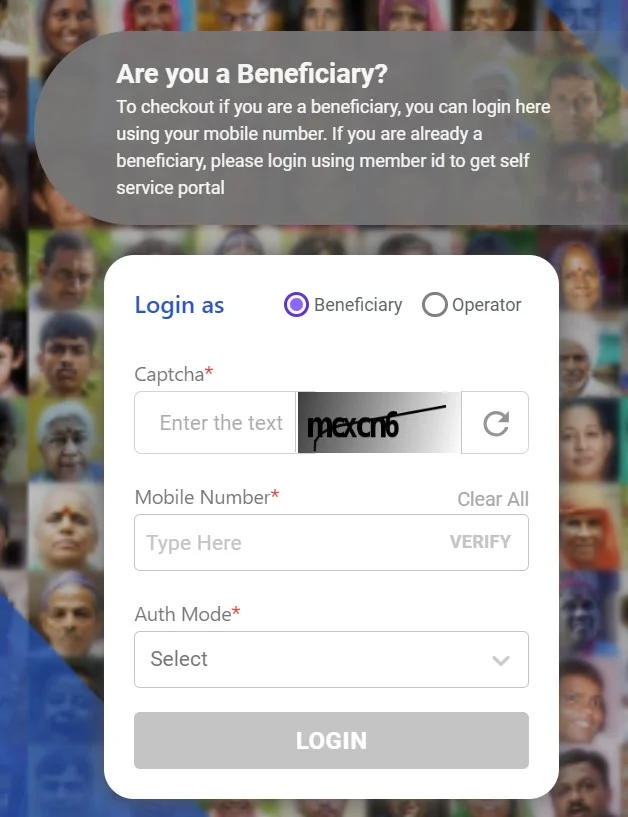

Step 3: Enter the CAPTCHA and your mobile number, validate, then enter OTP and submit

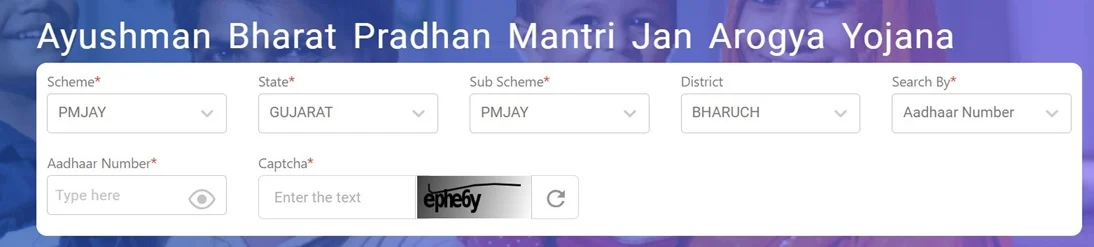

Step 4: Enter your state, scheme name, district, etc, and submit

If your family is covered under Ayushman Bharat Yojana, your name will be displayed in the results.

If not, you must visit Ayushman Mitra or an empaneled hospital and provide the identification documents, like an Aadhaar card, for registration.

After registration, you can download the PM-JAY card using the Ayushman Application App. The steps are shared in the video below (Ayushman’s official channel).

Should you depend on the Ayushman Bharat Pradhan Mantri Jan Arogya Yojana?

Undoubtedly, the Ayushman Bharat Pradhan Mantri Jan Arogya Yojana is an excellent initiative from Govt. of India to make medical treatment affordable with a cover of Rs. 5 lakh, which is a must.

I encourage all the count children whose parents are aged, eligible, and non-tech-savvy to take the initiative and apply for them.

However, entirely depending on the Ayushman Bharat Pradhan Mantri Jan Arogya Yojana may not be reliable until the process becomes seamless.

It’s better to have a standalone policy (if possible) or create a medical provision in your financial planning process so that you always have a back to fall on in a medical emergency.