SEBI Registered Investment Advisor | RIA No.-INA000017222

Need Financial Clarity?

Use the search bar to explore trusted financial insights

SEBI Registered Investment Advisor | RIA No.-INA000017222

Use the search bar to explore trusted financial insights

Goal-Based Financial Planning For Every Stage of Your Life.

So that you achieve “Financial Peace of Mind”. Financial planning can transform your personal finance journey from chaos to clarity.

Without a plan, money management becomes confusing and unstructured; however, with a financial plan, you gain clarity, direction, and financial peace of mind.

(Chaos & Confused)

(Clarity & Peace of Mind)

Overspending is a habit that starts:

Financial planning services can help you recognize your overspending area by analyzing your cash flow and inculcating mindful spending habits that enable you to save more.

Paying high taxes can be avoided when one understands the income tax rules that work for them.

Tax planning is not about:

Financial planning services can help you plan your finances and taxes efficiently, which works for you.

The most common reasons for unwise investment decisions are:

Unwise investing is not limited to investing in a product you don’t understand but also making investment choices that don’t suit your goals and risk appetite.

Financial planning helps you in wise investing and savings decisions.

Your debt journey begins When you decide to make purchases on a loan.

Doesn't matter if these loans are for big or small purchases. Small purchases on EMI create a habit that leads to buying unnecessary things on EMI and creates a money crunch.

To become debt-free:

Financial planning services can help you close your loan faster by analyzing and creating the best strategy for you.

Becoming financially independent/early retirement is a dream for today's generation.

With the increase in lifestyle and multiple responsibilities, early retirement seems uncertain.

Financial planning services can help you get clarity on your retirement needs and plan for a confident retirement.

Financial planning is a 360° approach to your personal finance that helps you manage money by:

Individuals who spend first and do not keep money aside after a salary credit are Spender.

Financial Planning helps budget so you can keep excess cash aside for necessary investments after a salary credit.

Individuals who keep their money aside first to invest after a salary credit are investors.

Financial Planning helps not just invest and grow a portfolio but become a wise investor for a secured future.

Wise investors live a financially peaceful & secure retirement life due to clarity on their goals and planned action to achieve their goals on time.

1 - Weightage indicates how much each part contributes to comprehensive financial planning success

Note: The above-mentioned fee structure is applicable for Assets Under Advice (AUA) up to ₹5 crore.

Client's Love

EXCELLENT

"My focus is on my client, not on selling financial products."

I’m a SEBI Registered Investment Adviser (RIA No.:INA000017222) & Certified Financial PlannerCM (FPSB No.: 60832) with 15 years of experience in the financial industry.

I offer 360° structured fee-only financial planning and advisory services. I work jointly with individuals like you, helping simplify your personal finance with goal-based planning; this results in more savings, better investing, and a debt-free life for your secured financial future.

We start by:

I deeply understand client needs and provide professional advice, prioritizing their interests. Every suggestion is personalized, keeping today’s comfort in mind while still planning responsibly for tomorrow.

