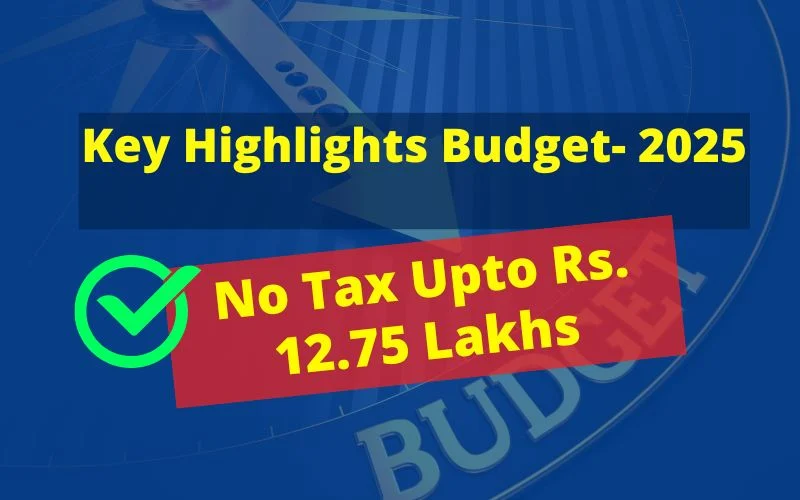

Budget 2025 Income Tax Rate Changed – 7 Highlights Impacting Personal Finance

- 1. Good News! No Income Tax payable up to Rs 12 Lakh under the new regime

| Income Tax Slab | Slab Rate |

|---|---|

| ₹ 0-4 lakhs | Nil |

| ₹ 4-8 lakhs | 5% |

| ₹ 8-12 lakhs | 10% |

| ₹ 12-16 lakhs | 15% |

| ₹ 16-20 lakhs | 20% |

| ₹ 20-24 lakhs | 25% |

| >24 lakhs | 30% |

- 2. The standard deduction limit increased from ₹ 50,000 to ₹ 75,000

- 3. Considering income tax slab and standard deduction, no income tax on a total income of ₹ 12.75 lakhs

- 4. TDS (tax deduction at source) rate doubled for Senior citizens: Rs 50,000 to Rs 1,00,000. This means no TDS on interest income up to ₹ 1 lakh.

- 5. Raised the annual limit for TDS on rent from ₹ 2.40 lakh to ₹ 6 lakh; this means no TDS will be deducted for rent of ₹ 50,000 p.m.

- 6. Increasing the threshold to collect Tax Collected at Source (TCS) on remittances under the RBI’s Liberalised Remittance Scheme (LRS) from Rs 7 lakh to Rs 10 lakh.

- 7. The time limit to file updated returns is extended from ₹ 2 to 4 years to encourage voluntary compliance.