As a salaried individual, there is always confusion when choosing an ITR form, ITR 1 vs ITR 2; this is a very common confusion and makes the salaried person feel tax filing is complicated. In this article, I will clarify your confusion so that you will never have confusion while choosing the ITR correct form between ITR 1 vs ITR 2.

What is ITR?

Income Tax Return is commonly known as ITR, is a formal process of documenting and reporting the assessee’s income, investments, and tax liabilities to the tax authorities, ensuring adherence to tax regulations and meeting tax obligations.

Why Should You File ITR as a Salaried Individual?

Filing Income Tax Returns (ITR) as a salaried individual is crucial for several reasons that directly impact your financial standing and compliance with tax laws:

Legal Compliance: Filing ITR is a legal requirement mandated by the Income Tax Act for salaried individuals whose income exceeds the basic exemption limit and meets the condition specified. By filing an ITR, you fulfill your obligation to report your income and taxes paid to the government.

It is mandatory to file ITR for salaried individuals if their total income in a financial year is more than the below-mentioned basic exemption limit.

| Age | Old Regime Basic Exemption Limit | New Regime Basic Exemption Limit |

|---|---|---|

| Below 60 years | Rs 2.5 lakhs | Rs 3 lakhs |

| 60 years or more but below 80 years | Rs 3 lakhs | Rs 3 lakhs |

| 80 years or more | Rs 5 lakhs | Rs 3 lakhs |

Specified Condition for Mandatory ITR Filing

For salaried individual

If your income is within the basic exemption limit, you will still have to file your income tax return if you meet any of the below-mentioned conditions:

a) Deposit of more than Rs. 1 crore in current bank account: As a salaried individual, it is mandatory to file ITR if you have deposited a total of Rs 1 cr. or more in one or multiple current accounts with a bank. However, no such restriction on deposits made in post office current accounts.

b) Deposit of more than Rs. 50 lakh in savings bank account: As a salaried individual, it is mandatory to file ITR if you have deposited a total amount of Rs 50 lakh or more in one or more of your savings bank accounts.

c) More than Rs 2 lakh spent on foreign travel: As a salaried individual, it is mandatory to file an ITR if you spent more than Rs 2 lakhs on foreign travel, whether for yourself or any other person.

d) Electricity expenditures are more than Rs 1 lakh: As a salaried individual, it is mandatory to file an ITR if your electricity consumption during the previous year is more than Rs. 1 lakh.

e) TDS or TCS is more than Rs. 25,000: As a salaried individual, it is mandatory to file an ITR if the total tax held in the form of TDS is more than Rs 25,000. For a senior citizen (above 60 years), this limit is Rs 50,000.

For Business & Professional Income

a) Business turnover is more than Rs 60 lakhs: As a business person, if your total sales, turnover, or gross receipt is more than Rs 60 lakh during the previous year, then it becomes mandatory for you to file an ITR.

b) Professional income is more than Rs 10 lakhs: As a professional, it becomes mandatory to file ITR if your gross receipts are more than Rs 10 lakhs during the previous year.

Claiming Tax Refunds: If you have had excess taxes deducted from your salary through TDS (Tax Deducted at Source) or have made advance tax payments, filing ITR allows you to claim refunds; this ensures you receive any overpaid tax amounts promptly.

Here are a few classic examples:

For resident individuals (Salaried, retirees, and homemakers): To claim excess tax deducted from FDs, one must file an ITR.

For NRIs– NRIs who invested in Mutual funds, while redemption funds due to NRI status, the mutual fund deducts tax (TDS); to claim excess tax deducted on FDs, one must file an ITR.

TDS rates for equity-oriented mutual funds:

- 10% tax on long-term capital gain (LTCG)

- 15% on short-term capital gains (STCG)

TDS rates for debt funds:

- 20% tax on long-term capital gain (LTCG)

- Based on income tax slab rates on short-term capital gains (STCG)

Documentation for Financial Transactions: ITR serves as an official record of your income, which is often required for various financial transactions such as applying for life insurance, loans, or visas. It provides proof of your financial stability and capability to meet obligations.

Avoiding Penalties: Timely filing of ITR helps you avoid penalties and legal repercussions. Non-compliance or late filing can result in fines and interest charges, affecting your financial resources negatively.

Utilizing Tax Benefits: By filing ITR, you can take advantage of various tax deductions and benefits available under the Income Tax Act; this includes deductions for investments, expenses (business/profession), and allowances, which can effectively reduce your taxable income.

