After the Finance Bill 2024 amendment, the government has provided significant relief to property (land or building or both) owners for capital gains tax on property sale who have acquired property before July 23, 2024, by offering a choice between two options for long-term capital gains (LTCG) tax on property.

Property owners can now choose between a 20% LTCG tax with indexation or a 12.5% LTCG tax without indexation.

While the Budget had initially proposed a reduced LTCG tax rate (12.5%) without indexation benefits, taxpayers now have the flexibility to select either the previous LTCG tax rate (20%) with indexation or the new lower rate (12.5%) without indexation to minimize their tax liability.

However, there is a catch – for the property owner who has acquired property before July 23, 2024, the decision of option for new or old tax regime will drive the option of LTCG of 20% with indexation or LTCG of 12.5% without indexation.

Let’s understand below with an example.

Who Is Eligible for Revised Capital Gains Tax on Property: Two Options for Property Owners?

Only individuals and HUFs are eligible. The choice is available for both land and buildings for personal or commercial properties.

NRIs, LLP, and Corporate are excluded and will have to pay taxes as per the new rule, i.e., any property sold after July 23, 2024, will not get the indexation benefit and will have to pay taxes 12.5% on capital gain.

Future property owners who buy the property after July 23, 2024, will have to pay a flat 12.5% tax without indexation if they sell their property in the future.

How to Calculate Which Option Will Help You Save Tax on Sale of Property?

It’s a three steps simple calculation:

Step: 1 Calculate the tax on long-term capital gains from the sale of immovable property at a rate of 20%, with indexation benefit.

Step 2 Calculate the tax on long-term capital gains from the sale of immovable property at a rate of 12.5%, without indexation benefit.

Step: 3 Compare the scenarios and opt for the one benefit you

Before proceeding, let’s understand how to calculate the cost inflation index.

How to Calculate the Cost Inflation Index?

If you acquired a property in 2001 for Rs.10,00,000 and subsequently sold it in the financial year 2024-25, consider the Cost Inflation Index (CII) values as follows:

- CII for FY 2001-02 = 100

- CII for FY 2024-25 = 363

The indexed cost of acquisition for the property can be calculated as:

Indexed Cost of Acquisition = (CII for FY 2024-25 / CII for FY 2001-02) * Cost of Acquisition

Substituting the given values:

Indexed Cost of Acquisition = (363 / 100) * 10,00,000

= 36,30,000

Therefore, the Indexed cost of purchase/ acquisition for the year of transfer/sale is Rs. 36.30 lakhs.

CII Table from the Financial Year 2001-02 (Base Year) to FY 2024-25

| Sl. No. | Financial Year | Cost Inflation Index |

|---|---|---|

| 1 | 2024-25 | 363 |

| 2 | 2023-24 | 348 |

| 3 | 2022-23 | 331 |

| 4 | 2021-22 | 317 |

| 5 | 2020-21 | 301 |

| 6 | 2019-20 | 289 |

| 7 | 2018-19 | 280 |

| 8 | 2017-18 | 272 |

| 9 | 2016-17 | 264 |

| 10 | 2015-16 | 254 |

| 11 | 2015-16 | 240 |

| 12 | 2013-14 | 220 |

| 13 | 2012-13 | 200 |

| 14 | 2011-12 | 184 |

| 15 | 2010-11 | 167 |

| 16 | 2009-10 | 148 |

| 17 | 2008-09 | 137 |

| 18 | 2007-08 | 129 |

| 19 | 2006-07 | 122 |

| 20 | 2005-06 | 117 |

| 21 | 2004-05 | 113 |

| 22 | 2003-04 | 109 |

| 23 | 2002-03 | 105 |

| 24 | 2001-02 (Base Year) | 100 |

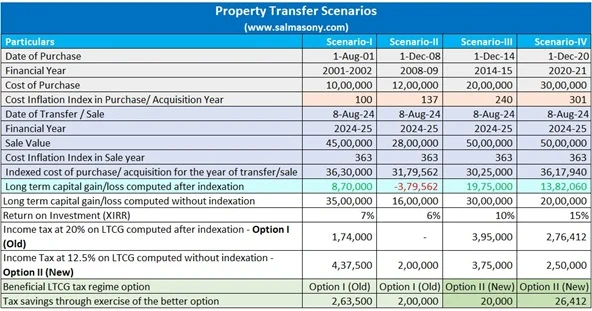

Scenario: Long Term Capital Gains Tax on Property

In this scenario-based calculation, I have considered four different scenarios to understand which tax Beneficial LTCG tax regime option while considering capital gain from the property sale.

| Property Sale/ Transfer Scenarios (salmasony.com) | ||||

| Particulars | Scenario-I | Scenario-II | Scenario-III | Scenario-IV |

| Date of Purchase | 1-Aug-01 | 1-Dec-08 | 1-Dec-14 | 1-Dec-20 |

| Financial Year | 2001-2002 | 2008-09 | 2014-15 | 2020-21 |

| Cost of Purchase | 10,00,000 | 12,00,000 | 20,00,000 | 30,00,000 |

| Cost Inflation Index in Purchase/ Acquisition Year | 100 | 137 | 240 | 301 |

| Date of Sale / Transfer | 8-Aug-24 | 8-Aug-24 | 8-Aug-24 | 8-Aug-24 |

| Financial Year | 2024-25 | 2024-25 | 2024-25 | 2024-25 |

| Sale Value | 45,00,000 | 28,00,000 | 50,00,000 | 50,00,000 |

| Cost Inflation Index in Sale Year | 363 | 363 | 363 | 363 |

| Indexed cost of purchase/ acquisition for the year of transfer/sale | 36,30,000 | 31,79,562 | 30,25,000 | 36,17,940 |

| Long-term capital gain/loss computed after indexation | 8,70,000 | -3,79,562 | 19,75,000 | 13,82,060 |

| Long-term capital gain/loss computed without indexation | 35,00,000 | 16,00,000 | 30,00,000 | 20,00,000 |

| Return on Investment (XIRR) | 7% | 6% | 10% | 15% |

| Income tax at 20% on LTCG computed after indexation – Option I (Old) | 1,74,000 | – | 3,95,000 | 2,76,412 |

| Income Tax at 12.5% on LTCG computed without indexation – Option II (New) | 4,37,500 | 2,00,000 | 3,75,000 | 2,50,000 |

| Beneficial LTCG tax regime option | Option I (Old) | Option I (Old) | Option II (New) | Option II (New) |

| Tax savings through the exercise of the better option | 2,63,500 | 2,00,000 | 20,000 | 26,412 |

Based on the above calculation, the old tax regime is beneficial when the return on investment is close to inflation, and if it is more than the new tax, it is beneficial.

Factors That Will Impact Your Tax Liability

- 1. Year of purchase of the property: If the year of purchase of property is before 2012 or 2020, as the cost inflation index moves to 200 and 300, respectively, that will impact the indexed cost of acquisition.

- 2. Return on investment: If the return on investment is close to inflation or more

- 3. Overall (including five heads of income), which tax regime is beneficial

Conclusion

Which tax option will benefit you will entirely depend on the above factors. It could be a situation where you may forcefully opt for a new tax regime and pay additional tax as it looks beneficial despite capital gain payment compared to the old tax regime with indexation benefits.

And, if the entire scenario is overwhelming, don’t hesitate to get professional help, be it a CA or an investment advisor who can plan your investment based on your financial planning needs.