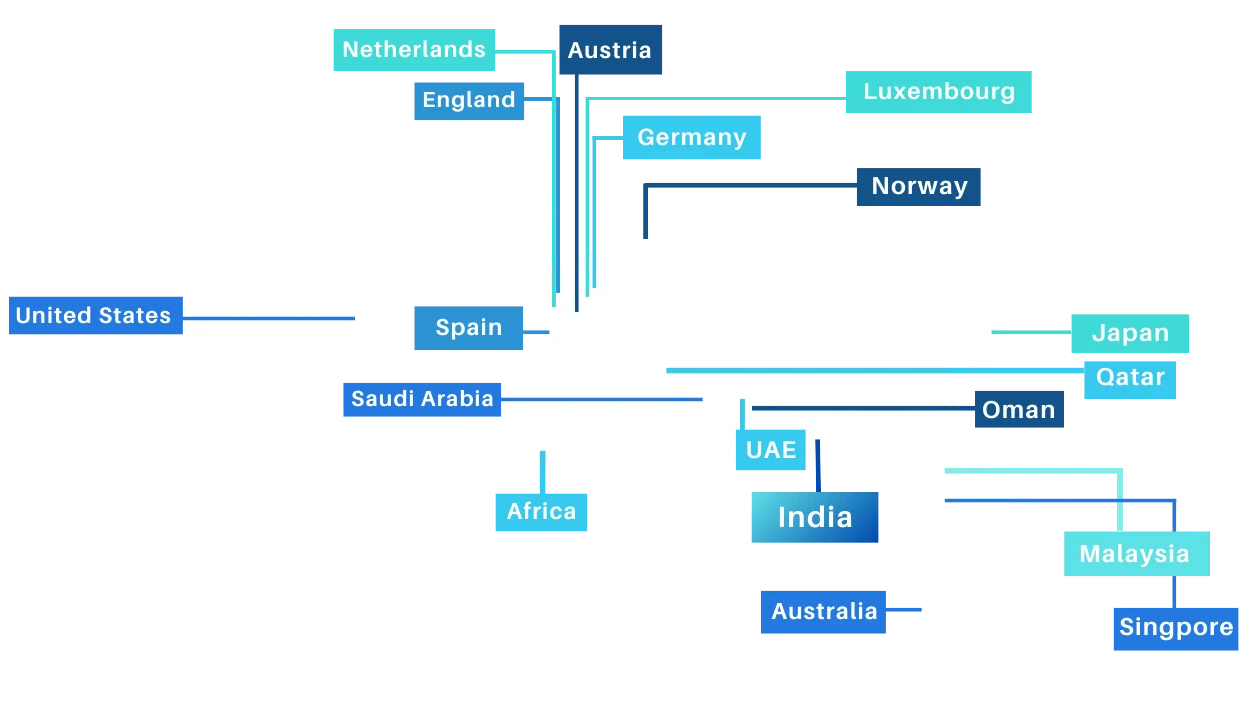

So far, I have advised 500+ clients from 15+ countries in their Financial Planning journey.

It’s time to secure your financial future, too. Let’s connect soon 🤝

You can directly book a video call with me by using a booking calendar at the bottom of this page or the website’s contact page. Alternatively, you can drop a WhatsApp message at +91 8180923895 or email me at salmasony.cfp@gmail.com.

Upon scheduling a 45-minute call using a calendar, you will receive an email invite with the Google Meet link to connect on the scheduled day and time.

During this call, I will focus on understanding your requirements, introducing how goal-based financial planning can help, and outlining the next steps.

Once the process and fee are agreed upon, I will need your essential document as a part of KYC to proceed.

Once I have them, I will share with you the below mentioned three documents:

Letter of Engagement– This is a formal engagement letter, as SEBI Regulations require. If you agree to the terms, please use Aadhar-based OTP for the e-singing of the engagement letter.

Data Collection Sheet – This is an Excel template where you will provide details about your current financial status, including family information (financial dependents), goals, income, expenses, assets, liabilities, etc.

Risk Profiling Questionnaire – This is an editable PDF questionnaire with a multiple-choice question-answer format. You must download the pdf, choose the best-suited answer for all the questions, and send it to me for analysis to understand your risk appetite.

After signing the Letter of Engagement by both parties (Client & Advisor), you must pay the fee to the provided bank or UPI details, completing our sign-up.

Upon receipt of the filled Data Collection Sheet and Risk Profiling questionnaire, I will schedule a 45-minute meeting to review your data in detail, including providing guidance on financial goals and addressing any queries you may have.

Planning – I will prepare a financial plan with the data you provided after our data collection meeting. I take 2-3 weeks to study your case and prepare a customized financial plan thoroughly.

Execution – Once you receive the plan, I encourage you to review it thoroughly and list any questions or concerns.

In our next meeting, I will take you through the plan and address your queries to the best of my abilities. Once you clearly understand the plan, you can proceed with its implementation.

As I follow Fee-Only Financial Planning, implementing the financial plan is your (client’s) responsibility. However, I will assist you if you face difficulties during the implementation process.

I encourage connecting to address any of your queries related to implementation support when needed. Formally, we meet semi-annually, where I will address below:

a) How well have you implemented the plan, and if any missing action needs to be taken care of?

b) How are your investments doing?

c) Understand if there is any change in your financial situation and clarify any doubts.

I follow the annual review process for your financial plan. Upon renewal, I will review your goal’s progress.

Please note that even after I deliver the financial plan, you can always contact me during the one-year engagement period to discuss any matters related to personal finance, investing, or your financial planning.

Apart from the above, I will address any changes in your financial goals, cash flow, or any life situation impacting your financial plan as and when they occur. Your evolving needs are my priority.

Financial Planning Services will help you create a road map of your life financial goals and help you achieve them on or before time by implementing, grabbing market opportunities, and tracking right.

If you have several financial goals, especially if your family is dependent on you financially, then the right time is NOW.

Financial Planning Services is an annual service.

Financial Planning Services cover all aspects of personal finance. Click here to learn more about our Financial Planning Services approach.

A fee only financial advisor / fee only expert financial planner are SEBI Registered Investment Advisor who operates on a transparent and straightforward model. Unlike financial planners in India who earn commissions or fees based on product sales, fee only financial advisors charge a flat fee only for their financial services, ensuring unbiased financial advice that aligns with client’s financial goals. This structure eliminates conflicts of interest, putting the client’s best interests ahead of everything else.

In this internet era, getting your finances sorted virtually with financial planning services is convenient and saves you time.

Salma Sony is a SEBI-Registered Investment Advisor (RIA) and Certified Financial Planner (CFP), featured as “One of the Best Fee-Only Financial Planners in India.”

She has advised 500+ working professionals across 15+ countries to help them gain clarity, control, and confidence in their finances through practical, goal-based financial planning.

She aims to help you shift from surviving paycheck to paycheck to thriving with a clear, structured, and confident financial roadmap.

If you are earning well but wondering, “Where does all my money go?” – I’m here to help you find the answer and change the outcome.

You can contact Salma Sony, Fee Only Financial Advisor, directly on WhatsApp (+91-8180923895) or email at salmasony.cfp@gmail.com. Also, can DM her on LinkedIn or Facebook.

Setting goals is the first step in turning the invisible into the visible.

-Tony Robbins