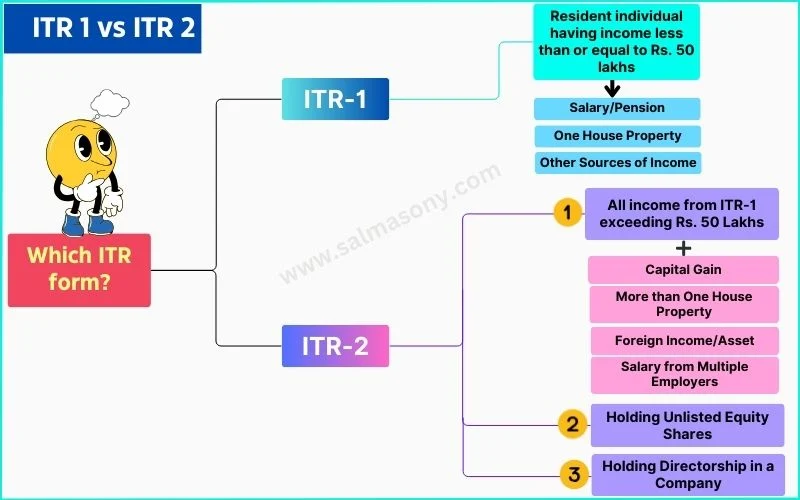

ITR 1 vs ITR 2 Form: Choose the Right ITR Form

The IT department has notified seven types of forms, i.e., ITR 1, ITR 2, ITR 3, ITR 4, ITR 5, ITR 6 & ITR 7. In this article, I will cover only ITR 1 and ITR 2, which most salaried individuals use.

Read my previous article, ITR For Salaried Person, to learn about other forms.

1. ITR-1 (Sahaj)

ITR-1, also known as Sahaj, applies to resident individuals in India who have income from salary, single house property, other sources (who do not have income from business or profession), and Agricultural Income up to ₹ 5,000. This form is designed for individuals with income from one or a combination of the four above sources. It is the simplest ITR form available. The total income of the individual should not exceed Rs—50 lakh.

The following individuals can use ITR-1:

- Salaried individuals with income from a single employer.

- Individuals with income from house property (excluding cases where losses are brought forward from previous years).

- Individuals with income from other sources such as interest, pension, or family pensions.

Who cannot file ITR-1?

- Individual’s total income exceeds Rs.50 lakh.

- Individuals have income from more than one house property.

- Individuals have any capital gains (short-term or long-term) or have invested in an unlisted company’s equity shares.

- Individuals have any foreign assets or income from a source outside India.

- Individuals have brought forward losses from previous years.

- Individuals who are directors in a company.

2. ITR-2

ITR-2 applies to individuals and HUFs (Hindu Undivided Families) who do not have income from business or profession. It includes income from salary, more than one house property, capital gains, and other sources. The total income can exceed Rs. 50 lakhs.

The following individuals can use ITR-2

- Individuals who are not eligible to use ITR-1 due to exceeding the income limit or having capital gains, foreign assets, holding unlisted shares, or holding directorship in a company.

- Individuals with capital gains from selling assets like property, stocks, or mutual funds.

- Individuals with income from more than one house property.

- Salaried individuals have income from multiple employers. This situation arises when you change your job in a financial year and need to consider two Form-16 when filing an ITR.

- Individuals with income from other sources like interest, pension, or family pension.

- Individuals with agricultural income of more than Rs 5,000

- Individuals whose payment or deduction of tax has been deferred on ESOP

5 Common Tax Filing Mistakes

Mistake-1: Incorrect personal information

One of the most common mistakes is providing incorrect personal information such as contact number, email ID, address, and bank details. It’s crucial to double-check all personal information before submitting the ITR to avoid any discrepancies.

Mistake-2: Choosing the wrong ITR form

Today’s article is my attempt to help you educate yourself about ITR forms so you do not make mistakes when choosing between ITR 1 and ITR 2. After reading today’s article carefully, I’m sure you will be confident in your choice of ITR form.

Mistake-3: Not reporting capital gains on switching units of mutual funds

When you redeem, switch, or set STP to move units automatically from one scheme to another mutual fund, they are considered a sale of units, and capital gain or loss arises by taking these actions.

These transactions are not reflected in the bank statements but are captured in each AMC’s Capital gain report. You can also acquire the capital gain statement from the CAMS & Karvy portal.

If you have worked with a financial planning expert who has planned your investment, lumpsum investments are likely planned with STP and switches. It is advisable to report these in the Income Tax Return to avoid this common mistake.

Mistake-4: Neglecting to report foreign assets and income

Individuals with foreign assets or income must report them in their ITR. Failure to disclose such assets or income can lead to penalties and legal issues. If applicable, comply with the Foreign Assets and Income Reporting requirements.

Mistake-5: Failure to report income from previous employers

If you have changed jobs during the financial year, you must report income from all employers. Often, individuals forget to report income from previous employers, leading to discrepancies in their ITR.

Consolidate income from all employers and include it in the appropriate section of the ITR form.

Conclusion

To conclude, while filing an ITR in India, it’s crucial to select the right ITR form, provide accurate information, report all sources of income, claim deductions correctly, and adhere to deadlines.

Double-checking your ITR before submission and seeking professional assistance (if needed) can help minimize errors and ensure a smooth filing process.